Markets | NGI All News Access | NGI Data

EIA Reports On-Target 48 Bcf Injection; September Natural Gas Holds Steady

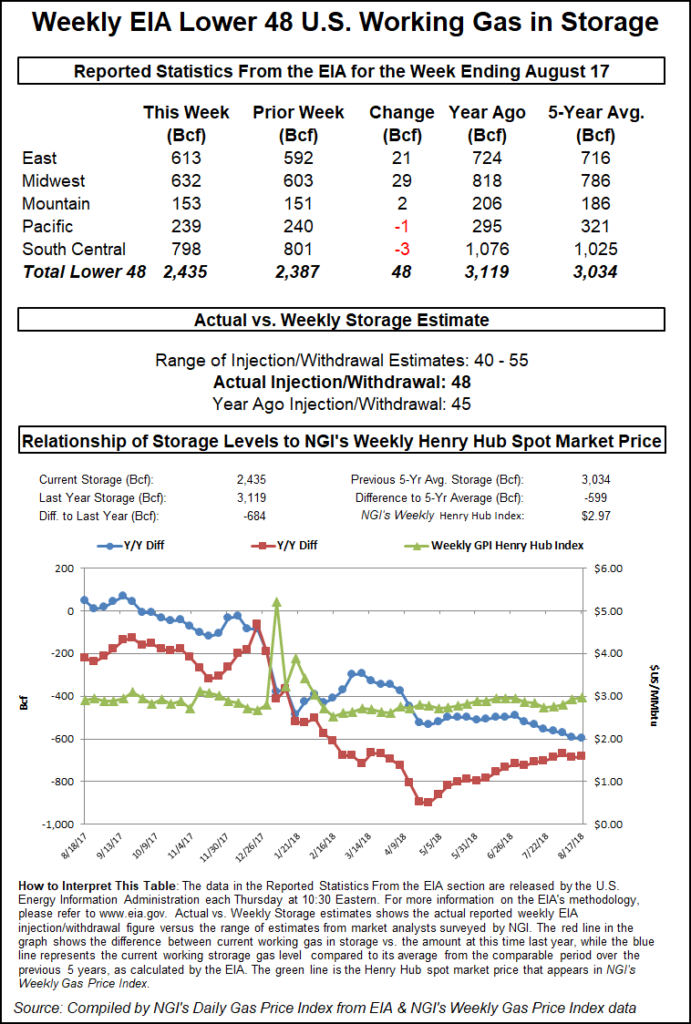

The Energy Information Administration (EIA) reported a 48 Bcf build into storage inventories for the week ending Aug. 17, right on target with some market participant surveys, although several estimates clustered in the 50 Bcf range as well.

Nymex September natural gas futures had a muted reaction to the EIA report, with the prompt month nudging one-tenth of a cent higher as the EIA print hit the screen. From there, the September contract continued to gain modest ground but then retreated again, trading less than a penny lower at $2.952 at 11 a.m. ET.

The net of the last two weeks yielded a difference of only 2 Bcf from expectations, indicating a strong reading of balance, according to Bespoke Weather Services, which had projected a 52 Bcf build. Today’s print, however, may ease some of the bearish fundamental pressure that the weather forecaster expected to see on prices into the weekend.

“The print was not quite as loose as expected with a solid draw across the South still, even with less impressive heat. However, we see in-week loosening that is likely to make next week’s print looser and keep resistance fairly firm,” Bespoke chief meteorologist Jacob Meisel said.

Genscape Inc., which had estimated a 49 Bcf build, said its daily supply and demand (S&D) model had last week’s total supply posting a notable increase from the prior week, with production having averaged 81.1 Bcf/d, up 0.7 Bcf/d from the prior week. Some of the supply-side gains from production were very slightly diminished by a 0.1 Bcf/d week/week decline in imports from Canada, “paced by sizeable reductions in weekly imports to the Pacific Northwest and New York,” Genscape senior natural gas analyst Rick Margolin said.

On the demand side, power burns retreated from the previous week and were estimated to have averaged 36.8 Bcf/d, but some of that decline was made up for by a 0.3 Bcf/d week/week increase in liquefied natural gas sendout and a 0.2 Bcf/d increase in exports to Mexico, he said.

Genscape’s storage estimates are a composite of its daily S&D model and its storage facility pipe sample model. The storage sample model for this week’s report showed a 48 Bcf injection, while the S&D model was at 50 Bcf.

Broken down by region, the East injected 21 Bcf into gas stocks, the Midwest injected 29 Bcf and the Mountain injected 2 Bcf, according to EIA. The South Central and Pacific regions continued to post withdrawals, pulling 3 Bcf and 1 Bcf, respectively, out of inventories.

As of Aug. 17, stocks sat at 2,435 Bcf, 684 Bcf below year-ago levels and 599 Bcf below the five-year average of 3,034 Bcf, EIA said. The deficit to year-ago storage levels shrank by 3 Bcf, while the deficit to the five-year average grew by 4 Bcf.

Even with the tighter EIA print, Bespoke said it would be “surprised to see $2.98-3.00 broken” on Thursday, with reversal risks on further loosening or cooling degree day losses.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |