EIA Storage Build Near Consensus as Natural Gas Futures Action Mixed

The Energy Information Administration (EIA) reported a 48 Bcf injection into Lower 48 natural gas stocks for the week ended Oct. 26, slightly below survey averages, prompting a mixed reaction from the futures market.

After probing above $3.310 in early trading Thursday on some colder temperatures expected during the second week of November, only to drop back to around $3.270 after 9 a.m. ET, Nymex front-month futures got a brief jolt at 10:30 a.m. ET as traders caught their first glimpse of the final number. The December contract briefly added about 1.5 cents to trade as high as $3.295, but within minutes prices reversed to probe as low as $3.252.

Shortly after 11 a.m. ET, December was trading down around $3.241, off 2.0 cents from Wednesday’s 3.261 settle.

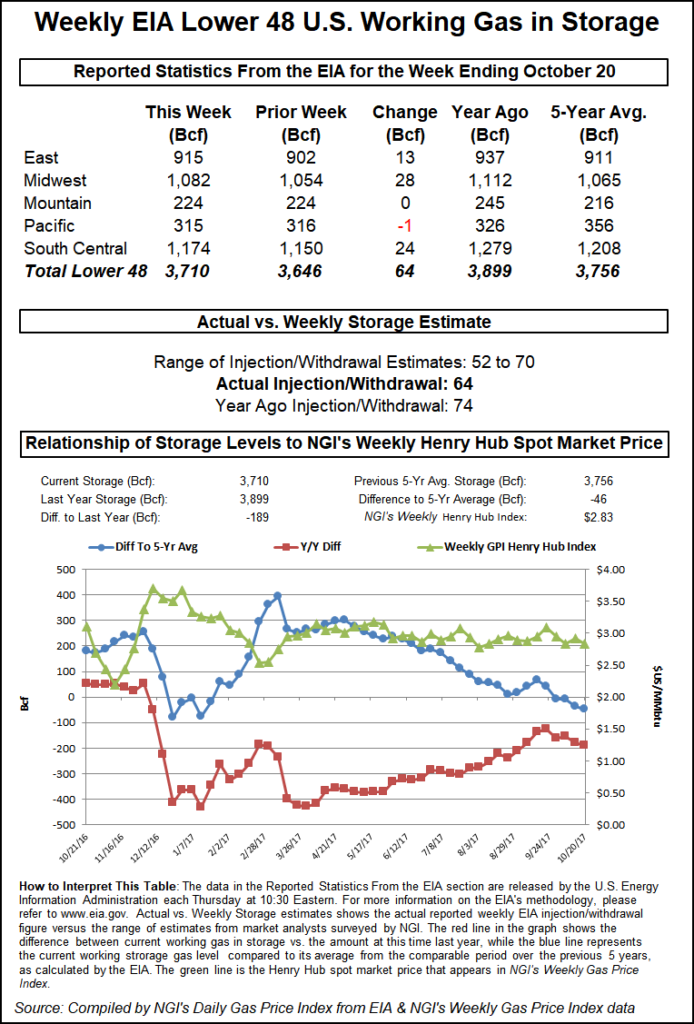

The 48 Bcf build widens the year-on-year and year-on-five-year deficits on the last report week before the start of the traditional November-to-March winter heating season. Last year EIA recorded a 65 Bcf injection for the week, and the five-year average is a build of 62 Bcf.

Prior to Thursday’s report, predictions from market participants had clustered around the low-50 Bcf range. A Reuters poll had a range of 38 Bcf to 60 Bcf, with a median injection of 50 Bcf. A Bloomberg survey showed a range of 42 Bcf to 66 Bcf, with a median of 52 Bcf.

Bespoke Weather Services, which had called for a 53 Bcf injection, viewed this week’s report as slightly tighter, indicating the “extreme looseness” evident in last week’s 58 Bcf injection was a “relative one-off.” Still, the forecaster said it sees enough looseness in the market that prices could “pull back significantly on any warming trends” as weather continues to steer the direction of prices.

Total working gas in underground storage stood at 3,143 Bcf as of Oct. 26, down 623 Bcf (16.5%) from last year and 638 Bcf (16.9%) below the five-year average, according to EIA.

By region, the South Central posted the largest build for the week at 23 Bcf, including 16 Bcf injected into salt and 8 Bcf into nonsalt. The Midwest posted a 22 Bcf net build for the week, while only 1 Bcf was refilled in the East. The Mountain saw a 3 Bcf injection, while Pacific inventories held flat week/week, according to EIA.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |