E&P | Markets | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Crude-Focused West Texas Economics Sending Natural Gas Prices to Historic Lows

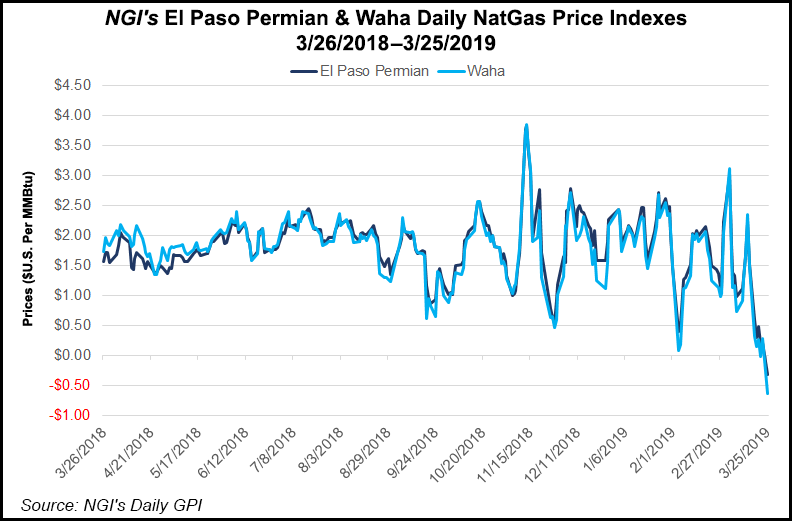

In an unprecedented display of both the severe constraints impacting the Permian Basin and the tolerance the region’s crude-focused producers have had for deep discounts on their associated gas output, natural gas spot prices in West Texas reached a new nadir this week.

Historical precedent went out the window in West Texas Monday as prices averaged well into negatives region-wide. The entire West Texas region on average traded at negative 43.0 cents on the day, according to Daily GPI.

Waha averaged negative 64.0 cents after dropping 92.5 cents day/day. El Paso Permian plunged 53.0 cents to negative 31.5 cents. Transwestern tumbled 99.0 cents to average negative 56.5 cents on the day.

Citing NGI’s spot price data, Genscape Inc. analyst Joe Bernardi noted Tuesday that “the only U.S. hubs that have ever averaged a negative spot cash price are all in the Permian, and all have done so within the last three days of trading.”

Combing NGI’s historical data for the North American natural gas spot market suggests there’s really no precedent for the recent pricing signals coming from West Texas.

In the recent past, other producing regions have seen supply gluts and pipeline constraints crush prices. Just last year, in Western Canada producers selling into NOVA/AECO C had to deal with negative prices. According to Daily GPI historical data, NOVA/AECO C averaged negative C1 cent/gigajoule for the May 4, 2018, trade date after going as low as negative C13 cents. Before that, prices at the location traded as low as negative C29 cents during the Sept. 26, 2017, trade date.

While stronger basis in the Marcellus/Utica shale region more recently suggests the pipeline buildout had begun to catch up with output, Appalachian producers for years saw crushing basis differentials as the midstream sector rushed to keep up with the burgeoning output. On Sept. 30, 2016, NGI’s Dominion South index averaged just 29 cents and saw trades as low as 10 cents.

These past examples, however, don’t compare to the extreme discounts recorded in West Texas in recent months — and especially Monday. NGI recorded negative West Texas spot prices on various occasions last year, but even with that in mind, Monday saw the Permian gas discounts venture into uncharted territory.

“I’ve never seen wholesale price negativity like this before,” said NGI’s Patrick Rau, director of strategy and research. “Prices got down to a quarter of a cent in the Marcellus once, and were certainly depressed for long stretches of time, but I don’t recall those ever going negative. Even within Appalachia, there were certain pockets of relative price strength. But in West Texas, outside of the El Paso-Plains Pool, it’s pretty bad. AECO has gone negative a few times, and has also suffered from relatively weaker prices for long stretches, but not like we are seeing in the Permian.”

Bernardi attributed the steep drop in West Texas cash prices to a “combination of unprecedented levels of Permian production and unplanned constraints moving gas out of the region. This weekend, our total Permian production estimate reached the 10.8 Bcf/d mark for the first time ever, representing an increase of about 700 MMcf/d versus the prior year-to-date average.

“Two ongoing force majeure events on El Paso Natural Gas (EPNG) have been cutting Permian outflows by over 200 MMcf/d,” Bernardi added. “The largest and more recent of the two affects the ”LINE2000’ meter in West Texas. This meter flows full, meaning that the operating capacity decrease of 195 MMcf/d that went into effect last Tuesday (March 19) has had a virtually identical impact on flows.”

This event is expected to continue impacting capacity until April 8, the analyst said. The second force majeure has been in effect since late December and is impacting flows through EPNG’s “LINCOLN N” meter in central New Mexico.

“In the last week, flows through there have averaged 68 MMcf/d less than the average in the week before the force majeure,” Bernardi said.

Mobius Risk Group natural gas analyst Zane Curry said although the EPNG restrictions are relatively small in nature, “when utilization is high, that small amount can be the straw that breaks the camel’s back.”

However, the largest impact on recent price action may be linked to one of the Permian’s intrastate pipelines, according to RBN Energy, as volumes between the interstate pipelines and Oasis Pipeline made some dramatic shifts on March 19. EPNG was delivering an average of 75 MMcf/d to Oasis over the first 18 days of March.

However, deliveries stopped abruptly and switched to an averaged receipt of 56 MMcf/d from March 19-22. “Flows between Oasis and Northern Natural Gas also shifted on the same day, moving from an average delivery of 35 MMcf/d to start March to an average receipt of 159 MMcf/d from March 19-22,” RBN analyst Jason Ferguson said.

The event appears to have ended on Saturday (March 23), but record production in the Permian over the weekend also weighed on prices. Meanwhile, the latest data from DrillingInfo led RBN to update its production model, resulting in a 0.17 Bcf/d increase in the balance-of-2019 production forecast and a 0.33 Bcf/d increase in its 2020 outlook.

“The higher production led to lower basis forecasts in our flow model of Waha,

Ferguson said. “We now see the balance of 2019 Waha basis strip averaging $1.80 under Henry Hub, versus $1.42 in last week’s outlook.”

That Permian producers aren’t drilling for gas in the first place likely helps explain their tolerance for negative prices.

“The Permian is driven almost entirely by liquids pricing, mainly crude oil, and natural gas is the associated (and oftentimes unwanted) byproduct,” Rau said. “You can’t just flare it all, so if you want to produce the oil, you’ve got to produce the gas. And producers are wanting to produce more oil now that both absolute and relative crude prices in the Permian are higher than they were in the latter stages of 2018. Both the absolute price of West Texas Intermediate (WTI) and the relative price (Midland Cushing spread) have increased since late 2018.”

Weaker gas basis differentials in West Texas have roughly coincided with strengthening crude differentials for Permian producers. After trading at a wide differential to prices at hubs in Cushing and Houston in mid-2018, WTI Midland crude prices have since closed the gap thanks to the addition of pipeline takeaway capacity, a trend that started last September, according to the Energy Information Administration (EIA).

“WTI Midland prices are now similar to WTI Cushing, suggesting the previous pipeline capacity constraints from the Permian region to Cushing have been largely removed,” EIA said. “Conversely, WTI Midland prices still trade lower than Houston crude oil prices, suggesting that the region still faces some takeaway constraints in shipping Permian crude oil to the U.S. Gulf Coast. Most recently, the difference has been about $7/bbl, which is less of a discount than in the middle of 2018.”

Daily GPI first recorded negative natural gas spot trades in West Texas this past November.

Even after deducting the costs of negative natural gas prices, recent crude prices likely leave many Permian producers in the money, according to Rau. “Permian producers are now receiving mid to upper $50s/bbl for their in-basin production. If they have to sell gas at, say, negative $2.00, that’s $12 on a crude oil equivalent basis, which would make the net proceeds of their oil closer to the $40-45 range.

“But that is still in the money for many Permian producers, as a significant portion of that acreage has breakeven prices below $40. My guess is Permian natural gas prices probably cannot get significantly more negative before they start reaching a pain point on the realized crude oil sales price. It’ll be interesting to see if utilities and the like start to scoop up this gas and put it into storage at an increased pace. This might set up the South Central storage region to replenish storage much more quickly than normal, everything else being equal.”

While price is a consideration, the duration of the depressed pricing environment is likely more of a factor for producers when deciding whether to shut in production, according to Curry. “The realized gas prices at which crude output is curtailed varies widely across the basin. It depends on how gassy the stream is. Sure, producers are taking a revenue hit, but does it outweigh the decision to shut in production? Absolutely.”

The West Texas gas price environment might not improve for some time, potentially leading to more flaring as producers await new projects entering service, according to analysts. In a note last week, analysts at Jefferies LLC, pointing to recent Waha forward basis prices trading at a more than $2 discount to Nymex, said they “expect little relief on Waha basis until gas pipelines to the Gulf enter service in late 2019.”

Analysts with Tudor, Pickering, Holt & Co. (TPH) recently offered a similarly bearish outlook on Permian gas prices. “Though near-term market concerns have faded on an expectation of less stringent flaring regulations, the dramatic swing in spot differentials highlights continued tightness in the Permian natural gas market,” the TPH team said.

“The updated U.S. production outlook sees little improvement for Permian natural gas takeaway dynamics as about 2.0 Bcf/d of annual residue gas growth maintains pressure on infrastructure despite greenfield capacity adds of 4.0 Bcf/d from Kinder Morgan’s Gulf Coast Express and Permian Highway projects over the next two years, indicating the natural gas problem (or midstream opportunity) isn’t going away soon.”

Indeed, natural gas flaring in the Permian could exceed 1 Bcf/d at some point this year before the first of the major pipeline takeaway projects comes online, according to data compiled by analysts with Sanford C. Bernstein & Co. LLC.

The Railroad Commission of Texas (RRC) has been “quite supportive” of gas flaring, said Bernstein analyst Jean Ann Salisbury and her colleagues, but without more capacity to move copious amounts out of the basin, producers “will be forced to sign up for a new pipe.” The RRC typically issues a standard 45-day permit that allows as much flaring as required, and extensions may be requested.

The gas project “best positioned” to achieve a positive final investment decision (FID) next could be the 2 Bcf/d Bluebonnet Market Express, sponsored by Williams and Brazos Midstream, because of interconnects into the Transcontinental Gas Pipe Line, aka Transco, said Bernstein analysts.

However, Williams wants “more than a 10-year signup,” which the exploration and production companies “have been hesitant to sign.”

“None of the pipeline options in the hunt…seem to be making major progress, but we believe this summer when flaring rises significantly, one will move forward,” Salisbury said. “Bluebonnet seems to be the most likely at the moment, in our view, but we think Williams would need to get to 15 year-plus terms and five-six times multiple to get any sort of positive investor response in the current anti-capital expenditure climate.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |