NGI Data | Markets | NGI All News Access

EIA Reports Low-End, Triple-Digit Natural Gas Storage Build

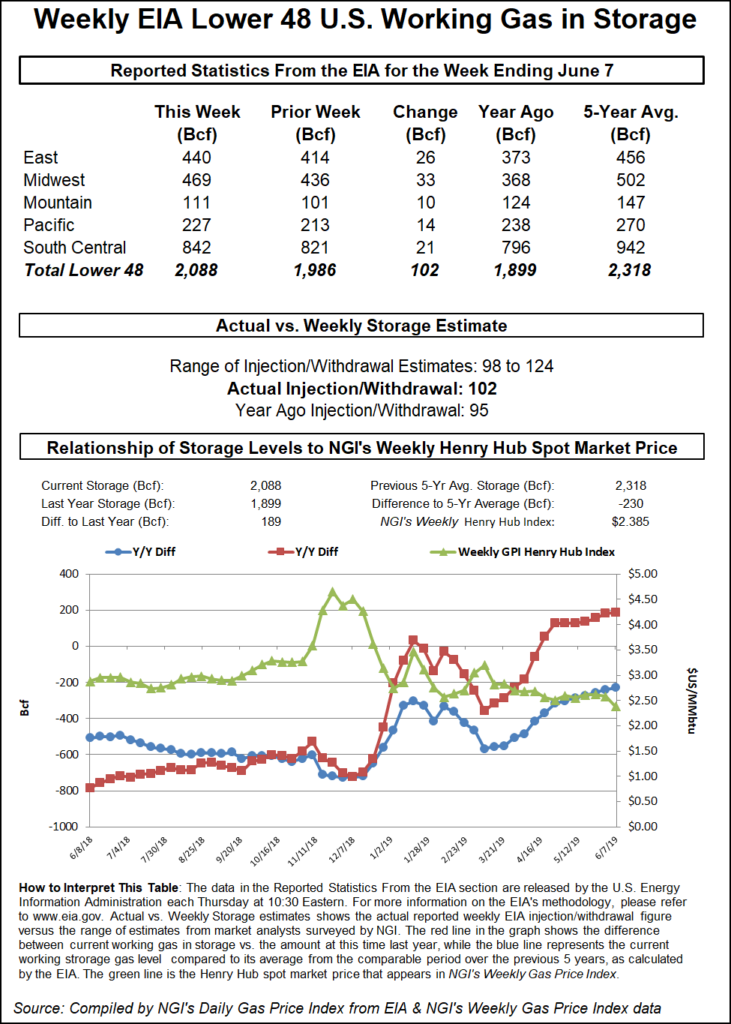

The Energy Information Administration (EIA) on Thursday reported a 102 Bcf injection into storage inventories for the week ending June 7.

The slightly smaller-than-expected build provided an initial modest uplift for natural gas futures prices, trimming earlier losses by around 1.5 cents. Ahead of the EIA’s 10:30 a.m. ET report, the July Nymex gas futures contract was trading 2.6 cents lower at $2.36, but as the print hit the screen, the prompt month rose to $2.376, down only a penny on the day. By 11 a.m., however, July futures were trading back down to $2.359, off 2.7 cents.

The reported 102 Bcf injection was larger than both last year’s 95 Bcf build and the five-year average injection of 92 Bcf. However, it came in on the low end of expectations as most estimates had clustered around a build near 110 Bcf. NGI had projected a 108 Bcf injection.

Nevertheless, most market analysts shrugged off the slight miss, especially after two massively bearish storage reports in a row. With prices remaining in the red, there was further downside risk ahead, according to Flux Paradox LLC President Gabriel Harris.

“The three-day natural gas price rally Friday through Tuesday just set up the market for a short opportunity,” Harris said on Enelyst, a chat room hosted by The Desk. “I don’t think we’re done exploring new price lows yet. I think new lows will come as the supply/demand balance is still loose.”

Thus far, lower prices have not made the weather-adjusted injections look any tighter, which starts to cause reasonable doubt in the market on the whole coal-to-gas switching mechanism, according to Harris. “The market will need dramatic evidence that the price-switching mechanism is at full strength before a bottom occurs.”

However, Bespoke Weather Services said balance wise, the 102 Bcf injection is considerably tighter than last week’s loose 119 Bcf print, giving the firm more confidence in the data after the previous two big misses. “We feel that the tighter balances will show up in next week’s number as well, though with this week being a low demand week, we could still see another triple-digit build.”

By region, the Midwest reported a 33 Bcf injection into inventories, while the East added 26 Bcf, according to the EIA. Stocks in the Mountain region grew by a larger-than-expected 10 Bcf, and stocks in the Pacific rose by 14 Bcf.

Working gas in storage as of June 7 stood at 2,088 Bcf, which is 189 Bcf higher than a year ago but still 230 Bcf below the five-year average, according to EIA.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |