Weekly Natural Gas Spot Prices Mixed as Arctic Temps Pass Through

With demand from a recent Arctic blast peaking and then fading, and with more seasonal conditions expected in the week ahead, natural gas spot price moves were mixed during the trading week ended Friday (Nov. 15); NGI’s Weekly Spot Gas National Avg. added 11.0 cents to $2.695/MMBtu.

Numerous hubs in the eastern Lower 48 rallied more than $1 week/week amid the unusually chilly temperatures. Algonquin Citygate surged $1.205 to average $4.510 on the week, while Transco Zone 6 NY picked up $1.330 to $3.775. In Appalachia, Texas Eastern M-3, Delivery gained $1.190 to $3.560.

Consistent with analyst estimates suggesting national demand totals peaked in the early half of the trading week as the cold front worked its way through, prices in the Midwest sold off during the period. Chicago Citygate fell 24.0 cents to $2.565, while Michigan Consolidated dropped 21.0 cents to $2.515.

Elsewhere, the resolution of a restriction on the Natural Gas Pipeline Co. of America (NGPL) system supported hefty week/week gains for production-area hubs in West Texas and the Midcontinent. Waha gained 77.0 cents to average $1.900 on the week, while NGPL Midcontinent added 72.5 cents to $2.005.

Meanwhile, helped by recent model runs returning cold to the outlook, natural gas futures gained Friday as the market looked ahead to the weekend weather data for more clarity on the upcoming pattern. The December Nymex contract picked up 4.1 cents to settle at $2.688/MMBtu. Week/week the front month fell just over a dime after settling at $2.789 the previous Friday.

Coming off milder trends at the start of the week, a “gradual move back colder” from forecasts helped natural gas prices pare losses going into the weekend, according to Bespoke Weather Services.

“We suspect production may return to its highs over the weekend, but the market will be focused mostly on what happens” with weather models, Bespoke said. “There are mixed risks, and confidence in details is lower, so we definitely feel like it is a weekend to be cautious and stay neutral until we see what the modeling looks like on Sunday and Monday.

“Our lean is toward some colder risks” for late November, “but projected tropical forcing still suggests some warming into early December, and if that is correct” models “may begin to sniff that out” during the week ahead.

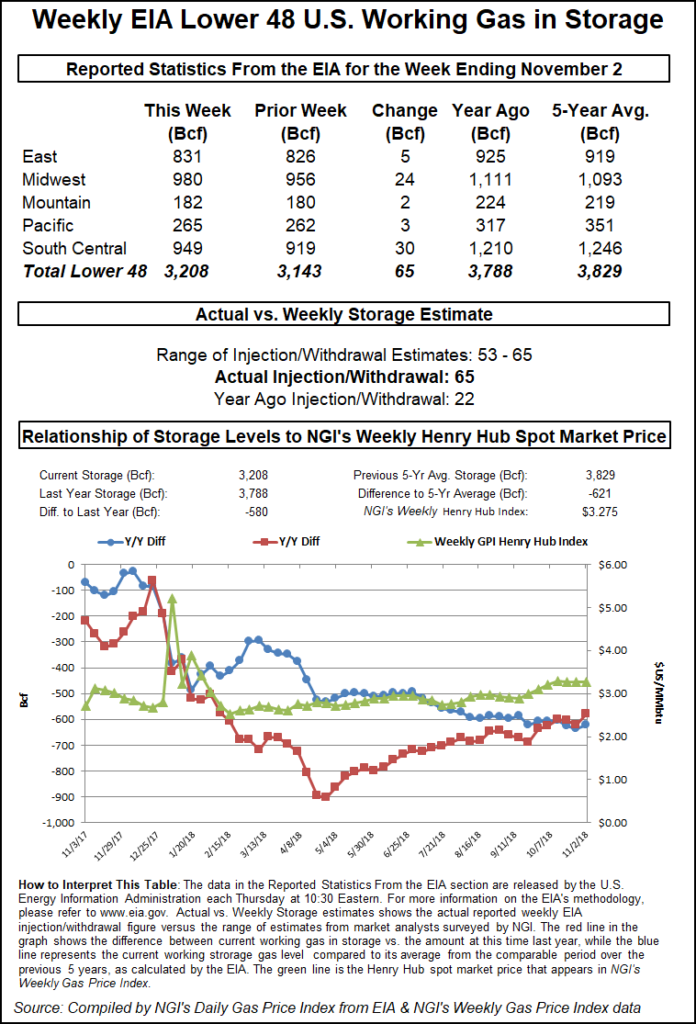

Looking at the inventory picture, the Energy Information Administration (EIA) on Thursday reported a 3 Bcf injection into U.S. natural gas stocks for the week ended Nov. 8, extending the refill season. The 3 Bcf build came in on the higher side of consensus, as expectations had ranged from a single-digit withdrawal to a single-digit injection. However, 3 Bcf is bullish against the historical comparisons, as last year EIA recorded a 42 Bcf injection for the period, and the five-year average is a 30 Bcf build.

Total Lower 48 working gas in underground storage stood at 3,732 Bcf as of Nov. 8, 491 Bcf (15.1%) higher than year-ago levels and nearly flat with the five-year average of 3,730 Bcf.

“On a weather-adjusted basis, the market is back in 3 Bcf/d oversupplied territory, where it has been for much of the fall, after a small reprieve” in the previous week’s report when balances came in around 1 Bcf/d oversupplied, according to analysts at Tudor, Pickering, Holt & Co. (TPH).

The withdrawal season is poised to “get started in a big way” with the next EIA report, the TPH analysts said. They pointed to early estimates calling for a withdrawal north of 80 Bcf based on residential/commercial demand tracking 38% above historical norms amid the recent cold weather sweeping through the Lower 48.

Residential/commercial demand over the past week averaged 38.5 Bcf/d, “levels not normally witnessed until late December, and given the significant oversupply in the market, it’s possible” the next storage print will be the “largest until Christmas if weather normalizes,” the TPH team said.

The Desk’s Early View storage survey Friday showed 20 respondents predicting a median 89 Bcf withdrawal for the week ended Nov. 15, with expectations ranging from a withdrawal of 65 Bcf up to a 102 Bcf pull.

Over the past nine weeks, injections have tracked 93 Bcf above the five-year average, but total degree days have exceeded the five-year average by 108 Bcf, Genscape Inc. analysts Eric Fell and Brandon Lee noted. During that time, balances have on average been loose by 4 Bcf/d when adjusting for weather and seasonality, they said.

Forecasts calling for a chilly pattern for the eastern Lower 48 over the weekend helped rally prices on three-day deals Friday at a number of East Coast hubs.

In the Northeast, Algonquin Citygate gained 55.5 cents to $3.475. In the Southeast, Transco Zone 5 added 8.5 cents to $2.855.

The National Weather Service (NWS) on Friday was monitoring a developing surface low off the Southeast coast that was expected to intensify and move slowly northward over the weekend.

“High pressure in the wake of the coastal system will settle in across the eastern United States, keeping temperatures near to below normal,” the forecaster said. “Daytime highs could be 10-20 degrees below normal, mainly across portions of the Ohio Valley and along much of the Eastern Seaboard.”

Over on the West Coast, PG&E Citygate eased 2.5 cents to $3.065 going into the weekend, while SoCal Citygate dropped 30.0 cents to $3.990.

Maintenance early in the upcoming work week on Pacific Gas & Electric Co.’s (PG&E) Baja Path could impact up to 0.6 Bcf/d of flows into Southern California Gas and Kern River, according to Genscape analyst Joe Bernardi.

“PG&E will perform planned maintenance on the Topock and Hinkley compressors, requiring flows at those stations to go to zero for the duration of the work,” the analyst said. “When the shutdown begins at 5 a.m. PT on Tuesday, no further receipts onto PG&E will be available from the interconnects with Transwestern or El Paso Natural Gas. Together, these two points have averaged 632 MMcf/d in the past 30 days.

“Receipt capacity will remain available at PG&E’s interconnect with Kern River at the High Desert Lateral. That interconnect typically features deliveries from PG&E to Kern, rather than receipts onto PG&E from Kern; however, receipts there are possible and have maxed out at about 150 MMf/d this year.”

Deliveries into SoCalGas from PG&E at the Kern River Station are also likely to see impacts from this work, according to Bernardi.

“Those volumes have averaged about 200 MMcf/d over the past month; they are tied to Baja Path receipts, particularly those at the two points (El Paso and Transwestern) that will be limited to zero by this maintenance,” Bernardi said.

The NWS called for above-normal temperatures over the western United States heading into the weekend “underneath of persistent upper level ridging. Weak disturbances rounding the top of the ridge may bring snow to the higher elevations in the Northwest. In between, a front crossing the north-central United States will bring periods of scattered rain and snow showers from the northern Rockies/Plains to the Upper Mississippi Valley. Light snow accumulations are possible across parts of Northern Wisconsin and Northeast Minnesota.”

Midwest prices were steady Friday. Emerson eased 2.0 cents to $2.465. In the Midcontinent, Northern Border Ventura fell 3.5 cents to $2.450.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |