Markets | NGI All News Access | NGI The Weekly Gas Market Report

DOE Official Says U.S. Committed To Strengthening Natural Gas Ties With Mexico

U.S. companies can play a vital role in expanding Mexico’s access to cheap and abundant natural gas, a U.S. Department of Energy (DOE) senior advisor said Monday.

“Mexico is a critical and strategic partner for the United States, especially in our efforts to promote comprehensive energy security and economic prosperity across the western hemisphere,” Ken Stevens of the DOE’s Office of International Affairs said at the U.S.-Mexico Natural Gas Forum in San Antonio, TX.

He added, “Our energy systems are inextricably linked by physical infrastructure, commercial ties and cross-border investment.”

Stevens cited plans announced last Friday by the U.S. International Development Finance Corporation (DFC) to finance a $632 million natural gas pipeline in southern Mexico as evidence of the U.S. government’s commitment to strengthening energy ties with Mexico.

DFC, formerly known as the Overseas Private Investment Corporation (OPIC), has signed a letter of interest to finance the project, which is under development by Rassini S.A.B de C.V. in Mexico’s southern states.

“Private sector investment is essential to promoting the development of prosperous, stable and secure communities across Mexico,” DFC CEO Adam Boehler said Friday. “This pipeline will foster development in the south of Mexico while strengthening energy security and facilitating trade. These advancements will accelerate economic growth and create transformative opportunities in southern Mexico to improve quality of life.”

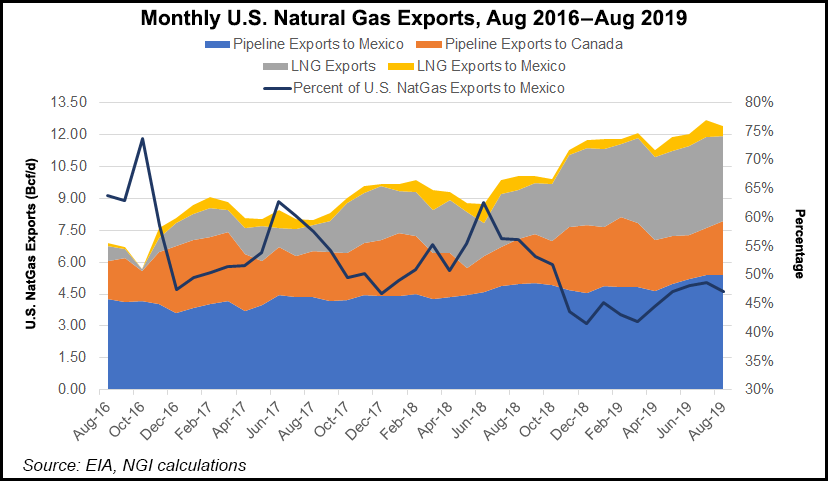

Stevens cited that Mexico surpassed Canada during the first half of 2019 as the United States’ largest trading partner.

“About $1.7 billion in goods cross the United States-Mexico border daily in each direction,” Stevens said. “Energy is a major component of that trade relationship.”

He noted that U.S. gasoline exports to Mexico could fall over the coming years if President Andrés Manuel López Obrador’s administration follows through on pledges to strengthen the local refining segment. “Under the right investment climate, U.S. companies can play a supportive role modernizing Mexico’s refining sector, given their deep expertise and technological advances.

The United States supports [López Obrador’s] goal of investing in Mexico’s energy sector and remains committed to seeing Mexico’s energy sector thrive, “which is a vital part of the security and prosperity of both countries,” Stevens said. Mexico is the third-leading source of U.S. crude oil imports, while the country meets about half of its gasoline demand through imports from the United States.

“Further development of cross-border infrastructure will only produce positive benefits for both sides,” Stevens said. “U.S. companies are particularly well-positioned to partner with Mexico on energy sector projects.”

Meanwhile, delays to the signing of the U.S.-Mexico-Canada-Agreement (USMCA) are not affecting natural gas flows from the U.S. to Mexico, according to Stevens. The main hindrance, has been delays to downstream pipeline projects on the Mexican side of the border.

Mexico’s pipeline import capacity grew by 40% with the entrance into operation in September of the 2.6 Bcf/d Sur de Texas-Tuxpan pipeline.

The U.S. Energy Information Administration projects net natural gas exports to average 4.6 Bcf/d in 2019 before rising to 7.2 Bcf/d in 2020, driven by growing liquefied natural gas export capacity and the expansion of Mexico’s pipeline network.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 1532-1266 |