Infrastructure | NGI All News Access

After Merger Failure, Avista Reports Growth in Pacific Northwest

Now that the dust has settled from an aborted merger with Hydro One Ltd., natural gas and power distributor Avista Corp. has found solace in lowering its utility costs and finding customer growth in the Pacific Northwest, retiring CEO Scott Morris said during a second quarter conference call.

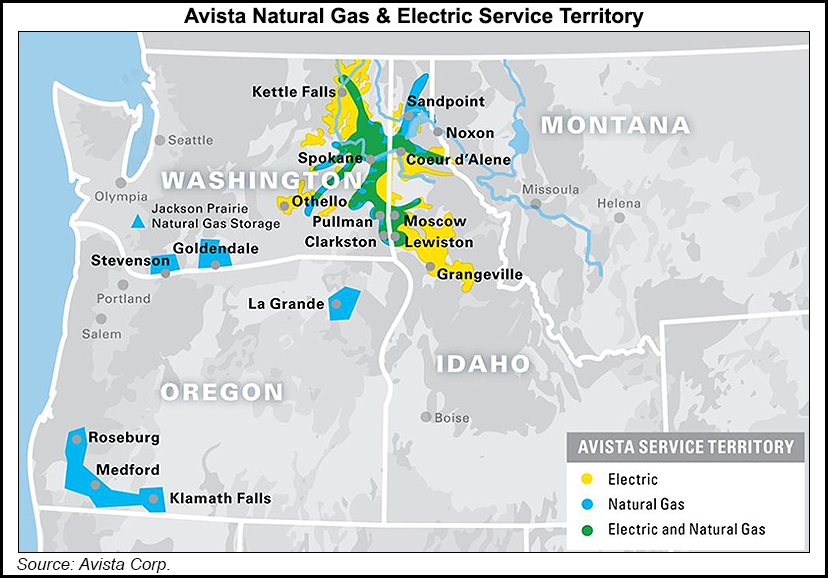

In the trio of states it serves, Avista has about 350,000 gas utility customers, with nearly half, or 163,000, in Washington, 102,000 in Oregion and 83,000 in Idaho. The utility’s gas customer total was 318,000 in 2012. However, since 2014 the growth has all been concentrated in Washington, with Oregon and Idaho essentially flat.

Since lack of approvals from state regulators led Avista to abandon its $5.3 billion merger, the utility has been attempting to wrap up major rate proceedings in Idaho, Oregon and Washington.

Avista reached an all-party settlement last month in Oregon on a pending general rate case and will file it with the regulatory commission in the coming weeks. The utility also has pending gas cost adjustment and decoupling cases that if approved by the Oregon Public Utility Commission (PUC) would increase annual gas utility rates by 9.8% starting Nov. 1.

“In June, we filed an electric general rate case in Idaho, and we continue to work through the regulatory process in Washington,” Morris said. “We expect these cases to provide rate relief in 2020 and reduce the regulatory lag that we have been experiencing.”

In the second quarter, “gas utility margin benefited from the implementation of new base rates in Washington state that were effective in 2018, and in Idaho to reflect the lower 21% corporate tax rate,” Morris said. “The 2Q2018 true up of the estimates related to these base rate changes that positively affected utility margin.”

Morris is remaining on the board after his retirement. President Dennis Vermillion has been named to take over as CEO on Oct. 1.

The Spokane, WA-based utilty has raised its full-year earnings guidance for 2019 by 5 cents/share to up to $3.03, including a $1.01/share termination fee from Hydro One.

For 2Q2019, Avista reported net income of $25.3 million (38 cents/share), compared with $25.6 million (39 cents) for the same period in 2018.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |