NGI Weekly Gas Price Index | Markets | NGI All News Access

Sweltering Temps Ignite Weekly Prices in California; Futures Rise as Outlooks Trend Hotter

Mild weather gripped natural gas prices for the June 10-14 week, with a large weather system that swept across the central and northern United States holding temperatures down as far south as Texas and leading to widespread losses. But with record-breaking heat suffocating the West Coast and leading to much higher prices in that region, the NGI Weekly Spot Gas National Avg. rose 3.5 cents to $1.99.

While much of the country has yet to see much meaningful summer heat, the West Coast was baking for the second week of June. Until the heatwave hit the region, Southern California cooling demand so far this summer (considered the April-October period in the natural gas market) had been running below both last year’s levels and the five-year summer-to-date average, according to Genscape Inc.

PG&E system demand had also lagged last year and the five-year average, but jumped back above the 2 Bcf/d mark for the first time since late winter, Genscape senior natural gas analyst Rick Margolin said.

Power supply had been temporarily cut to thousands of Pacific Gas & Electric Co. customers during the June 8-9 weekend as a precautionary measure against wildfires, but it did not make a dent in overall demand.

“Power prices reportedly topped the $1,000/MWh mark and noncore electric demand for gas hit 876 MMcf/d, a mark not reached last summer until mid-July,” Margolin said.

The surge in demand led to a substantial rally for California prices during the five-day period, with the SoCal Border Avg. shooting up 68.5 cents to average $2.365. PG&E Citygate rose nearly 20 cents to $2.795 for the week.

Rockies prices also strengthened quite a bit as various pipeline maintenance events restricted supplies during the period of heightened demand. Northwest Sumas jumped 65 cents for the week to $1.97, while Cheyenne Hub posted the region’s smallest gain of 12 cents.

Farther upstream, Permian Basin markets enjoyed some early-week gains that sent cash as high as $1.45 thanks to the strong West Coast demand, but as temperatures began to ease later in the week, West Texas prices crashed hard. Waha fell 18 cents for the week to a 43-cent average, although trades plunged as low as minus 40 cents Friday.

Most other market hubs across the country posted losses of less than a dime. Benchmark Henry Hub averaged $2.33 for the week, down 5.5 cents.

It took some persuading, but natural gas traders finally warmed up to the idea of returning heat later this month. After three days of small increases, the July Nymex gas futures contract began to retreat Wednesday but then losses kicked into high gear on Thursday following the latest storage data.

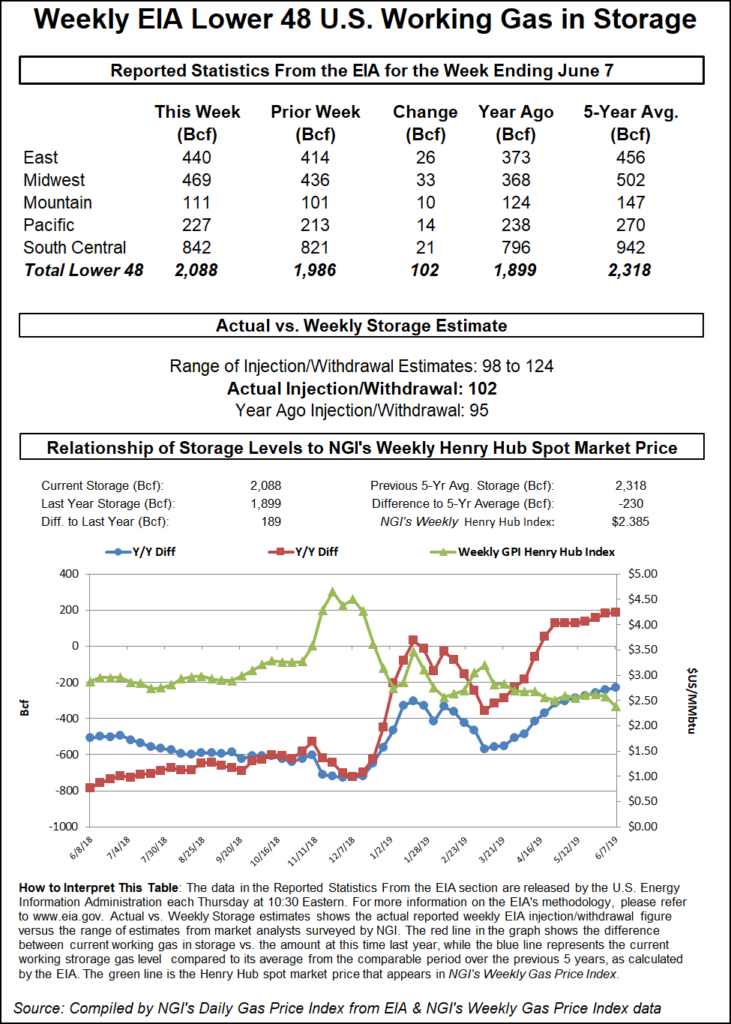

The Energy Information Administration (EIA) reported a 102 Bcf injection into storage inventories for the week ending June 7. Although the report came in on the low end of expectations, it was the sixth consecutive triple-digit injection going back to mid-May.

Compared to degree days and normal seasonality, the 102 Bcf injection was about 0.6 Bcf/d loose versus the five-year average, which was close to neutral and the tightest build of the injection season so far, according to Genscape.

The stock gain pushed Lower 48 inventories to 2,088 Bcf, enabling the year/year surplus to grow to 189 Bcf while closing the current inventory deficit to the five-year average to 230 Bcf.

But Thursday’s 6-cent decline may have been a bit overdone, as July futures were already a couple of cents higher at Friday’s open as overnight weather models shifted warmer for the long range.

The outlooks showed a weak trough developing in the West in the 11- to 15-day time period, while a downstream hotter ridge was set to evolve farther East, which is similar to what occurred in the second half of May, according to Bespoke Weather Services. As in May, the best chance of above-normal heat in the coming weather pattern should be in the southern half of the United States and possibly into the Mid-Atlantic at times. Storminess was forecast to continue in the Midwest, limiting heat opportunities there.

“We also saw a hotter shift in the European weeklies, hinting at hotter chances in the eastern half of the nation into the first half of July,” Bespoke chief meteorologist Brian Lovern. “We aren’t ready to go that far, but do think the slightly hotter-than-normal pattern can hang on into the very beginning of July, given the look of the day 15 pattern.”

Overall, the data added back demand compared to Thursday’s data, including the European model, which added 7 total degree days, although was still not nearly as hot as the Global Forecast System (GFS) model, according to NatGasWeather.

“It’s possible it’s enough of a hotter trend for the markets to want a few cents back, although the markets would likely prefer to see the European model trend further hotter to better match the GFS if they are to believe it.”

Apparently, the early-morning data was convincing enough as the prompt month was up more than 7 cents by midday, trading just shy of $2.40. The July Nymex contract went on to settle Friday at $2.387, up 6.2 cents. For the June 10-14 period, the prompt month rose 3 cents.

Looking ahead, liquefied natural gas (LNG) exports are expected to ramp up this summer, with Cheniere Energy Inc. management indicating this week that it has started producing at the second train at its Corpus Christi export terminal along the Texas coast. Sempra Energy’s Cameron LNG is also set to start exporting this summer from the first of three trains at its Louisiana facility. Altogether, some 7 Bcf/d of feed gas demand is expected by year end.

Meanwhile, exports to Mexico, which reached an all-time high of around 5.5 Bcf/d, are expected to continue growing. Already, gas has started to flow into the Valley Crossing pipeline, which feeds into the newly completed 2.6 Bcf/d Sur de Texas-Tuxpan marine pipeline.

On Thursday those flows were estimated around 60 MMcf/d. They had risen to roughly 100 MMcf/d early Friday, or less than 4% of operational capacity of the cross-border pipeline.

“We don’t expect the marine pipeline to fill right away, but these initial flows are certainly a positive step, especially ahead of increased summer demand,” said NGI’s Patrick Rau, director of strategy and research.

Tudor, Pickering, Holt & Associates Inc. (TPH) said it expected the pipeline to run materially below its nameplate capacity as further interconnects within Mexico are still required to reach demand centers. The firm is currently modelling 0.7 Bcf/d of initial flows.

Meanwhile, crude oil futures initially retreated from Thursday’s more than $1/bbl spike in response to a reported attack on two oil tankers in the Gulf of Oman. Given the risk that attacks will mount, Thursday’s price gain remained a surprisingly mild response, according to EBW Analytics. “The possibility that oil prices will rise $20 or more sometime this summer should not be ruled out.”

The firm noted that disruptions in the Persian Gulf do not only affect the oil market. Qatar remains the largest liquefied natural gas (LNG) producer in the world, accounting for 23% of global supply, all of which is shipped through the Strait of Hormuz. “If traffic through the Strait is shut down for even a week or two or slowed down for an extended period, demand for LNG from other sources will skyrocket,” EBW said.

High oil prices, if they occur, will also reduce utilization of oil-fired plants around the world, further increasing demand for LNG. This should increase the odds that U.S. liquefaction plants will run flat out, potentially for much of next year, according to EBW.

“In an increasingly integrated global market, prices for energy resources are increasingly linked. Tensions in the Gulf have the potential to disrupt energy markets — and the global market — far more broadly than the current reaction suggests.”

However, TPH said it’s been one or two oil market cycles since the market has seen a sustained geopolitical risk premium place an effective floor under oil prices. Therefore, the firm is not entirely convinced that Thursday’s oil price bounce “is of the sustainable variety given investor anxiety on the global oil demand side of the equation.”

Nevertheless, the July Nymex crude oil futures contract went on to settle Friday at $52.51, up 23 cents on the day.

Spot gas prices were quite mixed Friday amid a slew of pipeline maintenance events and progressively warmer weather forecast for most of the country this week. The exception to the hotter forecast was the western United States, which finally began to cool following a week of record heat. With much cooler weather expected for the third week of June, prices plummeted Friday.

PG&E Citygate spot gas tumbled 38 cents to $2.405, with steeper declines seen in the southern part of the state.

Cash prices over in the Rockies also softened, where El Paso Bondad posted the heftiest drop of roughly 40 cents on the day.

On the pipeline front, beginning Monday and lasting through June 25, Williston Basin Interstate (WBI) will perform line maintenance on Segment 28 in northwestern North Dakota, according to Genscape. The line will be taken out of service for nine days, cutting off transportation services to a gas processing plant, a power plant and an interconnect between WBI and Northern Border Pipeline.

Oneok Rockies Midstream LLC, a subsidiary of Oneok Inc., holds a firm transportation contract between the “Stateline I” plant and the “Northern Border-Stateline” interconnect that accounts for 82 MMcf/d of the affected 165 MMcf/d to be impacted by this maintenance, Genscape natural gas analyst Matthew McDowell said. “This is the only firm contract through the Northern Border interconnect, implying that the maintenance will restrict roughly 165 MMcf/d instead of the cumulative nominations of the plant and interconnect.”

The Pioneer Generating Station, a 239 MW peaking plant in Williston is to be shut in for the duration of the event as well, according to Genscape. EIA plant data lists WBI as the sole pipeline connected to the plant. “It has nominated an average of 10 MMcf/d for the last 30 days,” McDowell said.

Over in West Texas, with downstream demand on the West Coast falling from recent highs, Permian Basin prices continued to struggle Friday. Waha tumbled more than 20 cents to average minus 25 cents, with every transaction pricing below zero.

Adding to the weak pricing environment in the Permian was a force majeure on Transwestern Pipeline that was to be in effect through Saturday (June 15), restricting roughly 40 MMcf/d of Permian flows westward.

Prices in the country’s midsection also declined Friday, although most losses were limited to less than a dime and occurred as ANR Pipeline was set to continue unplanned and planned maintenance along its Southwest Mainline, limiting up to 155 MMcf/d of northbound flow through Kansas through Friday.

As maintenance has been ongoing since mid-May, flow continues to be restricted through the “SWML Northbound” throughput meter at various levels, according to Genscape. The most impactful period of this maintenance event will occur this week, when total capacity through “SWML Northbound” will be restricted by 140 MMcf/d, leaving 549 MMcf/d available.

“Over the past 21 days with maintenance ongoing, flows through SWML Northbound have averaged 617 MMcf/d and maxed at 704 MMcf/d, therefore leading to flow cuts of up to 155 MMcf/d during the most impactful restriction period,” Genscape analyst Anthony Ferrara said.

Louisiana cash prices were up a few pennies, while some market hubs in the Southeast posted gains of nearly a dime.

Over in Appalachia, Transco-Leidy Line was up a nickel to $1.945, although Columbia Gas posted the region’s only decrease.

Transco Zone 6 NY spot gas jumped more than 10 cents to $2.11, moving to a penny premium over the often more volatile Algonquin Citygate.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |