NGI The Weekly Gas Market Report

NGI The Weekly Gas Market Report | Forward Look | Markets | NGI All News Access

December NatGas Prices Plunge in West; Maintenance Events Plague Permian Hubs

December natural gas forward prices fell an average 9 cents from Oct. 25-31 as steep declines in the West drove down the overall average even as the majority of pricing hubs failed to move more than a nickel throughout the week, according to NGI’s Forward Look.

That’s not to say that it was a quiet week. The Nymex futures curve continued to experience volatility as weather models continued to fluctuate. The December contract, which took over the prompt position on Tuesday, edged up just a half-cent during that time to settle Wednesday at $3.261.

Conflicting and sometimes changing weather models have been behind the recent volatility in the futures curve, with recent warmth possibly giving way to returning cold weather as soon as the end of next week. While the latest mid-day data held warmer trends early next week as mild high pressure sets up to dominate much of the southern and eastern United States, it also held colder risks or trended further colder Nov. 9-14 as a series of weather systems and cool shots sweep across the northern, central and eastern United States, according to NatGasWeather.

The data suggests a milder break around Nov. 15-16, and was mixed on whether additional cool shots would follow into the northern United States on Nov. 17-18, the forecaster said. “But overall, the data is notably colder during the second week of November compared to what the data showed early in the week”, adding several heating degree days (HDD)/Bcf in demand, NatGasWeather said.

Going forward, the forecaster said it expected the markets to closely watch the Nov. 15-18 pattern “since some solutions show a mild pattern setting up and others show cold shots returning. Clearly, if cool shots were to continue for the third week of November, deficits wouldn’t have much opportunity to improve.”

Indeed, with colder weather potentially in store, stubborn storage deficits that have developed in the face of record production have kept market bulls in the game. On Thursday, the Energy Information Administration (EIA) reported a 48 Bcf injection into storage inventories that lifted gas stocks to 3,143 Bcf, 623 Bcf (16.5%) below last year and 638 Bcf (16.9%) below the five-year average.

“Today’s EIA report was a touch to the bullish side, suggesting last week’s bearish miss could have been a one-off report, but will need another report or two to confirm,” NatGasWeather said.

Bespoke Weather Services, which had called for a 53 Bcf injection, viewed this week’s report as slightly tighter, indicating the “extreme looseness” evident in last week’s 58 Bcf injection was a “relative one-off.” Still, the forecaster said it sees enough looseness in the market that prices could “pull back significantly on any warming trends” as weather continues to steer the direction of prices.

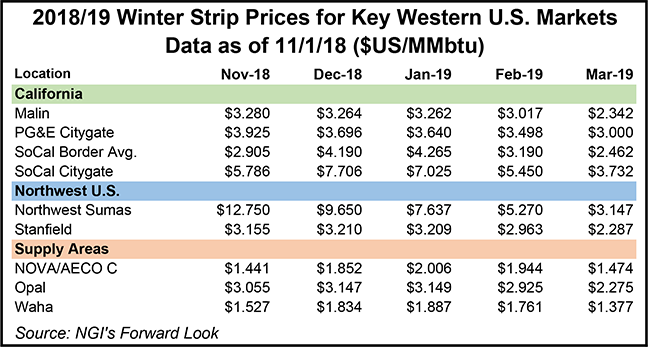

But while the majority of pricing hubs followed the general lead of Nymex futures this week, some West Coast markets posted sharp decreases as mild weather continues to blanket the region. SoCal Citygate December prices plunged $1.20 from Oct. 25-31 to reach $7.706, while January dropped 94 cents to $7.025. The balance of winter (January-March) was down 63 cents to $5.40, according to Forward Look.

Malin December fell 19 cents to $3.264, January slipped 23 cents to $3.262 and the balance of winter (January-March) fell 21 cents to $2.87.

The losses at Malin are rather significant as the pricing hub had recently experienced some uplift due to the rupture on Enbridge Inc.’s Westcoast Transmission system that has restricted Canadian imports. Westcoast on Thursday announced that it had completed repairs on the section of 36-inch diameter pipeline that exploded, and as a result expects that it will be able to return some additional southbound flow capacity over the next 48 hours.

The increased flows on the T-South system will allow between 820 and 900 MMcf/d of gas flows. Previously, this maximum capacity was 800-850 MMcf/d. Going forward, Westcoast will be inspecting its T-South system at various points along the line to ensure operating integrity.

Enbridge has stated that it expects maximum capacity for the Huntingdon constraint to increase to 1.2-1.3 Bcf/d by the end of November, as both the 36-inch line and another 30-inch parallel line would continue to operate at 80% of capacity.

Even as gas flows had already begun increasing earlier in the week, Northwest Sumas forward prices for December continued to strengthen. December rose 7 cents from Oct. 25-31 to reach $9.65, while January plunged 36 cents to $7.637 and the balance of winter (January-March) dropped 69 cents to $5.35, Forward Look data show.

Meanwhile, forward prices in West Texas/southeastern New Mexico continued to decline as the region has seen quite a bit of pipeline maintenance in recent weeks. El Paso Natural Gas (EPNG) will begin a three-day maintenance event Friday that could cut Permian exports by around 100 MMcf/d, in addition to limiting specific points within the basin.

A flow control valve installation that is part of EPNG’s ongoing Permian North expansion project is the reason for the planned work, according to Genscape Inc.. The “EUN PECS” and “PERM N” flow points are both expected to experience operating capacity reductions.

EUN PECS, which tracks southwestern flows between the Eunice and Pecos stations, will be limited to zero. It only averaged 21 MMcf/d across October, but it spiked up to 166 MMcf/d during the initial cycles for Thursday’s gas day, Genscacpe natural gas analyst Joe Bernardi said.

PERM N posted steadier volumes in October, at an average rate of 130 MMcf/d, and will be limited to 83 MMcf/d, he said.

Seven non-throughput meters on El Paso will also see their operating capacity reduced to zero for the duration of this work, including the IMCHRNCH and IROCKDOV meters. The largest daily average nominations in October came at the IMCHRNCH (Merchant Ranch Storage) meter, which injected an average of 26 MMcf/d, and the IROCKDOV processing plant meter, which received an average of 38 MMcf/d.

For the Oct. 25-31 period, El Paso-Permian December dropped 18 cents to $1.924, January fell 10 cents to $1.77 and the balance of winter (January-March) slipped 4 cents to $1.77. Waha December was down 22 cents to $1.834, January was down 15 cents to $1.887 and the balance of winter (January-March) was down 11 cents to $1.68, according to Forward Look.

Over in South Texas, Texas Eastern was scheduled to conduct a pipe replacement between its Thomaston and Provident City compressors on its 16-inch Line.

During the Nov. 6-9 outage, capacity through the Thomaston compressor station (CS) will be reduced to zero. Over the last 14 days, Thomaston CS flows have averaged 86 MMcf/d but have been trending upwards, reaching 118 MMcf/d on Oct. 30, according to Genscape natural gas analyst Josh Garcia. “Alternative supply can be sourced from further upstream on the 16-inch from the Joaquin to Provident City compressors, or from the southern 30-inch line that runs along the Gulf Coast,” he said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9915 | ISSN © 2577-9877 | ISSN © 1532-1266 |