Regulatory | NGI All News Access

California Officials Focused on PG&E’s Fire Liabilities

The dire circumstances surrounding California’s largest energy utility stemming from multi-billion dollar wildfire liabilities continue to consume the attention of the state’s leaders, driving political, financial and regulatory concerns to a fever pitch as the new year gets into full swing.

Gov. Gavin Newsom marked his first two days on the job focused on wildfire mitigation measures and the growing plight of San Francisco-based Pacific Gas and Electric Co. (PG&E) and its parent PG&E Corp. Newsom indicated he’s focused on the utility in real time, and its “solvency” is a growing topic of concern.

While the PG&E stock price gained 27 cents on Wednesday to close at $17.83 /share, the slight rally wasn’t enough to offset recent trading when it lost nearly half of its value. S&P cut the company’s credit rating to a junk level, and the utility’s bonds dropped to historic lows.

“Addressing the aftermath of last year’s deadly wildfires will be a top priority for myself, Gov. Newsom and my colleagues in the state legislature,” said Assemblymember Chris Holden, chairman of the utilities and energy committee, and one of the principal sponsors behind Senate Bill 901, a bill dealing with the wildfires. “Maintaining a reliable, safe, and affordable utility service for all Californians continues to be our ultimate goal.”

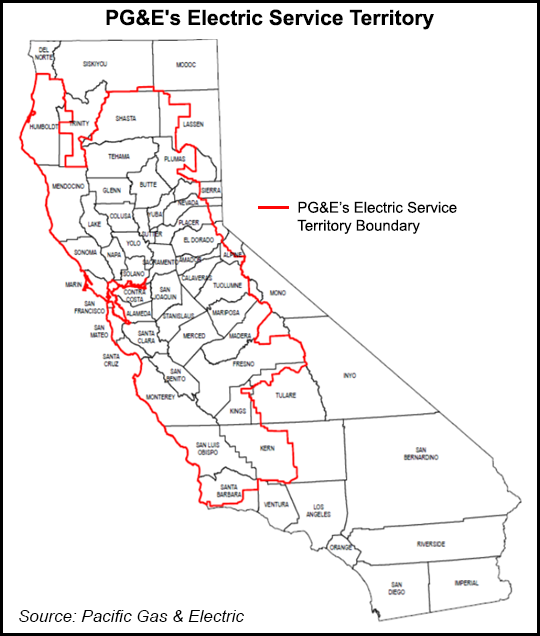

Speculation about PG&E’s future continues to accelerate with the financial community anticipating a bankruptcy filing as early as next month, a break up of the company and its board of directors, and an imminent shake up of its senior executive team running the combination utility’s electrical system, which has been implicated in many of the nearly two dozen fires that have struck Northern California in the past two years.

PG&E spokesperson Matt Nauman confirmed that Patrick Hogan, senior vice president in charge of the electric system, is retiring and being replaced by Michael Lewis, 56, a former Duke Energy Corp. senior executive who joined PG&E last August. Additionally, two executives under Hogan who oversaw the company’s distribution and transmission systems will retire this month.

PG&E early last year suspended its dividend, citing 2017 wildfire liabilities. It has fully drawn down all its lines of credit and is now carrying more than $18 billion of debt. In addition to numerous lawsuits by individual property owners who lost homes in the Camp Fire, the utility has been sued by several insurance companies.

Lawsuits have been filed by Allstate Corp., State Farm Insurance Co., United Services Automobile Association and their subsidiaries.

The California Public Utilities Commission (CPUC) has an ongoing investigation to examine the utility’s safety culture through its organizational structure, management teams and its board of directors.

Citing the regulators’ investigation, a CPUC spokesperson, Terrie Prosper, told NGI on Wednesday that regulators led by commission President Michael Picker are evaluating PG&E’s “corporate governance, structure and operations to determine the best path forward for Northern California to receive safe electric and gas service.”

In response to specific questions about a possible utility bankruptcy or spinning off of PG&E’s gas system, Prosper said the CPUC “cannot comment at this time on any specific proposals.” She did add that under California law, the sale of any utility assets is subject to the CPUC’s review and approval.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |