U.S. Down One Natural Gas Rig; Another Sharp Decline For Oil Patch

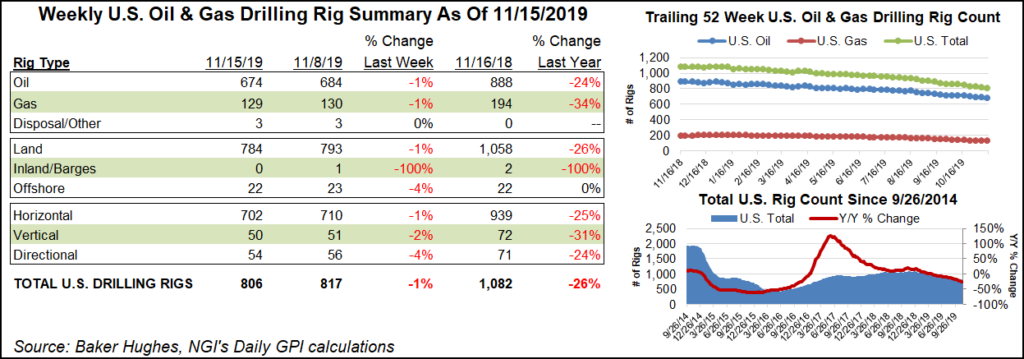

The U.S. natural gas rig count fell one unit to 129 for the week ended Friday, while a larger decline in oil drilling drove a double-digit drop in the overall domestic tally, according to data from Baker Hughes Co. (BKR).

Even after months of retrenchment, the U.S. rig count showed no signs of slowing the pace of its descent during the week, as 10 oil-directed rigs joined the one natural gas rig in exiting the patch. That put the combined U.S. count 276 units behind the 1,082 active rigs at this time last year.

Nine rigs departed on land, along with one offshore and one from inland waters, according to BKR. Gulf of Mexico activity held steady at 22 rigs. Eight horizontal units departed on the week, joined by two directional units and one vertical.

The Canadian rig count fell six units week/week to 134, with a decline of nine oil-directed rigs partially offset by the addition of three gas-directed units. Canada had 197 active rigs in the year-ago period.

The combined North American rig count fell 17 units to 940 for the week, down from 1,279 a year ago.

Among plays, the Permian Basin saw the largest decline for the week, with four rigs exiting the play. The Permian finished with 408 rigs, down from 493 in the year-ago period.

The Marcellus Shale dropped three rigs week/week to fall to 37, down from 58 a year ago. Conversely, the Utica Shale picked up two rigs to increase its total to 13, versus 17 a year ago.

Also among plays, the Mississippian Lime added one rig for the week, while the Ardmore Woodford, Cana Woodford, Denver Julesburg-Niobrara and Williston Basin each dropped one rig.

Among states, Texas dropped five rigs overall for the week, while Louisiana, West Virginia and Wyoming each dropped two. Colorado, North Dakota, Pennsylvania and Utah each dropped a rig, while New Mexico and Oklahoma each added one overall.

Based on the latest 3Q2019 earnings conference calls, signs continue to point to slowing activity in the U.S. onshore as 2019 winds down.

Pressure pumping expert ProPetro Holding Corp. deployed 25.1 fleets in the Lower 48 during the third quarter, but utilization in the final three months is likely to decline to 18-20 because of “customer budget exhaustion, seasonality and overall softening industry demand,” CEO Dale Redman said Thursday.

The Midland, TX-based oilfield services operator’s business for exploration and production customers is hydraulic fracturing and completion services.

The Permian Basin, where ProPetro activity is concentrated, has seen challenges in the last half of this year, Redman said, “as we adjust and adapt to the swing in activity and a change in approach by our customers. The drawdown in activity has pushed us to focus on our own profitability and cost structure to maintain acceptable returns and utilization.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |