Permian Crude Upends West Texas Natural Gas as Weekly Spot Prices Fall

As shoulder season conditions accompanied modest spot price action for most of the Lower 48, it was the historic lows in the Permian Basin that grabbed natural gas headlines for the four-day trading week for March gas delivery ended March 28; the NGI Weekly Spot Gas National Avg. slid 19.0 cents to $2.345/MMBtu.

In a situation that has no precedent in the North American market, the week saw natural gas in West Texas transition from being a commodity to being another expense item on the ledgers of Permian producers. Driven by a rise in associated gas output and a cap on takeaway capacity, prices throughout the region averaged well into the negatives for the week. At Waha, spot market “sellers” paid 84.0 cents/MMBtu on average to offload their gas.

NGI’s Patrick Rau, director of strategy and research, summed it up early in the week, when the region traded at an average price of negative 43.0 cents.

“I’ve never seen wholesale price negativity like this before,” said Rau. “Prices got down to a quarter of a cent in the Marcellus once, and were certainly depressed for long stretches of time, but I don’t recall those ever going negative. Even within Appalachia, there were certain pockets of relative price strength. But in West Texas, outside of the El Paso-Plains Pool, it’s pretty bad.

“AECO has gone negative a few times, and has also suffered from relatively weaker prices for long stretches, but not like we are seeing in the Permian.”

That Permian producers aren’t drilling for gas in the first place likely helps explain their tolerance for negative prices.

“The Permian is driven almost entirely by liquids pricing, mainly crude oil, and natural gas is the associated (and oftentimes unwanted) byproduct,” Rau said. “You can’t just flare it all, so if you want to produce the oil, you’ve got to produce the gas. And producers are wanting to produce more oil now that both absolute and relative crude prices in the Permian are higher than they were in the latter stages of 2018. Both the absolute price of WTI and the relative price (Midland Cushing spread) have increased since late 2018.”

Even after deducting the costs of negative natural gas prices, recent crude prices likely leave many Permian producers in the money, according to Rau.

“Permian producers are now receiving mid to upper $50s/bbl for their in-basin production. If they have to sell gas at, say, negative $2.00, that’s $12 on a crude oil equivalent basis, which would make the net proceeds of their oil closer to the $40-45 range,” he said. “But that is still in the money for many Permian producers, as a significant portion of that acreage has breakeven prices below $40. My guess is Permian natural gas prices probably cannot get significantly more negative before they start reaching a pain point on the realized crude oil sales price.”

Elsewhere in the weekly spot market — reflecting deals for delivery between March 26 and March 31 — prices generally trended lower by around 10-20 cents, with mild shoulder season conditions tamping down buying interest for the most part.

In the Northeast, Transco Zone 6 NY slid 19.0 cents to $2.565, while in the Midwest, Chicago Citygate dropped 11.5 cents to $2.580.

In the West, most locations trended lower, though weekly prices gained at the volatile SoCal Citygate, where reports during the week indicated two critical import lines could be back in service later than originally planned. Weekly prices there averaged $4.205, up 10.5 cents.

Turning to the futures market, the May Nymex contract slumped 5.0 cents to settle at $2.662 Friday, near the bottom of the daily range from $2.728 down to $2.656. The front month dropped 6.2 cents on the week, as the now-expired April contract opened at $2.724 Monday.

The lower prices Friday were “likely aided by the overnight weather data trending milder, especially the European model,” which lost more than 20 heating degree days (HDD) versus its previous run, NatGasWeather said. Midday data from the Global Forecast System (GFS) “held milder trends from the past couple days and trended a little further warmer with it.”

NatGasWeather said it’s possible the European and GFS models had trended too warm too quickly and would gain some HDDs back, but the outlook as of Friday showed a “solidly bearish” pattern setting up by the end of the upcoming work week.

“There’s still expected to be a weak glancing shot of cooler air across the far northern U.S. around April 7, but the overnight and midday data backed off substantially by keeping subfreezing air mostly over Canada,” the forecaster said. “Otherwise, a very comfortable pattern coming April 5-15 with pleasant temperatures and near ideal build weather for this time of year.

“This should be a good test to see how large builds can be this shoulder season when bearish weather conditions and near record production work in concert.”

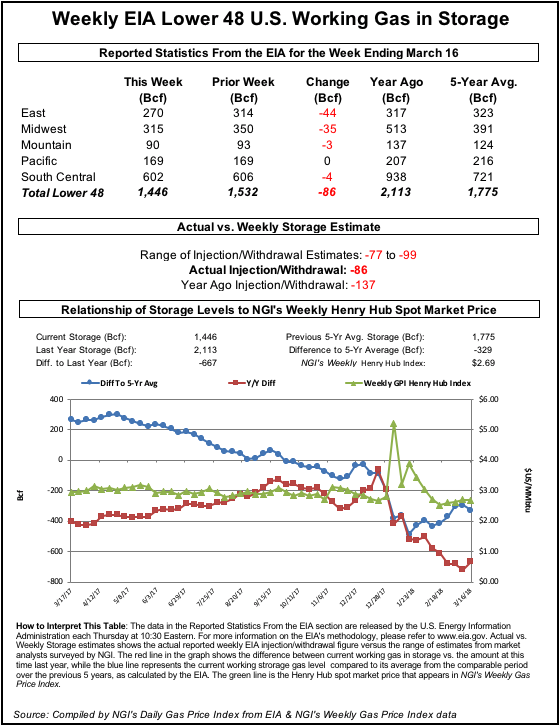

Futures prices charted a relatively tranquil pattern Thursday after the Energy Information Administration’s (EIA) weekly storage report showed a 36 Bcf withdrawal from U.S. stocks that was in line with estimates.

The 36 Bcf figure for the week ended March 22 compares to a five-year average withdrawal of 41 Bcf and a 66 Bcf pull recorded in the year-ago period. With temperatures rapidly warming and forecasts showing minimal lingering cold shots heading into April, estimates suggest the week’s report could also mark the end of the withdrawal season.

Bespoke Weather Services had called for a 34 Bcf withdrawal and viewed Thursday’s report as “neutral overall.”

“It was quite loose compared to last week and the five-year average, but prices are already off significantly week/week to reflect that loosening,” Bespoke said. “The market consensus was relatively close to the 36-37 Bcf level as well, and we have not seen prices move much since the release of the number.

“Modestly supportive overnight weather may prevent prices from really bleeding off, but cash back under $2.65, loose daily balances, and expectations of a warming April should keep prices under pressure even after this neutral EIA print.”

Total Lower 48 working gas in underground storage stood at 1,107 Bcf as of March 22, 285 Bcf (20.5%) below last year’s stocks and 551 Bcf (33.2%) below the five-year average, according to EIA.

By region, the East and Midwest both saw net withdrawals of 20 Bcf for the week. The Pacific region injected 8 Bcf overall, while Mountain region stocks finished flat week/week.

Chat participants on energy-focused social media platform Enelyst had been expecting the unexpected from the South Central region this week, but changes to stocks there offered few surprises based on comments following Thursday’s report. EIA recorded a net 4 Bcf withdrawal in the South Central, with a 7 Bcf withdrawal from nonsalt offsetting a 2 Bcf injection into salt.

The 36 Bcf pull for the week implies the market was 2.3 Bcf/d looser than last year on a weather-adjusted basis, according to analysts with Raymond James & Associates. The market has averaged 2.3 Bcf/d looser over the past four weeks, they said.

Compared to degree days and normal seasonality, Genscape Inc. analyst Margaret Jones said the EIA figure is about 2.0 Bcf/d looser than the five-year average.

“Total power generation was down around 12 average GWh versus the previous week,” Jones said. “Nuclear and renewable generation was down around 15 average GWh as wind fell off by 14 average GWh. Nuclear generation also dropped by a little over 1 average GWh as nuclear gen continues to come offline during refueling season.

“Coal was down around 2 average GWh, and gas was up 6 average GWh week/week for an estimated 1.0 Bcf/d more gas burn week/week.”

NGI’s daily spot price table in West Texas Friday might have seemed like an early April Fool’s joke, but the constraints hammering Permian Basin natural gas prices recently have been all too real. Rest assured, it was no joke that Waha averaged negative 53.0 cents Friday, which marked a $1.415 increase from Thursday’s abysmally low prices. El Paso Permian improved 93.5 cents day/day to average negative 51.0 cents.

According to analysts with Jefferies LLC, Permian gas production reached a new all-time high earlier in the week at 9.4 Bcf/d, with output over the last week averaging around 9.2 Bcf/d, versus 8.9 Bcf/d during the month of February.

A recent force majeure on the El Paso Natural Gas South Mainline has “knocked about 0.2 Bcf/d of westbound takeaway capacity offline, which has likely impacted pricing, but with production at all-time highs (despite many Permian producers slowing growth), pricing relief is unlikely to come until Kinder Morgan’s 2 Bcf/d Gulf Coast Express pipeline enters service in late 2019,” the Jefferies team said.

“While flaring is a potential option for producers, we have heard no indications that flaring is happening at the tailgate of gas processing plants, meaning that wellhead gas would have to be flared,” according to the analysts. Consequently, in the near term “producers with spot Waha exposure may be forced to choose between paying a counterparty to take their dry gas and losing the incremental cash flow from flaring” natural gas liquids.

Maintenance-related constraints could further squeeze the Permian natural gas market in the coming week, according to Genscape analyst Joe Bernardi.

Transwestern was scheduled to conduct maintenance Tuesday (April 2) that could “limit overall westbound flows out of the Permian and the Texas Panhandle, which may continue to apply downward pressure on plummeting West Texas prices,” Bernardi said. “Work at Transwestern’s Station 8 in Corona, NM, will reduce total westbound flow capacity by over 250 MMcf/d, down to 466 MMcf/d.

“This work is scheduled to last through April 18. Although Transwestern does not directly report flows through this station, calculated flows there have averaged about 550 MMcf/d in the past month, which would translate to a cut of about 85 MMcf/d versus the required operating capacity limit,” the analyst said.

The stronger prices in West Texas Friday coincided with some stronger prices in other regions as traders locked in deals for delivery Monday, the first day of April. With Sunday marking the last day of March, gas for weekend delivery was traded Thursday.

After a warm break across the southern and eastern United States and heading into the weekend, a “strong late-season weather system and cool shot” was expected to sweep across the Plains Friday, bringing “areas of rain and snow,” according to NatGasWeather. The system was then expected to advance into Texas and the South over the weekend before reaching the East early in the week ahead.

“This will result in a swing to stronger than normal national demand as lows behind the cold front drop into the teens to 30s from Chicago to New York City, including the 30s into the southern U.S.,” the forecaster said. “This is likely to be the last decent cold shot for quite some time as warm high pressure expands across the country” late in the upcoming week.

The price impact from what looked to be winter’s last gasp was most apparent in the Northeast and Appalachia Friday. Transco Zone 6 NY jumped 36.5 cents to $2.695, while further upstream Texas Eastern M-2, 30 Receipt added 14.5 cents to $2.435.

Following a January explosion in southeast Ohio, Texas Eastern Transmission (Tetco) is set to return its 30-inch diameter line to service in the week ahead, according to Genscape analysts Josh Garcia and Colette Breshears. The incident has cut southbound capacity through Tetco’s Berne compressor station to 1.6 Bcf/d since late January.

“Tetco continues to evaluate both Line 15 south of Berne and Line 10 between Athens and Uniontown,” the analysts said. “The pipeline currently estimates that Line 10 Athens to Holbrook and Line 15 Athens to Berne Valve Section 7 is targeted for a return to service” between Wednesday (April 3) and April 6. “Line 10 between Holbrook and Uniontown is targeted for full capacity by the middle of May, although capacity east of Berne to Uniontown is only around 40 MMcf/d away from full service and has not been constrained since late January.

“Interestingly, they did not specify full service for Line 15 Athens to Berne, nor did they mention Line 10 (the line that exploded) between Athens and Berne, which could still be slated for late April per the previous update.”

In the West, most Rockies locations gained on average Friday. Northwest Sumas picked up 2.0 cents to $2.345.

Pipeline constraints could restrict volumes flowing into the Pacific Northwest in the week ahead, according to Genscape’s Bernardi.

“Upcoming planned maintenance on Westcoast Energy could disrupt its southbound flows and tighten supply for the Pacific Northwest,” Bernardi said. “Station 4B South capacity will be reduced to around 1,150 MMc/f for Monday’s and Tuesday’s gas days (April 1-2). This will represent a decrease of around 190 MMcf/d day/day.”

Meanwhile, an unplanned constraint on Northwest Pipeline could limit flows bound for the Pacific Northwest out of the Rockies.

“Northwest Pipeline announced Thursday that it would be performing unplanned maintenance at its Muddy Creek compressor station, which it anticipates will last through April 12,” Bernardi said. “This work is limiting Muddy Creek northbound flow capacity to 523 MMcf/d, which is about 50 MMcf/d below the past 30-day average.”

While flow cuts into the region tended to cause significant price spikes at Northwest Sumas during the winter, “the extent of such pressure has been largely dependent on Pacific Northwest weather-driven demand,” the analyst said. “Genscape meteorologists are forecasting the region will experience very mild, lower-than-seasonally normal HDDs through this maintenance period.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |