EIA NatGas Storage Build Even Leaner Than Expected as Futures Reverse Losses

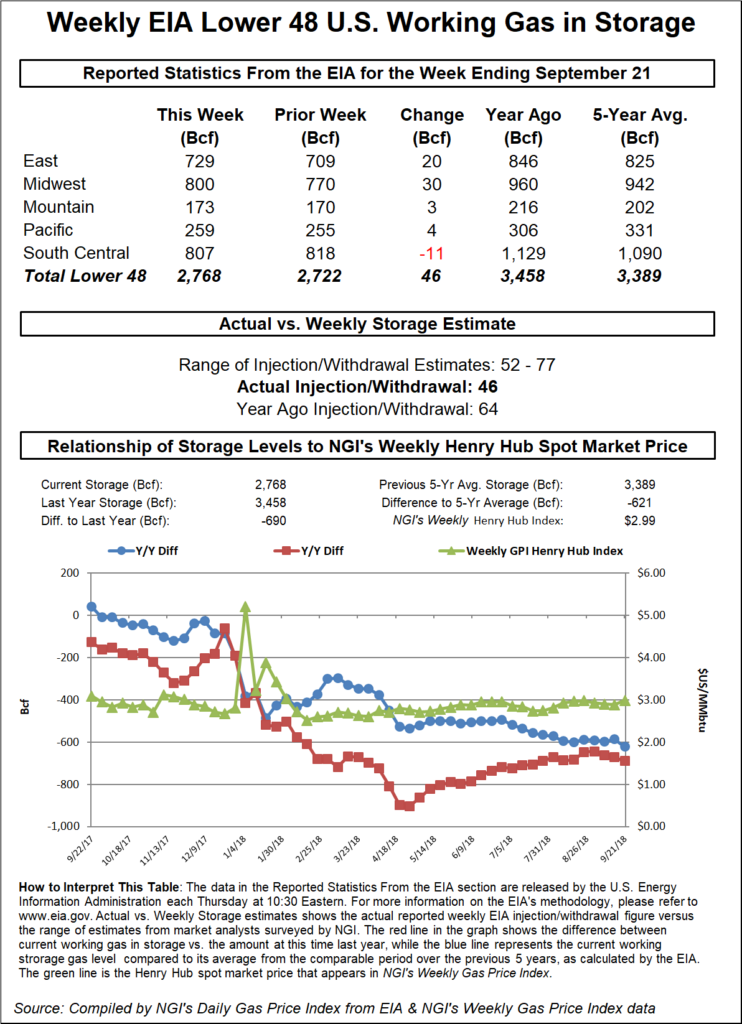

The Energy Information Administration (EIA) reported a 46 Bcf build into Lower 48 gas stocks Thursday that came in well below consensus and widened the yawning year-on-five-average deficit, helping the November contract to promptly reverse the prior session’s losses.

The 46 Bcf injection for the week ended Sept. 21 compares to a five-year average build of 81 Bcf and a 64 Bcf build recorded a year ago.

Traders may have had suspicions that EIA’s 10:30 a.m. ET report would surprise to the low side, as prompt month futures had been gaining steadily in the lead-up to the report, picking up momentum around 9 a.m. ET. As soon as the number crossed trading desks, the November contract jumped close to a nickel to trade up around $3.065/MMBtu.

By 11 a.m. ET, November was trading around $3.050, up 7.0 cents from Wednesday’s settle and a near-perfect mirror of the prior session’s 7.8 cent sell-off.

Prior to the report, the median from a Bloomberg survey of traders and analysts had keyed in on a build of 61 Bcf. Intercontinental Exchange (ICE) EIA financial weekly index futures had settled Wednesday at an injection of 52 Bcf.

The bullish miss featured an 11 Bcf pull from salt stockpiles in the South Central region. The report period saw strong spot prices in the Gulf Coast and Southeast coinciding with hot temperatures and reports of above-average nuclear outages in the aftermath of Hurricane Florence.

Last week the average day-ahead price at Transco Zone 5 climbed as high as $3.38, while Henry Hub crested the $3 mark by mid-week (Sept. 19 trade date), Daily GPI historical data show.

“We had seen very impressive power burns last week that rallied the market, and clearly the market had not” priced in the full extent of the tighter burns, Bespoke Weather Services said. “Nuclear outages helped spike burns, and demand destruction from Hurricane Florence was far less than expected. We view the tightening in this print as a relatively one-off event; next week’s print is expected to be solidly looser as we have seen burns ease off,” along with a decline in liquefied natural gas exports and higher Canadian imports.

“Still, this print is bullish enough to emphasize storage shortages and keep a bid under prices; a reversal off $3.07-$3.10 seems most likely.”

Total working gas in underground storage as of Sept. 21 stood at 2,768 Bcf, putting inventories 621 Bcf (18.3%) below the five-year average with only a few weeks left in injection season. Year-ago inventories stood at 3,458 Bcf, according to EIA.

The Midwest recorded the largest weekly net injection among regions at 30 Bcf, followed by the East at 20 Bcf. The Pacific injected 4 Bcf, while the Mountain region injected 3 Bcf for the week, according to EIA.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |