E&P | NGI All News Access | NGI The Weekly Gas Market Report

WPX Eyeing Double-Digit ’19 Production Following Strong Quarterly Results

Tulsa independent WPX Energy Inc. topped Wall Street expectations for the fourth quarter, with production up 49% year/year and 15% sequentially, and double-digit gains are expected this year, even as capital spending is reduced.

Oil production, primarily from the Permian Basin, increased to 96,000 b/d in the final three months of 2018, and the forecast for 2019 is to hit 149,000-161,000 boe/d, 22% higher at the midpoint of last year’s output.

The strong production is forecast even though capital expenditures (capex) have been slashed by 23% year/year. Capex for 2019 has been set at $1.1-1.275 billion. The company would be cash flow neutral at $50/bbl West Texas Intermediate (WTI) prices and cash flow positive at current commodity prices. Three months ago, WPX geared capex toward $65 WTI.

“Without question, 2018 was a pivotal year for WPX,” CEO Rick Muncrief said. “We reduced our operating areas from three to two, paid down nearly $500 million of senior notes, achieved our deleveraging goal and continued to benefit from our midstream strategy.

“Managing our oil output has always been a practical means to a strategic end, starting with how we leveraged our growth to create financial stability amid shifting oil prices. We can use that strength over time to deliver additional benefits for shareholders.”

The capex plan this year funds five rigs in the Permian Delaware and three in the Williston Basin. Planned increases in production are to “materialize more significantly in the latter half of the year based on the cadence of WPX’s 2019 development program.”

Total production volumes of 156,400 boe/d in 4Q2018 were up 61% year/year and were 26% higher than in 3Q2018. Quarterly liquids volumes of 122,300 b/d accounted for 78% of production and were 59% higher than in 4Q2017. Total production increased from 2017 by 64% to 127,100 boe/d predominately from growth in the Delaware sub-basin of West Texas.

Last year, WPX completed 132 net wells across its operating areas and participated in another eight in nonoperated areas.

The Stateline operation in the Delaware is getting a lot of muscle and money this year, including a pilot test that’s underway on the Pecos State acreage to delineate the southern portion of the leasehold.

In the Pecos State leasehold, WPX completed 11 wells with two-mile laterals during 4Q2018, and eight had 24-hour initial production (IP) rates of 3,000 boe/d-plus. The highest IP was achieved on the Pecos State 39-46B-2H Wolfcamp A well at 5,478 boe/d (48% oil), which compared to the average peak rate of nearly 4,500 boe/d on the four-well Pecos State pad.

WPX is continuing to test an 800-foot core sample extracted from the Pecos State project, with findings expected to accelerate completion design makeovers. Positive early results have led to an overall well cost savings that are part of its 2019 outlook.

The Third Bone Spring drilling tests in the Delaware also are proving a success, with the CBR 22-27D-3H well holding a 24-hour IP rate of 4,571 boe/d (49% oil) and 30-day oil rate of 1,767 b/d. Spacing for six-to-eight wells per landing zone is being tested ahead of moving into full development mode.

In the final three months of 2018 Delaware production averaged 99,600 boe/d, up 32% sequentially and 70% higher than in 4Q2017. Oil volumes jumped 55% year/year and 13% sequentially to 48,300 b/d.

Average realized oil prices fetched in the Delaware were WTI less $1.44 for the quarter, including Midland basis swaps. Basis swaps increased the average realized price by $2.28/bbl.

In late December, WPX’s new natural gas processing plant in the Delaware exceeded 85% utilization of the first 200 MMcf/d cryogenic train and produced 19,000 b/d of natural gas liquids (NGL). The facility is part of a 50/50 joint venture (JV) operated by Howard Energy Partners. Construction on the second 200 MMcf/d cryogenic train remains on schedule for completion by mid-year.

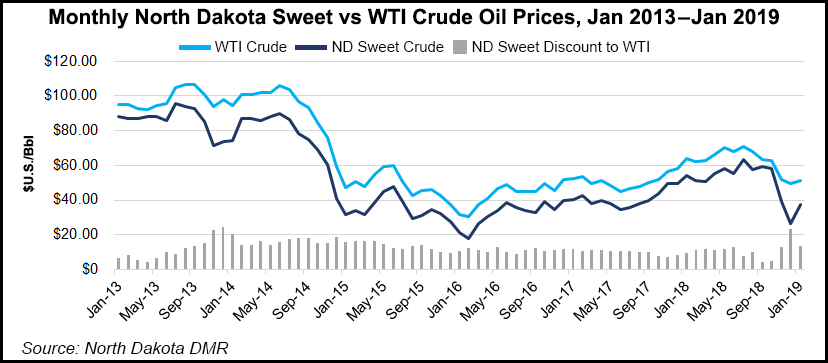

In the Williston, production averaged 56,800 boe/d in 4Q2018, up 17% sequentially and 47% year/year. Oil volumes were 44% higher year/year and 17% higher than in 3Q2018 at 47,700 b/d. However, “significant refinery turnarounds and other third-party unplanned outages” during the final three months of 2018 “created a market imbalance that affected price realizations for Williston volumes,” management noted. Differentials at the time were about $10 “but have since rebounded. Basis differentials for January were minus $6.00. February basis differentials are estimated at minus $2.50/bbl.”

The plan now is to return capital to shareholders by 2021 and leverage more of the midstream assets for operational and financial benefits, Muncrief said. “These goals speak directly to shareholder expectations. These are the fundamental metrics by which we’ll measure our success and align decision-making throughout the organization.”

Among other things, WPX is selling a 20% equity interest in WhiteWater Midstream LLC’s Agua Blanca natural gas pipeline in the Permian. Agua Blanca, with initial capacity of 1.4 Bcf/d, services the Delaware via 90 miles of 36-inch diameter pipeline and 70 miles of smaller diameter pipeline crossing portions of the West Texas counties of Culberson, Loving, Pecos, Reeves, Ward and Winkler.

Net income was $353 million (83 cents/share) in 4Q2018 versus a year-ago loss of $42 million (minus 6 cents). For 2018, net earnings were $143 million (57 cents/share), compared with a 2017 loss of $31 million (minus 8 cents).

Total revenue jumped in 4Q2018 to $1.02 billion from $155 million in 4Q2017. Revenue totaled $2.3 billion for 2018, compared with $$1.05 billion in 2017. Oil and NGL sales totaled $508 million in 4Q2018 revenues, with oil revenue grew 49% year/year with full-year 2018 sales of $1.79 billion.

Proved reserves at the end of 2018 were 479.3 million boe, 61% weighted to oil. WPX replaced overall 2018 production at a rate of 308% before divestitures, with 79% of reserves oil and NGLs. Permian proved reserves increased 28% from 2017 to 322.4 million boe, with Williston proved reserves up 20% to 156.9 million boe.

For 2019, WPX has 42,575 b/d of oil hedged with fixed price swaps at a weighted average price of $53.65/bbl and 7,321 b/d with collars at a weighted average price of $50 for the floor and $60.19 for the ceiling. About 108,470 MMBtu/d of natural gas also is hedged at a weighted average price of $3.07/MMBtu.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |