NGI Mexico GPI | E&P | Infrastructure | Markets | NGI All News Access

In Positive for Mexico, EIA Forecasts Even Lower U.S. Natural Gas Prices

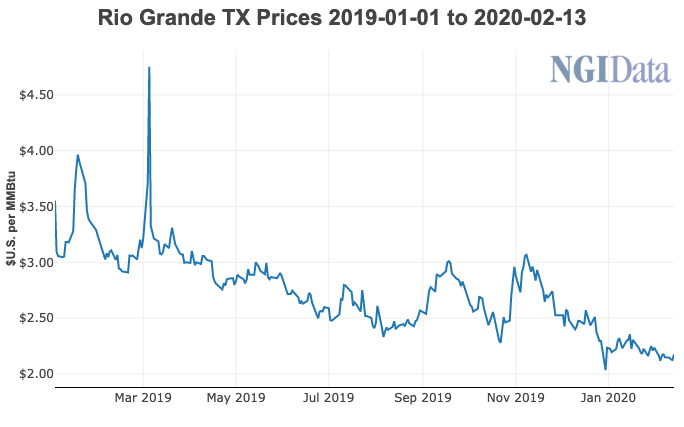

U.S. natural gas prices, to which a majority of gas transactions in Mexico are linked, remain bogged down and are likely to average just $2.21/MMBtu this year, despite an expected upturn beginning in the second quarter, according to the Energy Information Administration (EIA).

“In January, the Henry Hub natural gas spot price averaged $2.02/MMBtu, as warm weather contributed to below-average inventory withdrawals and put downward pressure on natural gas prices,” EIA said in its latest Short-Term Energy Outlook (STEO), released Tuesday.

EIA expects prices will remain below $2.00/MMBtu this month and next, but will rise in 2Q2020 as domestic production declines and gas use for power generation increases demand. Prices are expected to average $2.36/MMBtu in 3Q2020, a 21-cent decline from the agency’s previous STEO forecast, and 33 cents lower than the December STEO prognostication.

Given Mexico’s dependence on natural gas imported from the United States, gas price movements in Mexico track closely with prices north of the border.

Mexico’s IPGN monthly natural price index averaged $3.185/MMBtu in 2019, down from $4.127/MMBtu in 2018, a 22.8% slide.

The Henry Hub spot price averaged $2.566/MMBtu on a monthly basis in 2019, down 19% from the 2018 average of $3.167/MMBtu.

The STEO forecasts net natural gas exports from the United States, including by pipeline and in the form of liquefied natural gas (LNG), to average 7.6 Bcf/d in 2020, up from 5.3 Bcf/d in 2019.

Pipeline exports to Mexico averaged 5.29 Bcf/d in November 2019, up from 4.68 Bcf/d in the similar month for 2018, EIA data show.

The front-month natural gas futures contract for March delivery at the Henry Hub settled at $1.86/MMBtu on Feb. 6, down 26 cents/MMBtu from Jan. 2.

“Warmer-than-normal temperatures helped send natural gas front-month futures prices to their lowest level in many years,” EIA said. “Typically, January natural gas prices are among the highest of the year.” Based on National Oceanic and Atmospheric Administration data, EIA estimates that heating degree days (HDD) in January were 18% lower than the 2010-2019 average.

The spread between the first-month and third-month delivery futures contracts, which represents price differences between gas delivered in the winter compared with gas delivered in the spring, averaged minus 1 cent/MMBtu in January.

“The spread between the two values can be wide in winters with cold temperatures (as defined by HDD) in January,” EIA said. “The difference between the first and third month contracts averaged more than 30 cents/MMBtu during January of 2014, 2018, and 2019. Both 2014 and 2018 had more HDD than the 10-year average. However, in years with milder-than-normal weather in January, the spread is generally far smaller or even negative.”

Asia and Europe have also had mild winters, and concerns about the effects the coronavirus outbreak will have on economic activity have likely had a dampening effect on natural gas prices across markets, EIA said.

Lower liquefied natural gas (LNG) prices ” could reduce the competitiveness of U.S. LNG exports if current price levels persist,” according to EIA, but the agency’s forecast for LNG exports in 2020 remains relatively unchanged from the January STEO.

EIA reported a 137 Bcf withdrawal from storage inventories for the week ending Jan. 31. That left total Lower 48 working gas in underground storage at 2,609 Bcf, which was 615 Bcf (31%) above year-ago stocks and 199 Bcf (8%) above the five-year average.

Total working inventories are forecast to end March at almost 2.0 Tcf, 14% higher than the five-year average, and will rise by 2.1 Tcf during the April through October injection season to reach almost 4.1 Tcf at the end of October, which would be a record high end-of-injection season inventory level.

Monthly gas production, which reached a record high 92.1 Bcf/d in 2019, is expected to decline generally throughout 2020, falling from an estimated 95.4 Bcf/d in January to 92.5 Bcf/d in December. The falling production will be experienced primarily in the Appalachian and Permian basins, EIA said.

“In the Appalachia region, low natural gas prices are discouraging natural gas-directed drilling, and in the Permian, low oil prices are expected to reduce associated gas output from oil-directed wells,” EIA said.

Dry natural gas production is expected to stabilize in 2021 at an annual average of 92.6 Bcf/d, a 2% decline from 2020, which would be the first decline in annual average natural gas production since 2016, the agency said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |