E&P | NGI All News Access | NGI The Weekly Gas Market Report

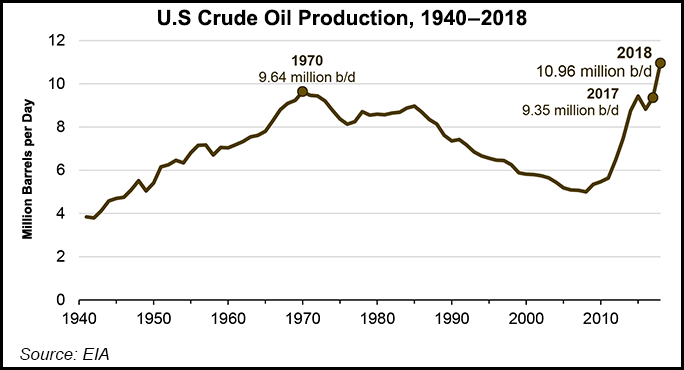

Domestic Crude Output in 2018 Highest in U.S. History, Says EIA

The unconventional revolution in the U.S. onshore continues to break records, as domestic crude production reached 11.96 million b/d in December, the highest level in U.S. history, the Energy Information Administration (EIA) said this week.

Annual U.S. crude production totaled 10.96 million b/d in 2018, up 1.6 million b/d (17%) compared with 2017, according to the agency, which said the most recent numbers continue a sharp growth trend over the past decade that coincides with the widespread adoption of horizontal drilling and hydraulic fracturing.

Growth should continue in 2019 and 2020, according to EIA, which projects U.S. crude output will rise to 12.3 million b/d in 2019 and 13.0 million b/d in 2020.

Like EIA, industry analysts have similarly called for continued robust growth of both crude and natural gas production as Lower 48 development continues to dramatically reshape the domestic supply picture. Surging crude production could flood associated gas into an already well-supplied market, potentially driving an inverse relationship between crude and natural gas prices, analysts have said.

The recent spot price dynamics in West Texas — where pipeline constraints and liquids-focused economics have pressured sellers into paying to get associated gas out of the Permian Basin — offer a clear example of the potential for crude production trends to impact natural gas markets.

Texas remains the clear-cut leader in U.S. crude production, producing more than any other state or region and making up 40% of the nation’s output in 2018, according to EIA.

“Texas has held the top position in nearly every year since 1970, with the brief exception of 1988, when Alaska produced more crude oil than Texas, and from 1999 through 2011,” when Gulf of Mexico (GOM) production was higher, EIA said.

Crude production in Texas, home to a large chunk of the Permian, as well as the Eagle Ford Shale, averaged 4.4 million b/d in 2018 and set a record high monthly total in December at 4.9 million b/d, EIA said.

“Texas’s 2018 annual production increase of almost 950,000 b/d — driven by significant growth within the Permian region in western Texas — was nearly 60% of the total U.S. increase,” the agency noted.

Several other states or regions also set crude production records in 2018. Growth in the Permian drove a 215,000 b/d year/year increase in New Mexico.

In the GOM, producers brought online 11 projects in 2018 and are expected to start up another eight projects in 2019, EIA said. The GOM grew crude oil output by 61,000 b/d in 2018 to reach 1.74 million b/d, its highest annual average.

“Production levels in Colorado, Oklahoma and North Dakota each grew by more than 95,000 b/d from 2017 to 2018,” EIA said. “In Colorado and North Dakota, this increase was enough to set new record production levels for the year.” Colorado’s production increase was driven by the Niobrara formation, “while continued production in the Bakken region drove increases in North Dakota.

“Oklahoma’s crude oil production has yet to surpass its record level of 632,000 bd set in 1967.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |