Regulatory | NGI All News Access | NGI The Weekly Gas Market Report

Mexico Energy Minister Says Natural Gas “Most Important Issue” Facing Energy Sector

Natural gas is “the most important issue” currently facing Mexico’s energy sector, energy minister Rocío Nahle said on Tuesday.

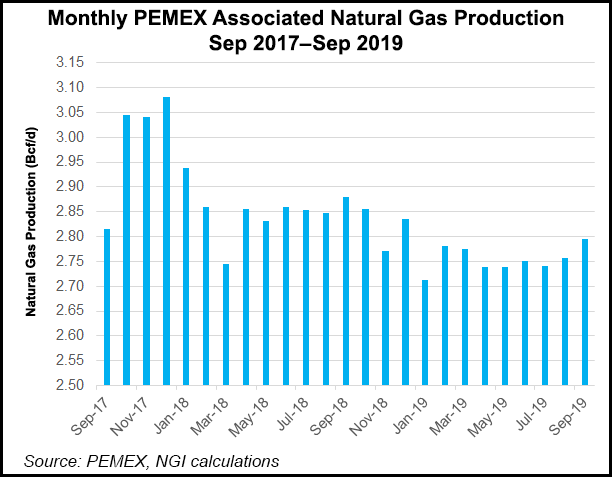

In an address to upstream oil and gas regulator Comisión Nacional de Hidrocarburos (CNH), Nahle said declining gas production from national oil company Petróleos Mexicanos (Pemex) has led to a “severe dependence” on gas imports from the United States.

“At the moment, fortunately, we have [access to] the cheapest gas in the world,” Nahle said, referring to imports from the United States. She warned, however, that Mexico would not be able to count on cheap gas prices forever.

This is especially relevant, given that combined-cycle gas turbines will play an increasingly important role as intermittent renewable energy occupies a larger share of the generation mix, Nahle said.

She said that although Mexico boasts immense prospective unconventional gas resources in areas such as the Burgos basin, President Andrés Manuel López Obrador has pledged not to pursue unconventional exploration and production (E&P) until “the technology advances,” due to concerns expressed by local communities.

Nahle said Pemex plans to increase its gas output through associated gas extracted from conventional onshore and shallow water oil plays, which are the focus of Pemex’s 2019-2023 business plan.

“As we produce more hydrocarbons, we will have gas, that is, associated gas,” said Nahle, a former Pemex engineer who worked in the company’s downstream division.

Asked whether the administration would allow Pemex to resume farming out operating stakes in its vast portfolio of upstream assets, Nahle said, “this must be decided by the company,” adding that farmouts “are not prohibited.”

While this is technically true, CNH was forced in June to cancel what would have been the sixth Pemex farmout tender, when energy ministry Sener withdrew the seven areas on offer from consideration for bidding.

As energy minister, Nahle also chairs Pemex’s board of directors.

Pemex’s 2019-2023 business plan does not include farmout tenders. Instead, private sector collaboration in the upstream segment with Pemex is limited to oilfield services (OFS) contracts, wherein Pemex maintains full ownership of the area in question, with the OFS provider earning a per-barrel fee from the state-owned company.

Just as unconventional E&P is not a priority, nor will Pemex pursue deepwater projects, Nahle said.

“We won’t go, as a government, to deep waters,” Nahle said, “because we don’t have the money, and because we have oil in shallow water and onshore.”

Prior to the farmout tender cancellation, CNH also was forced to suspend upstream bid rounds 3.2 and 3.3, which would have awarded conventional and unconventional gas-rich blocks in northern Mexico.

The government has said that bid rounds will not resume until the 107 contracts awarded through past rounds begin to show results.

Nahle said there is not a specific production amount that bid round winners must reach in order to convince the authorities. However, local oil and gas trade association AMEXHI has said it expects the private sector to produce 280,000 b/d of oil by 2024, the final year of López Obrador’s government.

Nahle said that the government will respect the 107 contracts awarded, and that it will not seek legislative changes to the 2013-2014 constitutional energy reform that made the rounds and farmout tenders possible.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 1532-1266 |