E&P | NGI All News Access | NGI The Weekly Gas Market Report

Mexico GDP Growth Said Further Pressured by Natural Gas Availability

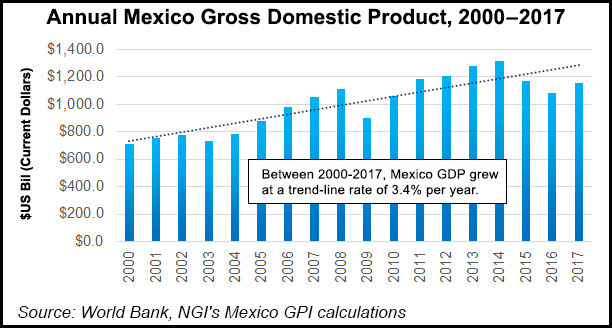

Mexico’s weakening economic growth prospects could be additionally hurt by a lack of reliable supply of cheap natural gas and electricity, several experts have warned in recent days.

The outlook for both appears less than certain over the near-term, amid declining hydrocarbon output by national oil company Petróleos Mexicanos (Pemex), pipeline bottlenecks preventing the arrival of cheap shale gas from the United States, and government efforts to delay the shuttering of legacy thermal plants powered by diesel and fuel oil.

Central bank Banxico is forecasting economic growth of between 1.1 and 2.1% for 2019, and between 1.7 and 2.7% for 2020, both downward revisions from the bank’s previous projections.

If gas supply challenges for industrial consumers persist, recent experience shows that growth could slow even further, according to Bank of Mexico (Banxico) economist Carlo Alcaraz.

In a webcast interview earlier this month with Mexico City-based think tank Pulso Energético, Alcaraz cited the example of 2013, a year in which Mexico’s economy grew by 1.4%, down from forecasts of 3% at the beginning of the year.

Natural gas shortages from the second quarter of 2012 through the second half of 2013 “reduced the Mexican GDP annual growth rate by 0.28 percentage points in the second quarter of 2013,” according to a report co-authored by Alcaraz about the economic impact of the 2012-2013 supply interruptions.

Hardest hit was the west-central Bajio region, which is home to more than half the country’s industrial activity, Alcaraz said.

The study found that a natural gas shortage equal to 25-30% of demand translates to a GDP growth reduction of about 0.3%, as large-scale consumers are forced to switch to more expensive fuels such as diesel and fuel oil.

Industrial groups Confederación de Cámaras Industriales (Concamin) and Cámara Nacional de la Industria de Transformación (Canacintra) told local paper El Universal in late February that some of their members were being asked by Pemex to reduce their natural gas consumption by 25-27%, pending the completion of gas pipelines currently facing delays.

“Any public policy measure that is implemented must consider this [issue],” Alcaraz said. “If they decide, for example, that we’re going to reduce the [supply] of gas in Mexico to inject more into oil deposits to produce more oil, [gas supply for industrial clients] must be considered.”

Mexican President Andrés Manuel López Obrador has called on Pemex to raise its oil production to 2.4 million b/d by 2024 from 1.6 million b/d currently.

The power sector accounted for 50.8% of Mexico’s natural gas demand in 2017, followed by the oil and gas (26.4%) and industrial (21.1%) sectors, according to energy ministry Sener.

Despite Banxico’s trimmed growth forecasts, power demand growth in certain areas of the country could remain robust, according to Hunt Mexico Inc. President Enrique Marroquin.

“I had a conversation last week with [a Mexico-based] power company executive, and he was sharing … that demand growth in some regions in Mexico is expected to be 5% or larger,” Marroquin said during a panel last week at the Woodrow Wilson International Center for Scholars in Washington.

“The question is, can the grid keep up with that demand,” Marroquin said. “What we hear is that CFE wants to turn on their fuel oil … plants just because they want them used … Well that’s going to create a change in the marginal cost of production and that’s going to raise prices.”

The government’s rationale for increasing reliance on fuel oil and diesel in the power sector is to reduce dependence on natural gas imports from the United States, according to Energy Policy Research Foundation, Inc. fellow Emily Medina.

“These sources are much more expensive and carbon-intensive … than natural gas,” Medina said at the Wilson Center event.

“If the government chooses this self-sufficiency strategy based on an increased reliance on fuel oil … we will see increased prices of electricity, and this will hurt Mexico’s economy. Mexico’s manufacturing center is more competitive due to the fact that it has access to cheap sources of power generation.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 1532-1266 |