Infrastructure | E&P | NGI All News Access | NGI The Weekly Gas Market Report

Differentials Aside, U.S. Onshore Could See 100 More Rigs Rising This Year, Says Raymond James

The U.S. rig count should continue to increase into the second half of this year, with up to 100 oil and gas rigs added, even with potential price differential issues in the No. 1 play, the Permian Basin, Raymond James & Associates Inc. said Monday.

Analysts J. Marshall Adkins and Praveen Narra said they expect a nearly 100-rig count rise through the end of the December with “modest” growth continuing in 2019.

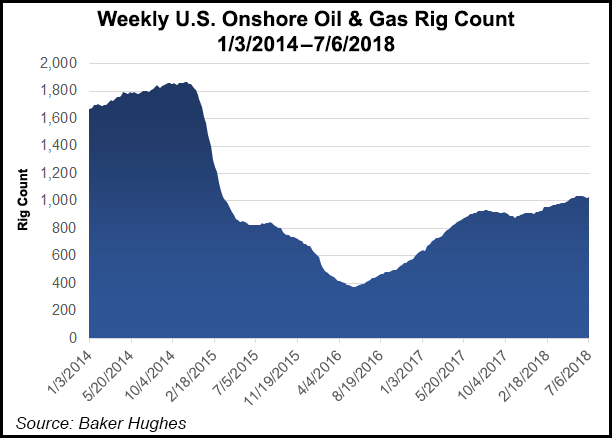

The United States added five oil rigs in the onshore last week from a week before, bringing the domestic count to 1,052 from a year-ago tally of 952, according to Baker Hughes Inc. (BHI). For the oily onshore plays, Energent Group estimated the Permian count rose 0.2% week/week to 475 rigs, while the Eagle Ford Shale saw a 1.3% gain to 81 rigs and the Williston Basin, i.e. Bakken Shale, count climbed 5.6%.

The average U.S. rig count for June 2018 was 1,056 — up 10 from the 1,046 counted in May, and up 125 from the 931 counted in June 2017, BHI said Monday.

“Given the rig count outperformance in the first half of the year and continued growth in 2018, our average rig count comes in up about 22% this year at 1,070,” Adkins and Narra said.

Following a “robust” exit rate in 2018 estimated at 1,160 rigs, the count should continue to rise, albeit more modestly, at around 14% in 2019 on “buffered support” from the Bakken and Eagle Ford shales.

In 2020 and beyond, Raymond James analysts are forecasting “consistent multi-year growth” in the United States because of a tightening global market.

Even with the negative press around widening Permian oil price differentials and lower Permian spot oil prices, he U.S. oilfield market is prime for continued growth in part because U.S. exploration and production (E&P) cash flows should be healthy in 2018, rising by 56% year/year and up again in 2019 by around 18%, which would support more spending, said Adkins and Narra.

“Even if Permian oil price differentials widen to an irrational $25/bbl average over the next 18 months (as we are modeling), realized Permian spot prices would still be in-line with initial 2018 budgeting assumptions (in the low to mid-$50 range).”

With the potential for price reductions in the Permian, the Raymond James team is modeling average U.S. realized prices above $65/bbl over the next 18 months as many domestic producers “should see realized prices closer to Brent levels.”

The incremental rig count growth expected in the Eagle Ford and Bakken “should more than offset a temporarily stagnating Permian rig count.”

In addition, most of the larger E&Ps may be “unwilling to turn off the efficiently running Permian well manufacturing ‘machine’ for a short-term downward blip in oil prices,” said Adkins and Narra.

The U.S. rig count historically lags West Texas Intermediate crude prices by four or five months.

“Since crude prices have moved steadily higher over the past year, we have yet to see the impact of higher oil prices over the past quarter show up in U.S. drilling activity,” said the Raymond James team. “In 2020 and beyond, 5-10% annual growth in oilfield activity still is forecast “as operators struggle to offset the impact of rising U.S. production declines.”

The outlook for a higher rig count precedes second quarter reports, which are scheduled to begin later this month.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |