Infrastructure | NGI All News Access

Sempra to Make FIDs on Mexico, U.S. LNG Projects Early Next Year

San Diego-based Sempra Energy expects to reach final investment decisions (FID) during the first half of next year for liquefied natural gas (LNG) expansion projects while it finishes construction of its second and third liquefaction trains at the Cameron, LA, LNG export site.

Sempra President Joe Householder indicated that the Energia Costa Azul (ECA) phase one LNG export project in North Baja California, Mexico, should reach the FID stage in 1Q2020, and the first phase of the Port Arthur, TX, LNG export project will do the same in 2Q2020.

With the first liquefaction train operating at the Cameron LNG facility in Hackberry, LA, the three-train project is more than 96% complete, Householder said.

“We recently began limited site activity at Port Arthur, and we continue to advance discussions with interested customers for the rest of the plant capacity,” Householder said.

Householder said that Sempra’s marketing efforts for LNG globally have picked up momentum with “significant participation” at the highest levels of the involved organizations. “We’re focused on bringing all of our LNG projects to fruition and securing binding offtake agreements to satisfy global demand and deliver value to shareholders,” he said.

The vision of Householder and CEO Jeffrey Martin is that Sempra export projects on the Gulf Coast and the west coast of Mexico are going to “unlock North America’s energy potential.” Householder said Sempra wants to take the extra time to “get it right,” and added that partners in the projects “have to get comfortable” with their projected returns.

Sempray is signing “a lot” of memorandums of understanding for supply “and the customers are quite excited about the projects,” Householder said. “Mexico continues to be an attractive market for us.”

Earlier this year Sempra secured two approvals from the U.S. Department of Energy (DOE) for global exports of liquefied natural gas (LNG) via the ECA liquefaction project.

The authorizations allow Sempra “to export U.S. produced natural gas to Mexico and to re-export liquefied natural gas (LNG) to countries that do not have a free-trade agreement with the U.S., from its Phase 1 and Phase 2 liquefaction export facilities in development in Baja California, Mexico,” Sempra said.

The two-phase ECA liquefaction project, a joint venture between Sempra LNG and Infraestructura Energética Nova (IEnova), will be built adjacent to Sempra’s existing ECA LNG receipt terminal near the city of Ensenada. IEnova is Sempra’s Mexico subsidiary.

Sempra reported 3Q2019 earnings of $813 million ($2.84/share), compared with $274 million (99 cents) in the same period last year.

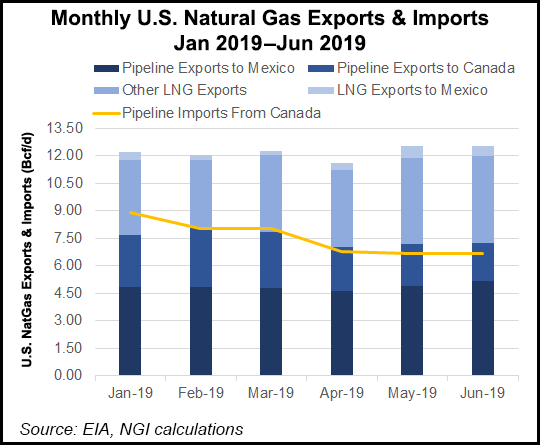

U.S. natural gas exports reached 31 markets and grew by 27% in the first six months of the year, according to the latest trade scorecard of the DOE.

First-half 2019 U.S. exports were 2.13 Tcf or 11.8 Bcf/d, compared with 1.68 Tcf or 9.3 Bcf/d in the same period of 2018, DOE said.

The increased U.S. exports included LNG ocean tanker and ship container deliveries to 29 countries, as well as pipeline flows to Canada and Mexico.

American gas exports to Mexico rose by 10.4% to 883.3 Bcf or 4.9 Bcf/d in the first half of this year from 800.2 Bcf or 4.4 Bcf/d a year earlier.

The first-half 2019 average price for U.S. pipeline exports to Mexico dropped by 11.7% to $2.82/MMBtu from $3.20/MMBtu during the comparable 2018 period.

Prices fetched by U.S. LNG cargoes varied widely across their 29 destinations from $2.95/MMBtu in Jamaica to $10 for small volumes sent on container ships to Haiti, the Bahama Islands and Barbados.

More than half of U.S. LNG exports were destined for South Korea, Mexico, Spain, Chile, Japan and the Netherlands, DOE said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |