NGI The Weekly Gas Market Report

Markets | Forward Look | NGI All News Access

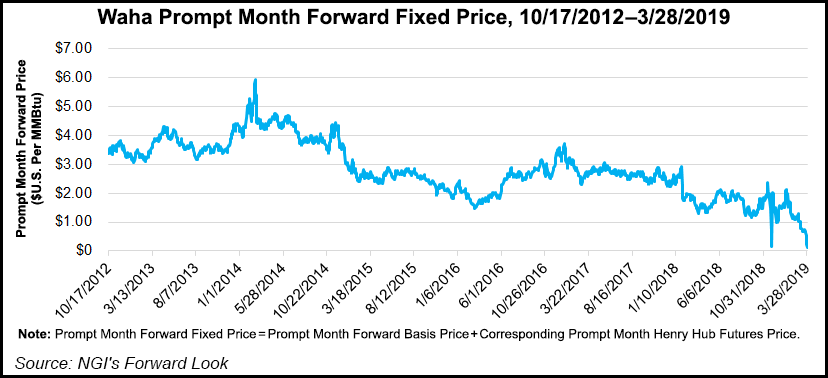

Natural Gas Forwards Slip Further; Permian Pains Likely Just Beginning as April Hits New Low

Downward momentum revved up a notch for natural gas forward prices during the March 21-27 period as spring tightened its grip on the country at the same time that Lower 48 production has rebounded to levels not seen since December. April tumbled 11 cents on average, while May and summer strip (April-October) prices fell similarly, according to NGI’s Forward Look.

The majority of market hubs across the United States posted losses that were in line with Nymex futures contracts. But like in the cash market, Permian Basin pricing stood out as record regional production, a lack of gas takeaway capacity and pipeline maintenance wreaked havoc on the market and sent April forward prices down to their lowest level ever at one of the region’s key trading hubs.

Waha April plunged 50 cents from March 21-27 to settle Wednesday at just 13 cents, a record low, Forward Look data show. Prompt-month prices had been under $1 for weeks, but the recent plunge could be the tip of the iceberg of further losses as spot gas has traded in negative territory since late last week. On Wednesday, Waha cash plunged to minus 75 cents as maintenance events on El Paso Natural Gas (EPNG) and Transwestern Pipeline cut outbound flows.

In an update Tuesday, EPNG indicated that an offline unit at its Florida compressor is now expected back online Sunday, ahead of schedule. An offline unit at the Lordsburg compressor is still on track to return to service April 5. Transwestern’s outage was resolved late Wednesday and receipts at the affected compressor station were expected to increase starting with the Intraday 2 cycle.

But other maintenance events on intrastate lines could have also affected flows, according to RBN Energy. EPNG was delivering an average of 75 MMcf/d to Oasis Pipeline over the first 18 days of March. However, deliveries stopped abruptly and switched to an averaged receipt of 56 MMcf/d from March 19-22.

“Flows between Oasis and Northern Natural Gas also shifted on the same day, moving from an average delivery of 35 MMcf/d to start March to an average receipt of 159 MMcf/d from March 19-22,” RBN analyst Jason Ferguson said.

The various maintenance events were likely not the sole culprit of the Permian pricing plunge. Instead, the slew of pipeline work and the impact on regional prices has been exacerbated by record production in the basin. RBN estimated that Permian production has reached a new high of 9.9 Bcf/d during the last several days, a level that represents an increase of more than 2 Bcf/d versus March 2018.

Genscape Inc. estimated Permian production reached 10.8 Bcf/d for the first time ever this past weekend, about 700 MMcf/d higher than the prior year-to-date average.

Given strong crude oil prices, associated gas growth is likely to continue, but without any increase in takeaway capacity for another six months, the worst of the price pain may be yet to come, according to RBN.

“For most Permian oil wells, gas prices would have to fall much further than we have already seen to cause producers to shut in the well,” Ferguson said.

The Permian does have some old gas wells that produce relatively small amounts of oil, and producers would likely consider shutting in these wells if negative prices persist, according to RBN. But two considerations will likely limit the impact of this mitigating factor.

For one, there is a relatively small number of these old gas wells in the basin. RBN’s analysis shows that less than 0.5 Bcf/d of Permian gas comes from wells that produce mostly gas and very little oil, leaving little wiggle room as associated gas volumes ramp up this summer. Furthermore, these gas wells still likely contain at least modest amounts of natural gas liquids that can be removed to provide meaningful uplift to a gas well’s revenue.

“As a result, the current pool of gas eligible to be shut in at today’s prices may be far below that 0.5 Bcf/d level, leading us to believe the worst for Permian gas pricing may be yet to come,” Ferguson said.

While certainly far from negative territory, futures prices declined for the third week in a row as balmy weather and near-record production weighed heavily on the market. The Nymex April gas futures contract rolled off the board Wednesday at $2.713, down about 11 cents from March 21. May priced marginally higher at $2.719, although it too slid about 11 cents on the week.

The spring season is in full swing with mild conditions building across the Great Lakes, Ohio Valley and Northeast the next few days as high temperatures warm into the 40s to 60s, according to NatGasWeather. Very warm weather was expected across the southern United States and Mid-Atlantic Coast through Friday, with highs in the 70s and 80s making for light demand.

The West and central United States, meanwhile, were forecast to be “only slightly cool” into Saturday before a more impressive cold shot was set to hit much of the country this weekend. Lows were expected to plunge as low as the teens as cold air was forecast to drop out of Canada and sweep across the northern, central and eastern United States and linger through early next week, including into Texas and the South, the forecaster said.

The blast of chilly air trended slightly stronger in overnight weather models and combined with a pattern in the longer term that holds a slightly stronger trough across the center of the country that can allow weak cold shots into the East, according to Bespoke Weather Services. The upstream negative Eastern Pacific Oscillation still looks to break down, however, and the lack of any downstream blocking limits how cold any air can get.

“The question is more simply one of how warm the East is able to get, and with enough cold air overhead, such warmth can be kept in check with gas-weighted degree days (GWDD) closer to average. Still, we would be surprised to see many GWDDs get added moving forward given the unfavorable upper level pattern for any kind of consistent, strong cold,” Bespoke chief meteorologist Jacob Meisel said.

Midday American model data backed off the colder trends, shedding several heating degree days from its outlook.

Adding to the slightly bearish sentiment is production growth following a winter that featured prolonged freeze-offs in some areas. Upon incorporation of revisions to Genscape’s pipeline data, its estimate for Sunday and Tuesday’s Lower 48 production both increased above 88 Bcf/d.

“This marks the return of production prints above the 88 Bcf/d mark for the first time since December 22,” Genscape senior natural gas analyst Rick Margolin said.

Production this week is averaging more than 1.2 Bcf/d above the month-to-date average, according to Genscape. In addition to the previously mentioned growth out of the Permian, increases are fed by more than 0.4 Bcf/d of growth from the rest of Texas outside of the Permian, the restoration from freeze-offs in the Denver-Julesburg and Williston basins and the conclusion of maintenance offshore Gulf of Mexico.

Looking ahead, Genscape’s production outlook reflects more than 6.7 Bcf/d of summer-on-summer growth, supply needed to refill deplenished storage inventories ahead of next winter.

On Thursday, the Energy Information Administration (EIA) reported a 36 Bcf withdrawal from storage inventories for the week ending March 22. The reported draw was in line with expectations and even regional storage data offered no surprises.

The 36 Bcf figure for the week ended March 22 compares to a five-year average withdrawal of 41 Bcf and a 66 Bcf pull recorded in the year-ago period. Prior to the report, a Bloomberg survey showed estimates ranging from a withdrawal of 29 Bcf to 54 Bcf. Intercontinental Exchange futures had pointed to a 32 Bcf withdrawal. NGI’s storage model had predicted a withdrawal of 40 Bcf.

Bespoke, which had called for a 34 Bcf withdrawal, viewed Thursday’s report as “neutral overall” as it was quite loose compared to last week and the five-year average, but prices are already off significantly week/week to reflect that loosening.

“Modestly supportive overnight weather may prevent prices from really bleeding off, but cash back under $2.65, loose daily balances and expectations of a warming April should keep prices under pressure even after this neutral EIA print,” Meisel said.

Total Lower 48 working gas in underground storage as of March 22 stood at 1,107 Bcf, 285 Bcf (20.5%) below last year’s stocks and 551 Bcf (33.2%) below the five-year average, according to EIA.

By region, the East and Midwest both saw net withdrawals of 20 Bcf for the week. The Pacific region injected 8 Bcf overall, while Mountain region stocks finished flat week/week. EIA recorded a net 4 Bcf withdrawal in the South Central, with a 7 Bcf withdrawal from nonsalt offsetting a 2 Bcf injection into salt.

With temperatures rapidly warming and forecasts showing minimal lingering cold shots heading into April, estimates suggest this week’s report could also mark the end of the withdrawal season. Storage injections are likely to begin in earnest by early to mid-April, rapidly erasing the year-over-year storage deficit, according to EBW Analytics. As the deficit is erased, the bullish argument from low storage inventories is likely to become increasingly tenuous, eroding support and easing Nymex futures lower.

By 30-45 days from now, early summer weather projections will increasingly influence the market. Preliminary summer forecasts suggest 2019 cooling demand may fall by 82 cooling degree days (CDD) year/year and yet still register 96 CDDs above normal, the firm said.

“The potential for a wet April may further increase soil moisture levels and further reduce odds of a very hot summer, but the possibility of a hot start to summer and quick transition away from the low demand shoulder season presents an upside price risk,” EBW CEO Andy Weissman said.

While Permian Basin pricing has garnered much of the attention in recent days, markets out West that have been volatile throughout the winter continued to see sharp swings during the March 21-27 period.

SoCal Citygate April prices shot up 31 cents to $4.258 as Southern California Gas (SoCalGas) has delayed the expected return-to-service of two critical import lines. Capacity on L235-2 was to be fully restored by next week; it is now expected to resume flows at reduced pressure on May 4. Capacity through Line 235-2 has been limited since an Oct. 1, 2017, explosion.

SoCalGas discovered two additional leaks on this line during testing on March 23 and concluded that the required additional work would require at least one month to complete.

The delayed return-to-service of L235-2 also pushes back the schedule of work on a separate import line, L4000. SoCal plans to begin work on Line 4000 after Line 235-2 is back in service.

“The losses on these two lines translate to a currently effective capacity reduction of 1,067 MMcf/d for the Needles/Topock area zone,” Genscape analyst Joe Bernardi said.

The stout gains at SoCal were limited to the prompt month, with prices shifting only a few pennies throughout the summer. The winter 2019-2020 (November-March) package was down 8 cents to $4.25, Forward Look data show.

Meanwhile, the wet winter in the Pacific Northwest has made for abundant hydro output this spring and summer, typically low demand seasons for the region. The reduced need for gas was apparent in the latest EIA data and also reflected in forward curves in the region.

Northwest Sumas April prices plunged 38 cents from March 21-27 to reach $2.682, while May dropped 27 cents to $2.282 and the summer fell 30 cents to $2.72.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9915 | ISSN © 2577-9877 | ISSN © 1532-1266 |