Shale Daily | E&P | NGI All News Access

OPEC, Allies to Extend Global Crude Reductions to End of March 2020

As expected, OPEC, aka the Organization of the Petroleum Exporting Countries, and its Russian-led allies have agreed to extend crude production reductions to the end of next March to help balance a global market upended by massive U.S. supply.

Because of “the underlying large uncertainties and its potential implications on the global oil market,” the Saudi-led cartel and non-OPEC members meeting in Vienna reaffirmed their “continued commitment…to a stable market…” and to earning “a fair return on invested capital.” There has been an “overall improvement in market conditions and sentiment,” leading to “the return of confidence and investment to the oil industry.”

The voluntary production adjustments instituted last December were extended nine months to March 31. Late last year, OPEC agreed to cut production levels by 1.2 million b/d, despite pressure from President Trump to maintain higher levels (and thus lower oil prices) to benefit U.S. consumers.

Saudi Oil Minister Khalid Al-Falih during a press conference said the Kingdom was willing to reduce oil output more deeply than its quota if necessary to help balance the global oil markets, which he admitted had been roiled by Lower 48 oil.

“I have no doubt in my mind that U.S. shale will peak, plateau and then decline like every other basin in history,” Al-Falih said. “Until it does I think it’s prudent for those of us who have a lot at stake, and also for us who want to protect the global economy and provide visibility going forward, to keep adjusting to it.”

Analysts with Tudor, Pickering, Holt & Co. Inc. (TPH) called the decision to hold production lower for nine months instead of six a net positive for maintaining the global supply/demand balance “as it gives runway to see how supply/demand balance trends into 2020, given seasonally soft demand post-4Q2019.

“Russia appears to be aligned with the extension,” partly because of oil contamination issues that have hindered its ability to ramp volumes in the near term, even as some market participants thought the country would back away.

Saudi Arabia is to remain at/near current production levels of 9.7 million b/d to the end of March and appears “not concerned about losing market share.”

However, if global oil demand growth continues to disappoint, more reductions or limited growth from “key” sources outside OPEC including the United States “may be required to balance the market to complement actions” by the cartel and its allies, TPH said.

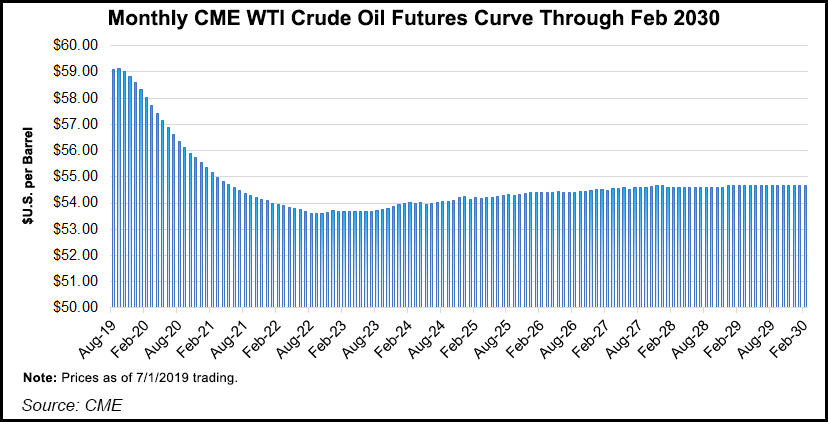

Crude on Monday tracked back early gains during the day, “potentially attributable to broader concerns of the 2020 imbalance and general demand concerns outweighing an extension of cuts in the face of ramping U.S. production.”

If the International Energy Administration’s 2020 forecast plays out, with oil supply of 2.3 million b/d-plus and demand of 1.4 million b/d, “there will be a meaningful imbalance in the market,” said analysts.

The TPH team is looking for a combination of improving demand trends in the second half of the year, as well as potentially slower growth from the non-OPEC heavyweights in the United States, Norway and Brazil, as well as “deeper cuts” from the cartel and its allies, which continues to be under discussion.

ClearView Energy Partners LLC noted that OPEC has more to balance these days than the oil market. “Sealing the bargain outside the official auspices of OPEC drew opposition from Iran, which has less opportunity to benefit from OPEC strictures now that U.S. sanctions have cut its export volumes by 80%.”

There’s also “process versus optics,” ClearView analysts said. OPEC in its communique acknowledged the “crucial role” played by non-OPEC producers, underscoring the cartel’s “concerns about demand weakness in the face of continued U.S. supply growth.”

Tighter markets also could lead to a spike in oil prices, which could lead the U.S. Congress to advance NOPEC, the No Oil Producing and Exporting Cartels Act, basically outlawing OPEC under the Sherman Antitrust Act, ClearView noted. “Election pressures could diminish President Trump’s already limited patience with price volatility to the upside.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |