Markets | NGI All News Access | NGI Data

Late-Season Cold Helps Shatter Spot Price Record as Northwest Sumas Leads Weekly Natural Gas Gains

Late-season cold accompanied sharp natural gas spot price gains throughout the Lower 48 during the week ended Friday (March 1), including a new record-high trade in the Pacific Northwest; the NGI Weekly Spot Gas National Avg. added $1.315 to $4.590/MMBtu.

The weekly spot prices — reflecting trades conducted Thursday and Friday (Feb. 28-March 1) for delivery Friday through Monday (March 1-4) — showed the impact of polar air expected to pour into the Lower 48 during the first week of March.

The price impact from the cold was most acutely felt in the Rockies, Midwest and Midcontinent. Thanks to a record-setting day Friday at Northwest Sumas, weekly prices at the Pacific Northwest trading point finished $83.445 higher at $93.260.

While overshadowed by the volatile Northwest Sumas, other points in the region posted substantial gains. Cheyenne Hub picked up $2.655 on the week to $5.390. In the Midwest, Chicago Citygate surged $3.240 to average $5.935, while in the Midcontinent, Northern Natural Ventura added $3.480 to average $6.210.

With the cold expected to move into the East in the upcoming week, prices in the Northeast and Southeast also strengthened. Algonquin Citygate gained $2.490 to $5.955.

April Nymex futures rallied to close out the week but hardly reflected the standout strength in the physical markets Friday. The front month settled at $2.859, up 4.7 cents. After opening the trading week at $2.772, the April contract picked up 8.7 cents from Monday to Friday.

The midday guidance was mixed Friday, but it continued to show the same overall pattern of frigid cold for the first third of March, with milder conditions expected to develop toward the middle of the month, according to NatGasWeather.

Heading into the weekend, guidance was still struggling to lock in on the March 10-15 pattern, though the “bulk of the data favors a warm ridge building across the southern and eastern U.S. for near-normal demand,” NatGasweather said. “A second camp favors high pressure building across the East March 10-12, but then with a quick cold shot” to follow.

The midday Global Forecast System data Friday came in slightly milder for March 11-15, with “a stronger ridge across the East” noted, the forecaster said. “However, the data has been inconsistent all week, flip-flopping between milder and colder trends and could easily revert back colder over the weekend break.”

Any price uplift from the early March cold isn’t likely to last long, according to EBW Analytics Group CEO Andy Weissman said Friday.

By the middle of the upcoming week, when the coldest temperatures have passed, “day-ahead demand will start to decline, with a steep fall-off by Week 2,” Weissman said Friday. “As this occurs, we expect natural gas prices to first level off and then start to erode, with the potential for a significant decline later in March.

“Even in the most bullish scenario, Nymex gas futures prices most likely will be at or near their peak during the next two to three trading sessions, with few if any bullish catalysts in sight.”

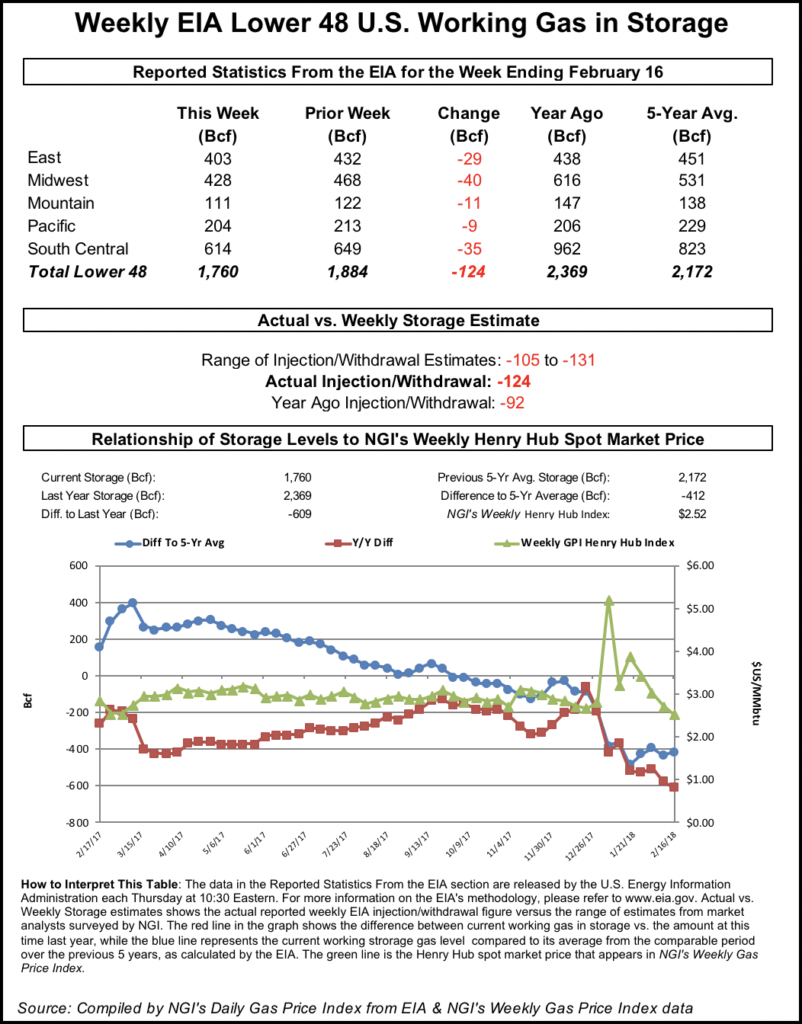

The Energy Information Administration (EIA) reported a 166 Bcf withdrawal from storage for the week ending Feb. 22. The reported draw compares to the year-ago draw of 85 Bcf and the five-year average draw of 104 Bcf.

The print was on the lower end of a rather tight range of estimates that ranged from a 160 Bcf to 180 Bcf pull. NGI’s model predicted a withdrawal of 167 Bcf.

“This was at the lower end of expectations and indicates slightly more holiday impact last week than expected,” said Bespoke Weather Services, which had called for a 174 Bcf withdrawal.

A Reuters poll of 19 market analysts showed a withdrawal range of 160 Bcf to 179 Bcf, and a median of 171 Bcf, while a Bloomberg survey of 13 analysts showed a withdrawal range of 165 Bcf to 180 Bcf, with a median draw of 173 Bcf.

Broken down by region, the EIA reported a 51 Bcf withdrawal in the Midwest, a 51 Bcf draw in the South Central, a 41 Bcf pull in the East and a 16 Bcf pull in the Pacific.

Genscape Inc., which had predicted a 169 Bcf withdrawal, said its daily supply and demand estimates showed a 0.6 Bcf/d production increase week/week for the period, along with a 0.3 Bcf/d increase in imports from Canada.

“Demand was relatively flat week on week, with a modest uptick in power burn,” and liquefied natural gas sendout “somewhat offset by lower residential/commercial demand and flat industrial demand and exports from Mexico,” Genscape said.

Working gas in storage as of Feb. 22 stood at 1,539 Bcf, 154 Bcf below last year and 424 Bcf below the five-year average of 1,963 Bcf, according to EIA.

Forecasts for near-term cold helped to offset the slight bearish miss from Thursday’s EIA report, according to Mobius Risk Group. The latest inventory data continues to indicate tighter market conditions in response to lower prices compared to pre-Christmas levels, the firm said.

The 166 Bcf withdrawal for the week came in roughly 0.5 Bcf/d lower versus market expectations and indicates the market is 3 Bcf/d looser year-over-year on a weather-adjusted basis, Mobius said.

“For reference, this compares to a winter average of plus 4.1 Bcf/d, and a four-week average of plus 2.1 Bcf/d,” the firm said. “Such metrics will be scrutinized in greater detail after the late winter cold shot, but for the time being all eyes will be trained on how low inventory will fall before injection season begins. In our view sub 1.15 Tcf is a likely path, with a continued cold pattern through March potentially causing a sub 1.1 Tcf start.”

Northwest Sumas Takes Off

The real price action Friday was in the physical markets as traders looked ahead to exceptionally cold temperatures arriving over the weekend. The headline grabbing move occurred at Northwest Sumas, an already volatile trading location that went soaring into the stratosphere, gaining $136.140 on the way to averaging $161.330.

The highest trade recorded Friday at Sumas — $200 — easily tops the most expensive individual North American natural gas trade on record at NGI. The previous record was set in January 2018 when Transco Zone 6 NY reached $175.

Northwest Sumas has seen significant volatility in recent months, driven by strong regional demand and supply constraints in the aftermath of an explosion on Enbridge Inc.’s Westcoast system last year that has restricted imports from British Columbia.

With the late-season cold driving big spot price gains across the Lower 48 and a number of other demand regions bidding up prices, the broader uptick in demand appeared to compound the factors that had already made Northwest Sumas prone to price spikes heading into Friday’s trading.

According to NatGasWeather, “Frigid cold blasts with polar origins are lined up” through the week ahead, “with the first advancing out of the Plains and into the east-central and south-central U.S.” over the weekend. This “polar front” was then expected to spread into the East early in the upcoming work week.

“Temperatures behind the cold front will be considerably colder than normal, with widespread lows of negatives 20s to 20s, including 20s and 30s into Texas and portions of the southern U.S.” to help drive strong national demand, according to the forecaster.

With cold set to pour into the heart of the Lower 48, spot prices in the Midwest, Midcontinent and Rockies posted some of the strongest gains Friday. Chicago Citygate surged a whopping $6.060 to average $8.965, while Northern Border Ventura jumped $7.000 to $10.165.

In the Rockies, the frigid temps helped drive Cheyenne Hub prices nearly $5 higher day/day to average $7.820 as points throughout the region finished well north of $5.000.

“Quite an active weather pattern” was shaping up across the country heading into the weekend as low pressure systems were expected to interact with an “arctic air mass anchored over the northern and central U.S.,” according to the National Weather Service (NWS).

“Moisture from an energetic Pacific cyclone is moving onshore into California,” the NWS said Friday. “The long fetch of moisture associated with this system is expected to bring widespread precipitation across much of the southern U.S. through Saturday. The main energy of this system is forecast to move off the central/southern Rockies Saturday night and then interact with an arctic front draped across the southern Plains.

“A low pressure system will form along the arctic front Sunday morning as snow is expected to expand across the central Plains toward the Midwest with a band of mixed precipitation on the southern edge,” the NWS said. “…Snow is expected to expand across the Ohio Valley during the day on Sunday before spreading toward New York, Pennsylvania and possibly the northern Mid-Atlantic states Sunday night.”

Points along the East Coast posted hefty gains Friday, especially in the pipeline-constrained New England region, where Tenn Zone 6 200L jumped $1.745 to $6.895. Further south, Transco Zone 6 NY shot up 42.5 cents to $3.375, while Transco Zone 5 climbed 37.0 cents to $3.365.

California locations also posted hefty gains Friday, with PG&E Citygate and Malin averaging more than $6 as average prices at SoCal Citygate and SoCal Border Avg. finished above $5 on the day.

Further upstream, West Texas prices benefited from the widespread strength in the cash market Friday, as prices in the region picked up more than $1 on average day/day, including a $1.010 increase at Waha, which finished at $2.045.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |