Infrastructure | NGI All News Access

DCP Takes Bigger Stake in DJ’s Cheyenne Connector, Boosts ’19 Budget

DCP Midstream Partners raising its spending for 2019 after increasing its ownership option last month in a major natural gas pipeline expansion project aimed at debottlenecking supply from the Denver-Julesburg (DJ) Basin.

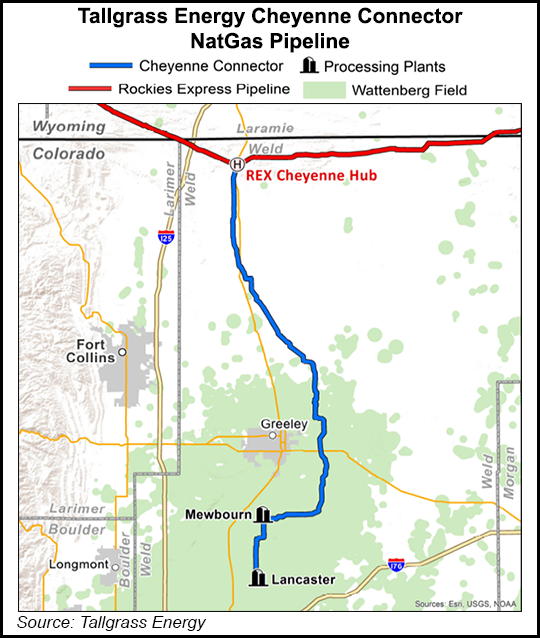

On a call to discuss third quarter earnings, DCP CEO Wouter van Kempen said the company increased its ownership in the Cheyenne Connector pipeline project to 50% from one-third following a deal with Tallgrass Energy LP. The 600 MMcf/d pipeline is expected to be in service in the first half of 2020 and “will fully alleviate all constraints” into the DJ, “unlocking the full potential of our customers’ production.”

Given DCP’s increased stake in the Cheyenne Connector and a capital efficient offload agreement to reduce 2020 growth spending, management now expects 2019 expenditures to “modestly exceed” the high end of its range of $800 million and “settle somewhere around $850 million,” according to CFO Sean O’Brien.

DCP is set to bring online by the end of this year a 90,000 b/d expansion of the Southern Hills natural gas liquids (NGL) pipeline system via the White Cliffs conversion, with further enhancements that could bring capacity to 120,000 b/d. Another project would expand the Southern Hills system by about 40,000 b/d to 230,000 b/d and is expected to be in service by the end of 2020.

Management remains confident in its decision to increase the capacity on Southern Hills despite a reduction in volumes during the third quarter, which O’Brien attributed to ethane rejection doubling sequentially. Some third-party volumes were also lost to other pipelines, while shorter-term volumes rolled off that were intended to bridge the gap until the White Cliffs conversion was completed.

“I can tell you we feel very comfortable, very strong about our Sand Hills margins and our Southern Hills margins, which by the way, year-to-date are up about 25%,” O’Brien said. “So we continue to grow the margins around those assets.”

Another DJ-focused project, the 200 MMcf/d O’Connor 2 plant, was placed into service during the third quarter and is averaging about 130 MMcf/d of throughput. “Our marketing team has done a great job executing on incremental interim takeaway solutions in the DJ, allowing us to exceed our initial volume expectations at the plant,” van Kempen said.

Together with the associated bypass of up to 100 MMcf/d, due online by the end of this year, total available DJ capacity would be 1.4 Bcf/d.

DCP also completed a $1.53 billion transaction to eliminate its general partner economic interests, including incentive distribution rights (IDR), in exchange for 65 million DCP common units. Enbridge Inc. and Phillips 66 maintain equal ownership in the general partnership, which owns 57% of DCP outstanding common units.

Van Kempen said the deal to eliminate IDRs lowers the future cost of capital, “positioning DCP for continued long-term success and continued ability to grow.”

Looking ahead, DCP continues to expand its fee-based margin profile, while balancing its portfolio and mitigating against potential overbuild. For 2020, the midstreamer expects the fee-based portion of its margin to grow to 70%.

Management is expected to issue full guidance in February, but van Kempen provided some color on expected trends and outlooks for 2020. The industry’s long cycle of growth is expected to slow, as companies focus on operating within cash flows. Additionally, DCP is planning for a “sustained, relatively low commodity price environment,” although management is confident the company will continue to “successfully navigate a very dynamic industry environment.”

DCP reported a net loss of $178 million (minus $1.59/share) for the third quarter, compared with $81 million (18 cents) in the third quarter of 2018. Distributable cash flow was $190 million in 3Q2019, down $19 million from 3Q2018.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |