NGI Mexico GPI | Markets | NGI All News Access

Natural Gas Futures Crash to New Low after EIA Delivers Shocking 115 Bcf Storage Build

A hugely bearish storage report swept the floor out from under U.S. natural gas prices Thursday, sending the prompt month down to a fresh low and crushing any hopes that market bulls had of reviving prices. The July Nymex gas futures contract, which had traded in positive territory early in the session, went on to settle 9.1 cents lower at $2.185/MMBtu. August dropped 9.7 cents to $2.166.

Spot gas prices also declined as soggy weather continued across much of the United States, keeping a lid on demand. Led by steep sell-offs in California and the Rockies, the NGI Spot Gas National Avg. fell 15 cents to $1.885.

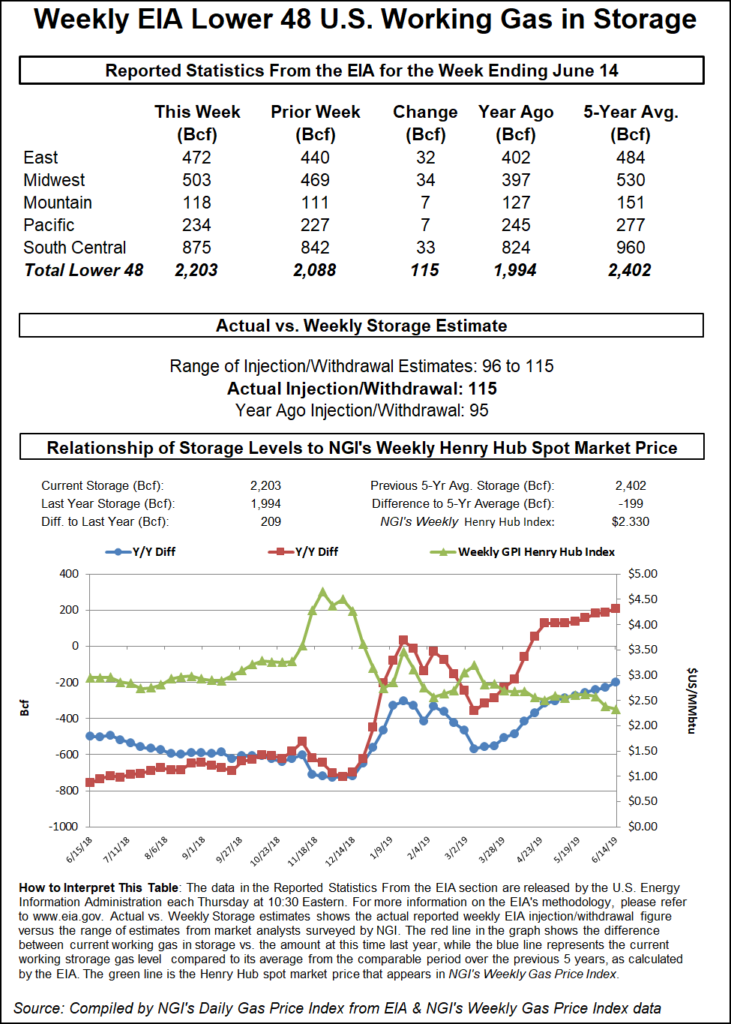

Nymex futures had an action-packed session on Thursday, trading in one of the widest ranges seen in the last several months as word spread of yet another huge miss on storage. The Energy Information Administration (EIA) reported a 115 Bcf injection into storage inventories for the week ending June 14, a print that was around 10 Bcf higher than what most analysts had expected.

The reported build compares with last year’s 95 Bcf injection and the 84 Bcf five-year average build.

“That was a big crusher,” said Huntsville Utilities’ Donnie Sharp, senior natural gas supply coordinator, on energy chat room Enelyst. “Lots of volumes reversing course very quickly.”

Indeed, the July Nymex contract was trading a couple of pennies higher before the EIA data was released but then immediately dropped around a nickel once the print hit the screen.

The 115 Bcf injection implies that the market was 2.4 Bcf/d looser (bearish) than last year on a weather-adjusted basis, according to Raymond James & Associates. The market has averaged 3.1 Bcf/d looser over the past four weeks, the firm said.

Bespoke Weather Services, which had projected a 104 Bcf build, said there appears to be much more supply out there than is indicated by the data, “giving us very low confidence in what to expect going forward in terms of the supply/demand balance.”

The uncertainty on supply has been building for weeks, after a string of bearish surprises in the EIA data. Thursday’s report was the sixth in which an injection of more than 100 Bcf was reported.

Broken down by region, 34 Bcf was injected in the Midwest, 32 Bcf was added in the East and 33 Bcf was stocked in the South Central, including 26 Bcf into nonsalt facilities and 8 Bcf into salts, according to EIA. At 2,203 Bcf, inventories are 209 Bcf above last year’s levels and 199 Bcf below the five-year average.

Longer term, with associated gas production remaining robust, the market needs only modest supply growth from Appalachia (and likely declines in most other gas plays) to balance, according to Raymond James. “We expect 2019 should prove to be a positive year for natural gas demand as both exports to Mexico and outbound liquefied natural gas (LNG) tanker activity ramp up.”

Genscape Inc. estimated that U.S. pipeline exports to Mexico surged to 5.7 Bcf/d on Thursday. “Exports have been continually setting new record highs, but today’s number represents a gain of nearly 170 MMcf/d above the previous record from June 13,” Genscape senior natural gas analyst Rick Margolin said.

Flows from Texas’ Valley Crossing pipeline to Mexico’s new Sur de Texas-Tuxpan subsea system have breached 0.45 Bcf/d as the line goes through testing, linepacking and startup operations.

Meanwhile, there are no clear signs that displacement of Mexican LNG imports has begun. However, Genscape is forecasting displacement to start in the middle of next month, at which time Sur de Texas will significantly displace LNG sendout from the Altamira terminal.

“Later in the year, we expect the Wahalajara pipeline system’s startup will displace Mexican LNG sendout at the Manzanillo terminal,” Margolin said.

On the LNG front, feed gas deliveries were revised lower for Wednesday as Sempra Energy’s Cameron LNG export project is back to taking in very little gas, according to Bespoke.

On the supply side, Lower 48 production is already running more than 10 Bcf/d higher year/year, with more associated gas supply expected, Raymond James said. “However, we believe an increasing domestic gas supply and growth in renewables that are increasingly becoming more cost competitive with gas are putting further pressure on Henry Hub gas prices.”

Indeed, the entire Nymex futures strip posted significant losses Thursday, with nearly 10-cent losses seen through December and most contracts in 2020 shedding more than a nickel day/day.

Next-day gas prices continued to slide Thursday as weather systems continued to bring showers and thunderstorms across the northern and eastern United States. The weather systems were expected to keep conditions comfortable across the northern and central part of the country as high temperatures top out in the upper 60s to 80s, according to NatGasWeather.

Demand remained strong across the southern United States, where highs in the 90s and low 100s continued, with the hottest conditions seen across the Southwest and Texas. “It’s also very warm up the Mid-Atlantic Coast with highs of upper 80s to 90s,” the forecaster said.

However, with cooler weather on track to sweep across the West and Plains this weekend, spot gas softened further Thursday.

In California, SoCal Citygate plunged a nation-leading 56.5 cents to $1.835, although sharp, double-digit declines were seen across the region.

If more heat arrives in the region, prices could see some renewed upswing after Southern California Gas (SoCalGas) on Wednesday announced another postponement to the return of the L235-2 import line, to July 30 from July 6.

“This is the sixth postponement to this schedule in the last three months; flows were at one time expected to resume as early as April 2,” Genscape natural gas analyst Joseph Bernardi said.

Over in the Rockies, losses between 20 and 30 cents were common, but Cheyenne Hub slipped just 12.5 cents to $1.535.

Interestingly, the sell-off in prices out West had no impact on Permian Basin pricing as next-day gas continued to move higher into positive territory Thursday. El Paso-Permian jumped 19 cents to average 41 cents, with some deals seen as high as $1.50.

That could be due to a jump in exports from West Texas, with exports there cresting the 0.8 Bcf/d mark for the first time, according to Genscape. The jump in flows is partly due to hotter weather and increased power burns, but also to support the development of the Wahalajara system in Mexico.

“Testing on two segments of the Wahalajara system is taking place this month; a portion of the increased flows out of West Texas is being directed towards these systems,” Genscape’s Margolin said.

Meanwhile, emergency maintenance at Transwestern Pipeline’s Station 9 near Roswell, NM, will tighten Permian outflow capacity but should not represent a cut to flows relative to recent averages, according to Genscape. However, it could pose a risk of downward pressure on Waha cash prices.

Transwestern said Wednesday that capacity through Station 9 would be reduced to 660 MMcf/d beginning Thursday and remaining in effect through June 30. The pipeline “does not directly post Station 9 volumes, but derived flows through this point have averaged 574 MMcf/d and maxed out at 677 MMcf/d in the past month,” Bernardi said.

This is the second unplanned outage on Transwestern in less than a week caused by equipment failures in New Mexico. On July 13, the pipe issued a force majeure that was in effect for parts of three days due to unit failures at its Station 5 near Thoreau, NM, which is downstream and farther west of Station 9 in Roswell.

That event cut slightly more gas relative to previous averages (around 40 MMcf/d) and may have contributed to Waha cash’s most recent dip into negative territory, according to Genscape. Once the event ended, prices rose back above zero and have continued to strengthen since.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |