Infrastructure | E&P | NGI All News Access

Four Rigs Exit Domestic Natural Gas Patch, Oil Count Rises

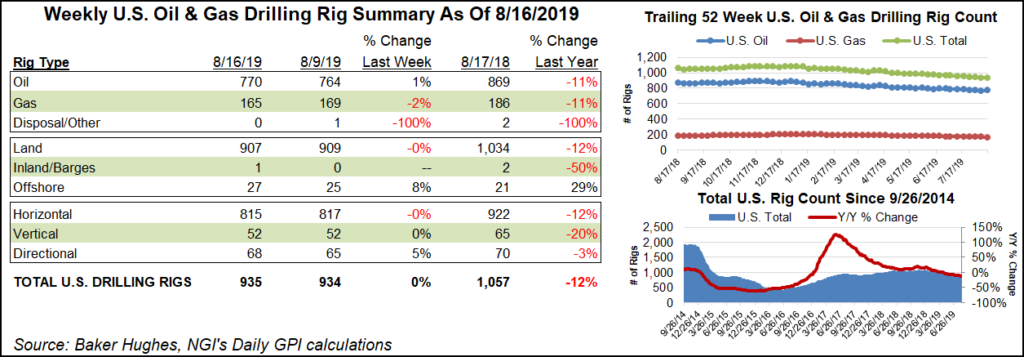

The U.S. natural gas rig count fell four units to 165 for the week ended Aug. 16, while domestic oil drilling rebounded, according to data published Friday by Baker Hughes, a GE Company (BHGE).

The United States added one rig overall to finish the week with 935, down from 1,057 a year ago. Changes included a net increase of six oil-directed rigs and a decline of one miscellaneous unit.

Land drilling declined by two overall, while two units were added in the Gulf of Mexico, along with one in inland waters. Three directional units joined the patch, while two horizontal units packed up, according to BHGE.

The Canadian rig count gained two overall to reach 142 rigs, with the addition of seven oil units offsetting the loss of five units drilling for gas. A year ago, Canada had 212 active rigs. The combined North American rig count climbed three units to 1,077, versus 1,269 in the year-ago period.

Among major plays, the Permian Basin saw its total rig count slide three units to fall to 441, down from 486 a year ago. The gassy Utica Shale dropped two rigs to 13, versus 23 in the year-ago period.

The Cana Woodford, Denver Julesburg-Niobrara, Eagle Ford Shale and Williston Basin each added one rig week/week.

Among states, West Virginia and Texas each saw four rigs exit the patch for the week, while three departed in Ohio, according to BHGE data.

Conversely, Pennsylvania added four rigs on the week, Louisiana picked up three rigs, while New Mexico and Alaska each added two. North Dakota added one rig to its total, as did Wyoming, while one rig departed in Oklahoma.

Bankruptcies in the upstream sector are on the rise this year as commodity prices have fallen with little sign of a rebound anytime soon, according to Haynes and Boone LLP, which regularly tracks filings across the oil and gas industry. Year-to-date 26 North American exploration and production companies have filed for bankruptcy, veresus 28 total last year and 24 total in 2017.

Operators across the country have scaled back as commodity prices have slid. Some gas producers in particular are facing even more pressure to perform as they grapple with high levels of debt, oversupply and investors that are losing interest in the space as they expect better returns.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |