NGI Weekly Gas Price Index | Markets | NGI All News Access | NGI Data

Flash of Volatility For New England Cash as Winter Continues Disappointing Natural Gas Markets

Hints of volatility in the Northeast and moderation out West highlighted a relatively uneventful week of winter trading in the natural gas spot market during the Jan. 13-17 period; NGI’s Weekly Spot Gas National Avg. picked up 13.0 cents to $2.155/MMBtu.

A return to more seasonable conditions late in the week prompted healthy gains for Northeast hubs. In New England, Tenn Zone 6 200L averaged $4.460 on the week, picking up nearly $2. Algonquin Citygate similarly added $1.740 to reach $4.330.

Limited overall demand accompanied steady prices through the middle third of the Lower 48 during the week. Benchmark Henry Hub slid 2.0 cents to average $2.050. In the Midwest, Alliance finished at $2.015, up 1.5 cents week/week.

Farther west, prices pulled back in the Rockies and California for the week. The elevated SoCal Citygate posted the largest drop-off, shedding 82.5 cents to average $4.365.

Meanwhile, sub-$2 front month natural gas futures could be a matter of “when” and not “if” absent more intimidating winter weather, as a much warmer forecast Friday prompted a sell-off that had the February Nymex contract testing that psychologically significant barrier. February fell 7.4 cents to settle at $2.003/MMBtu after dropping as low as $1.998; week/week the front month shed more than 20 cents, having settled at $2.202 the previous Friday.

Earlier in the week, it had seemed like Old Man Winter would at least deliver a “near-normal demand regime” for the back half of January, but prices “were crushed the rest of the week” by warming trends in the forecasts, Bespoke Weather Services said.

The latest guidance showed “a huge change in the warmer direction,” the forecaster said. The European data “has warmed enough to drop about 80-90 Bcf in natural gas demand over the last 36 hours, and that is only for the next 15 days,” the forecaster said Friday.

“…The warmer change can be directly attributed to the high latitude pattern offering no support for colder air intrusions into the United States…This pattern appears set to roll on into early February, and if that is the case, we will not hold $2.00 in prompt-month pricing” during the upcoming week, Bespoke said. Under such a scenario, “more demand losses will continue outweighing what would otherwise be solidly bullish balance data.”

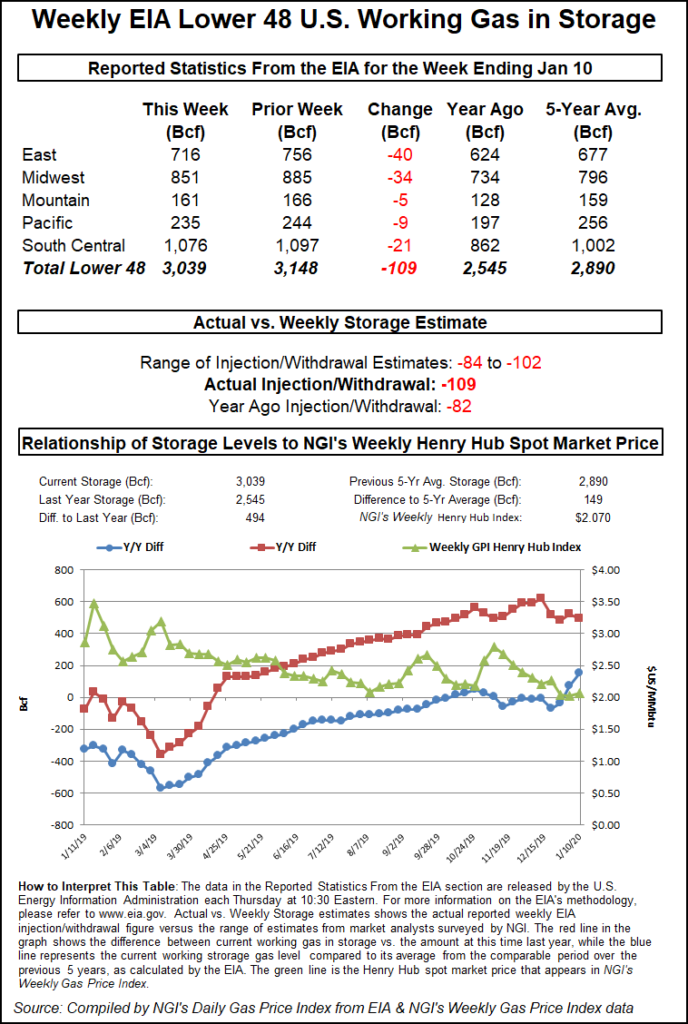

The Energy Information Administration (EIA) on Thursday reported a surprisingly hefty 109 Bcf weekly withdrawal from U.S. natural gas stocks for the week ended Jan. 10, lighter than the five-year average 184 Bcf but easily outpacing the 82 Bcf pull recorded in the year-ago period.

Prior to the report, projections had been pointing to a withdrawal just shy of the triple-digit mark. Major surveys had landed on a pull around 93-95 Bcf, with responses ranging from minus 84 Bcf to minus 101 Bcf.

NGI’s model had deviated from that range, predicting a 106 Bcf withdrawal for the week, not far from the actual figure.

Total Lower 48 working gas in underground storage stood at 3,039 Bcf as of Jan. 10, 494 Bcf (19.4%) higher than last year and 149 Bcf (5.2%) higher than the five-year average, according to EIA.

By region, EIA recorded a 40 Bcf withdrawal in the East and a 34 Bcf pull in the Midwest. The Pacific withdrew 9 Bcf on the week, while the Mountain withdrew 5 Bcf. In the South Central, an 18 Bcf pull from nonsalt and a 3 Bcf withdrawal from salt stocks resulted in a net 21 Bcf drawdown for the period, according to EIA.

Genscape Inc. analysts said the 109 Bcf pull is in line with the five-year average when compared to degree days and normal seasonality.

“While the vast majority of stats the past year or so have been loose, three of the last five weeks have been close to normal versus weather and seasonality,” according to the firm.

Analysts at Tudor, Pickering, Holt & Co. (TPH) said recent data suggests U.S. production may “finally have cracked.” Northeast production has trended lower over the past three weeks, helping drop total U.S. output to an average 95.5 Bcf/d over the past week, versus highs around 97 Bcf/d in late November, according to TPH estimates.

“Despite early signs of production roll-offs, weather continues to underwhelm, strengthening our conviction that spot pricing will dip below the $2/MMBtu mark, which appears likely to occur prior to injection season,” the TPH analysts said. “On a weather-adjusted basis, the larger-than-expected withdrawal implies a 2.5 Bcf/d undersupplied market, but we expect a correction back to oversupply in the coming weeks.”

Meanwhile, U.S. exports, both to Mexico and via liquefied natural gas (LNG), were showing signs of constraints as of Friday. Genscape estimated aggregate U.S. exports of 11.6 Bcf/d, a three-week low.

“Feed gas to U.S. LNG export terminals is at a 66-day low of 6.5 Bcf/d” for Friday, Genscape senior natural gas analyst Rick Margolin. “Earlier this week…Genscape proprietary monitors detected various trains at Sabine Pass either throttle down or completely shutdown and remain at limited operation.”

Genscape estimated Mexico exports Friday at 5.1 Bcf/d, about 0.6 Bcf/d off highs, indicating impacts from previously reported maintenance on the Valley Crossing Pipeline (VCP).

“Although a good portion of South Texas exports are getting rerouted to Mexico via other lines, VCP’s full volume is not being totally offset with re-routes,” Margolin said.

Price moves on deals negotiated Friday — for delivery through Tuesday due to the holiday — were mixed along the East Coast, with a number of hubs showing some volatility ahead of a wintry weekend forecast.

In New England, Algonquin Citygate gave back $2.420 on the day, but gas there still commanded a premium at $4.955 on average. Farther south, Transco Zone 5 surged $1.055 to $3.555.

The National Weather Service (NWS) Friday was calling for a “deepening winter storm” over the Central Plains Friday to push northeast into the Great Lakes by Saturday and into northern New York state and New England on Sunday.

“This storm will produce a widespread footprint of heavy snows from the Upper Mississippi Valley, across the Great Lakes, northern New York state into central to northern New England, with snow totals in the 6-12 inches range possible,” the NWS said. “…In the wake of the developing central U.S. storm, the Arctic air currently in the lee of the Northern Rockies across the Northern High Plains will be spreading east-southeastward” over the weekend, impacting the Upper Mississippi Valley and the Mid-Mississippi Valley/Ohio Valley regions.

These regions were expected to see temperatures fall to as much as 20 degrees below average, according to the forecaster.

Price movements were generally tame through the middle third of the Lower 48 Friday. In the Midwest, Emerson added 4.5 cents to $2.085, while in the Midcontinent, Northern Natural Ventura climbed 13.0 cents to $2.140. Discounts were the norm across most of Texas and Louisiana.

In the Western United States, California hubs moderated heading into the weekend. SoCal Citygate shed 46.0 cents to average $3.690.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |