No Clear End to Warming Trend Sends January NatGas Tumbling; Spot Gas Mostly Lower

After some flipping back and forth Wednesday, natural gas market bears regained full control on Thursday as weather outlooks showed truly cold air locked well north of the United States/Canada border after this week’s cold front passes through. The Nymex January gas futures contract fell 14.2 cents to settle at $4.327, while February lost 11.3 cents to hit $4.217 and March slid 8.2 cents to $3.924.

Spot gas prices also continued to retreat as demand was expected to ease somewhat despite the bitter conditions expected to linger on the U.S. East Coast through the weekend. The NGI Spot Gas National Avg. dropped 2.5 cents to $4.75.

On the futures front, Thursday’s trading action reflected a cautiously bearish market as the Nymex January contract opened the session just about 2 pennies below Wednesday’s settle but then went on to drop as much as 20 cents later in the morning. The prompt month recovered a bit but managed to settle within roughly a nickel of its intraday low.

“Front-month natgas futures have been trading in a wedge with huge volatile swings,” NatGasWeather said. “Prices tested resistance early in the week, but just tested support and marginally bounced. But will support hold?”

If current weather outlooks are any indication, prices could soon take out key support levels. Aside from the cold fronts forecast to sweep through the country through early next week, no additional truly cold air is expected to return until Dec. 20 at the earliest as mild high pressure is expected to dominate the United States, according to NatGasWeather.

The firm’s latest forecast suggested that cold would return around the start of the new year. “This data has been consistent the past few days showing this, but it is prone to changes in time due to it being a long range model,” the forecaster said.

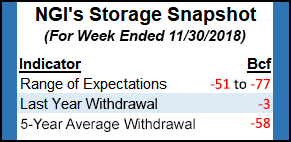

Meanwhile, Friday’s storage report from the Energy Information Administration wasn’t expected to move the needle much unless a large miss is reported, according to EBW Analytics. Estimates have clustered around a withdrawal in the low to mid-60 Bcf range, which would widen the deficit to year-ago levels but keep the deficit to the five-year average relatively steady.

A Bloomberg poll of 14 market participants showed a withdrawal range of 51 Bcf to 77 Bcf, with a median draw of 63 Bcf. A Reuters survey of 19 participants had estimates ranging from withdrawals of 57 Bcf to 77 Bcf and a median drawdown of 64 Bcf. Kyle Cooper of IAF Advisors projected a pull of 62 Bcf. EBW expected a 61 Bcf draw, as did Genscape Inc.

Genscape’s estimate is a composite of its supply/demand model and its storage facility sample, which showed little divergence for this week’s report. Within its supply/demand model, the firm estimated that production averaged 86.6 Bcf/d, about 1 Bcf/d stronger than the previous week. Lower 48 demand ran at an estimated 90.4 Bcf/d, nearly 1.3 Bcf/d stronger than the previous week, while net imports from Canada averaged 3.8 Bcf/d, about 0.2 Bcf/d below the previous week. Liquefied natural gas sendouts were relatively unchanged, and exports to Mexico recovered a bit by about 0.2 Bcf/d higher than the previous week.

Compared to degree days and normal seasonality, a withdrawal of 61 Bcf would appear loose by 4.2 Bcf/d versus the prior five-year average, Genscape said.

Last year, EIA recorded a 3 Bcf withdrawal for the period, and the five-year average is a withdrawal of 58 Bcf.

Spot Gas Continues Decline

Spot gas prices across most of the country remained on a downward trajectory Thursday, with demand expected to continue sliding as the current cold blanketing the eastern United States passes through. Although additional weather systems were expected to move through the country this weekend, the coldest air was expected to dissipate by Friday, according to various forecasts.

While sharp price movements were common in regions like the Northeast and Appalachia, other markets posted significant declines in Thursday trading. Prices across the Midwest were down 20 cents or more, while several hubs in the Midcontinent posted declines of more than 30 cents day/day.

Most points in East and South Texas fell 15 cents or more, while points in West Texas bucked the overall downtrend amid continued volatility due to rampant Permian Basin drilling and tight pipeline capacity. Waha shot up nearly 40 cents to $2.51.

Farther east, losses of 15 cents or more were the norm in Louisiana and across the Southeast, while prices in the Northeast were mixed due to tight pipeline capacity in New England, which drove up prices there. Tenn Zone 6 200L spot gas jumped more than $2 to $8.81. Meanwhile, spot gas at Transco Zone 6 NY slid more than 30 cents to $4.665.

In California, prices were mixed in response to a pair of pipeline maintenance events scheduled for Friday. Southern California Gas (SoCalGas) and Mojave Pipeline have scheduled pipeline work that will cut about 0.5 Bcf/d of gas at the Arizona-California border at Topock, according to Genscape.

Mojave’s planned force majeure valve repair will cut its receipt capacity from El Paso Natural Gas (EPNG) to zero. This will be the third force majeure to affect this interconnect in the past three weeks; volumes have averaged 364 MMcf/d during that time in spite of the flow disruptions, Genscape said.

“Mojave flows molecules from Topock west and delivers a portion of them back to EPNG’s Line 1903 at the Cadiz interconnect in California, with the remainder continuing west to the Mojave-Kern jointly owned line,” Genscape natural gas analyst Joe Bernardi said.

EPNG flows gas from Cadiz back southeast toward Arizona to the Ehrenberg border point, where much of it goes to SoCalGas. “Ever since SoCalGas has been able to receive gas at Topock again — which started in mid-September after a long outage — EPNG has been simply delivering more gas to SoCalGas at Topock instead of using the more complicated Line 1903 route,” Bernardi said.

Line 1903 flows have only averaged 17 MMcf/d in the past three weeks, according to Genscape. This force majeure will mean that EPNG’s ability to move gas on the Line 1903 route will drop off completely for one day.

EPNG, however, will not be able to simply reroute these Mojave/SoCal-bound molecules onto SoCalGas at the Topock interconnect, because SoCal is starting its own maintenance there on Friday as well, Genscape said. Its receipt capacity from both EPNG and Transwestern Pipeline at Topock will go to zero for one week, which would cut roughly 130 MMcf/d.

Transwestern’s deliveries at Topock have already been at zero for the last several weeks, but it could deliver more gas to SoCal at the nearby Needles interconnect in order to make up for SoCal’s lost receipts from EPNG at Topock, Bernardi said.

“These two events complicate SoCal’s import options, which could lead to more upward pressure on SoCal basis prices — particularly Citygate — to incentivize alternative supply, including storage withdrawals,” he said.

Genscape meteorologists are forecasting milder weather for southern California on Friday as the current cold snap there fades out. “This cold weather has driven SoCalGas’ system-wide demand above 3.0 Bcf/d for the first time since March, leading to the second-highest SoCal Citygate price spike since August,” Bernardi said.

Despite the milder weather on tap, SoCal Citygate spot gas jumped more than 90 cents to average $10.965 for Friday’s gas day. Southern Border, PG&E was down 51.5 cents to $3.855.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |