Markets | NGI All News Access | NGI Data

Tetco Explosion, Texas Heat Seen Behind EIA’s 49 Bcf Storage Injection

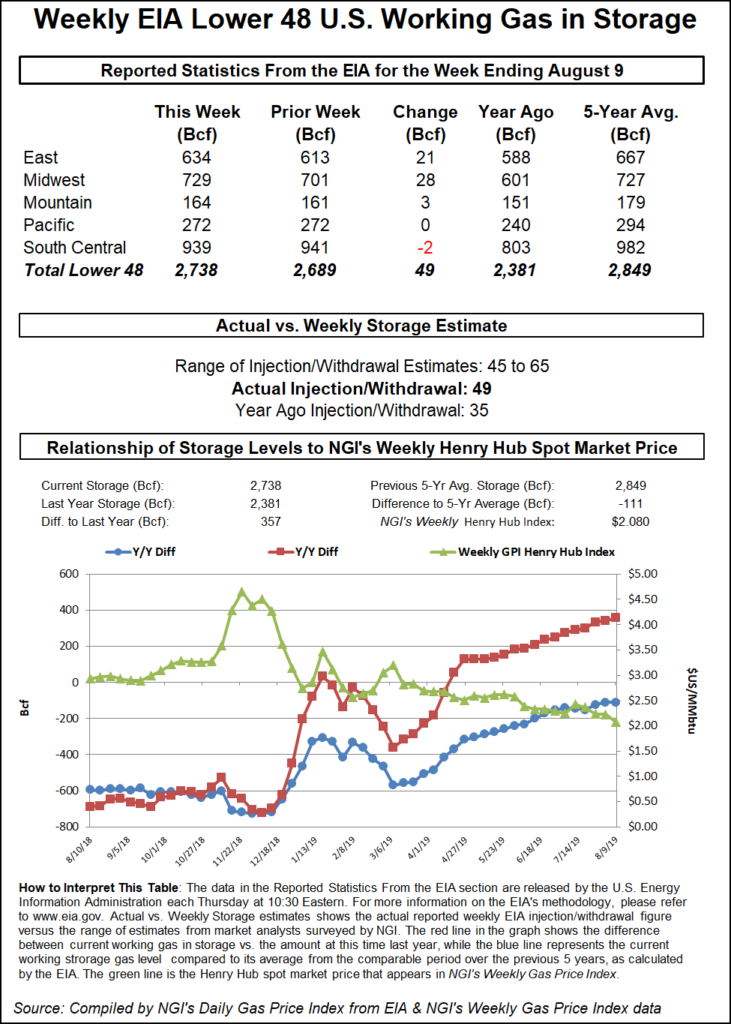

The Energy Information Administration (EIA) reported a 49 Bcf injection for the week ending Aug. 9, surprising analysts who had called for a build nearly 10 Bcf higher.

Although far off the mark, the reported injection was far higher than last year’s 35 Bcf injection but exactly on par with the 49 Bcf five-year average, according to EIA.

Natural gas futures responded immediately to the bullish storage data, with the September Nymex contract sitting at $2.18, up 3.7 cents, just before the print hit the screen and then steadily climbing in the half-hour afterward. By 11 a.m. ET, the prompt month was trading at $2.243, up 10 cents on the day.

“Once factoring in the week/week decline in liquefied natural gas (LNG), this number is quite tight,” said Bespoke Weather Services. “The magnitude of the miss is difficult to rationalize.”

The firm did see downside risk in this week’s EIA report, based on the strongest Texas heat of the summer and relatively low wind, “but there may have been some impact from the pipe explosion the other week as well. If this level of tightness shows again next week, however, the game may have finally changed.”

Indeed, several other analysts on energy chat room Enelyst, which is hosted by The Desk, agreed that the Texas Eastern Transmission (Tetco) explosion that occurred Aug. 1 had a profound impact on this week’s storage data, with the reshuffling of flows making the injection “almost completely unestimatable.”

Still, others said that Northeast production has continued to reach new heights despite the outage on Tetco, and that maintenance at the Sabine Pass LNG terminal offset the Tetco impacts in the South Central region.

Ahead of the EIA report, a Bloomberg survey of 11 analysts had an injection range of 45 Bcf to 65 Bcf, with a median of 58 Bcf. A Reuters poll produced the same range and median, while NGI projected a smaller 52 Bcf injection that proved to be more in line with the actual EIA figure.

Bespoke chief meteorologist Brian Lovern said that heat in Texas finally showed up in a big way over the last week, and wind output was lower as well, “which is always tough to model.

“Weather has sure done its best to try and support prices. It just hasn’t been enough. September and October don’t get much fanfare, but it definitely matters if weather demand can deviate strongly one way or the other,” Lovern said.

Broken down by region, the EIA reported a 28 Bcf injection in the Midwest, and a 21 Bcf build in the East. The South Central region reported a net withdrawal of 2 Bcf, which included a 7 Bcf draw from salt facilities and a 6 Bcf injection into nonsalts.

Working gas in storage as of Aug. 9 stood at 2,738 Bcf, which is 357 Bcf above year-ago levels and 111 Bcf below the five-year average, according to EIA.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |