E&P | NGI All News Access | NGI The Weekly Gas Market Report

Always Reliable Anadarko Basin Still Holds Plethora of Resources, Says IHS Markit

Oklahoma’s Greater Anadarko Basin, a reliable conventional producer since the 1950s, holds an estimated 16 billion bbl of oil and more than 200 Tcf of natural gas in unrisked, technically recoverable resources within its unconventional reservoirs, according to IHS Markit.

“The Anadarko Basin has long been a major contributor to U.S. production, but it is just getting started in terms of delivering on its unconventional production potential,” said IHS Markit Executive Director John Roberts, who oversees global subsurface operations and co-authored the new report with Prithiraj Chungkham, director of unconventional resources.

“We are now witnessing a new kind of Oklahoma land rush,” Roberts said. “But unlike what happened in 1889 when lands were opened to settlement, this time the competition is for access to the energy resources that lie below the surface.”

The analysis found that the basin is pushing toward new all-time production highs long after its conventional production peaked in the 1970s and the 1980s. Horizontal drilling has increased sharply since 2008, with the advent of combining horizontal drilling with hydraulic fracturing. Annual basin production volumes already have set new peak records.

Encana Corp. may be seeing the potential, as it is buying one of the leading Oklahoma operators, Newfield Exploration Co., which has an estimated 360,000 net acres.

IHS Markit research, which covers Texas, Oklahoma and Kansas, is the first phase of a comprehensive, 18-month-long project to model and interpret the Anadarko’s key geologic characteristics, including 3-D geologic models of 41 plays to better estimate its remaining hydrocarbon potential.

The estimate of the remaining recoverable gas resources did not include volumes of previously identified unconventional recoverable gas resources already known to exist in the Anadarko’s Granite Wash trend.

“By getting to a greater level of granularity and accuracy regarding producing formations, we change the entire view of the basin,” Roberts said. “For geologists, it’s like having a more powerful microscope.”

Among the “most surprising results” was the potential of the Simpson formation, which the authors believe could be one of the biggest yet-to-be developed shale plays in the United States.

“The Simpson has long been among the largest historical producers of vertical production in the Anadarko Basin,” Roberts said. “But our new analysis shows that there is also significant Simpson potential as a major driver for horizontal shale production.”

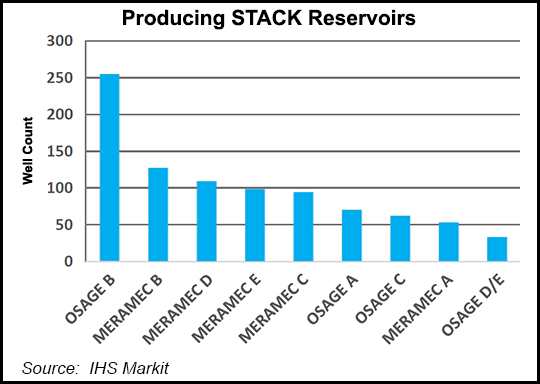

The analysis modeled and interpreted formations and benches in the two big Oklahoma targets, commonly called the STACK and SCOOP and formally known as the Sooner Trend of the Anadarko Basin, mostly in Canadian and Kingfisher counties, and the South Central Oklahoma Oil Province.

“As it stands now, only about 20% of the Anadarko Basin’s STACK ”sweet-spot’ locations have been drilled or developed,” Roberts said. “The play is still in its early stages of unconventional development. We can easily envision an additional 4,000-5,000 horizontal wells drilled.”

Overall, the results underscore the Anadarko’s “renewed attractiveness,” the authors said.

“The Anadarko is attractive because it has 41 stacked plays, which overlap in many parts of the basin,” Chungkham said. “For operators, that means multiple targets that can be accessed from one well pad.”

The analysis used proprietary historical well and production database that includes more than 320,000 wells, and proprietary tool ProdFit, that, for the first time, enabled researchers to leverage interpreted formation “tops” data to identify formations of completion intervals on 275,000 wells.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |