NGI Data | Markets | NGI All News Access

EIA Storage Report Misses Bearish as Weather-Focused Natural Gas Futures Swing Lower

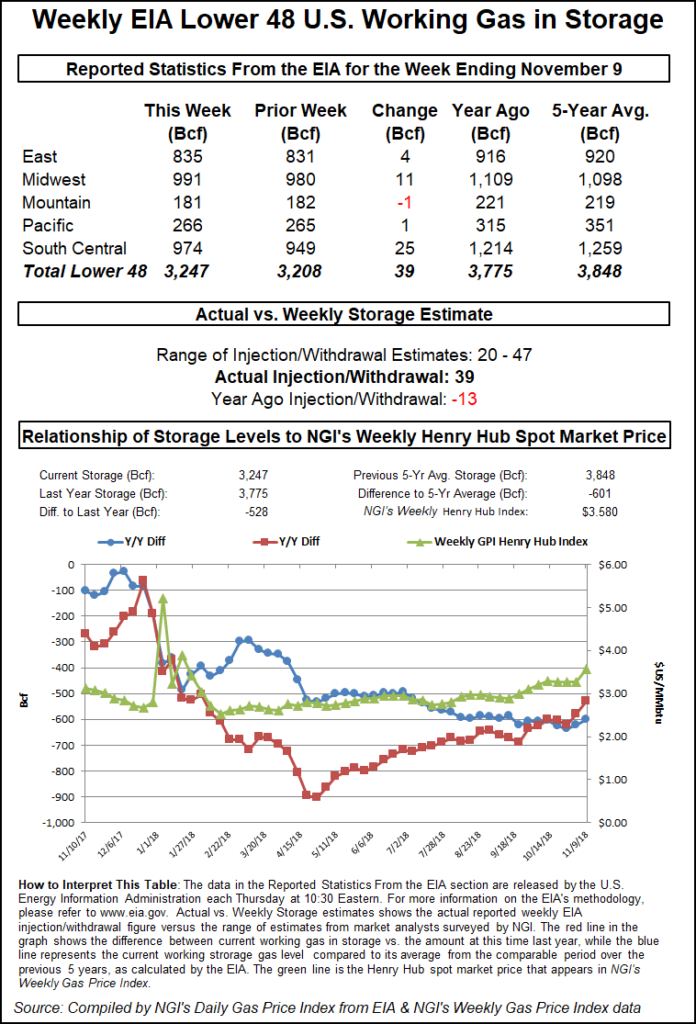

The Energy Information Administration (EIA) reported a somewhat larger than expected 39 Bcf injection into U.S. natural gas stocks Thursday, giving bears further encouragement with a volatile futures market already pulling back sharply on forecasts.

With natural gas futures on a run of extreme volatility amid concerns over historically low inventories and a robust start to the heating season, Thursday’s report did not appear to generate any immediate momentum in either direction.

Over the last few days, forecast changes have coincided with big price moves as the market has keyed in on the weather outlook, including a 73.6 cent rally during the previous session. Warmer trends overnight heading into Thursday’s session had the December Nymex contract trading about 55 cents lower when EIA’s report crossed trading desks at 10:30 a.m. ET.

In the minutes following the report, the prompt month continued to trade around $4.240-$4.300/MMBtu. By 11 a.m. ET, the December contract had slid to around $4.133, down 70.4 cents from Wednesday’s settle.

The 39 Bcf build for the week ended Nov. 9 compares to a 13 Bcf withdrawal recorded a year ago, while the five-year average is a 19 Bcf injection.

Prior to Thursday’s report, major surveys had pointed to a build in the mid- to low-30s Bcf, with estimates ranging from 28 Bcf to 42 Bcf. Intercontinental Exchange EIA financial weekly index futures had settled Wednesday at a build of 36 Bcf.

Prior to release of the report, Bespoke Weather Services said it had viewed risks as skewed lower.

“The market consensus seemed a bit lower too, so we see this number as still slightly bearish coming in above the consensus for a second week,” the firm said. “The build in the East was a bit of surprise, but otherwise the large salt build fit our expectations as we raced to fill storage ahead of the coming winter season.

“The market will likely shake this print off as the focus is much more on the large draw next week and latest weather forecasts. Yet what this confirms is with average weather the market is still decently well-supplied, indicating any normalization of weather can quickly push prices back below $4. Long-range blocking remains too significant to ease bullish risks, but this report should ease some fear.”

Total Lower 48 working gas in underground storage stood at 3,247 Bcf as of Nov. 9, 528 Bcf (14.0%) below last year and 601 Bcf (15.6%) below the five-year average.

By region, the South Central injected 25 Bcf for the week, including 19 Bcf into salt and 6 Bcf into nonsalt. The Midwest saw an 11 Bcf injection, while 4 Bcf was refilled in the East for the week. The Pacific posted a 1 Bcf net build, while Mountain region saw a net withdrawal of 1 Bcf, according to EIA.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |