Markets | NGI All News Access | NGI Data

Weekly Prices Mostly Rise, But Returning Production Sends Rockies Prices Lower

Weekly natural gas prices were on the upswing this week as a heat wave engulfed much of the country at the start of the week, only to give way to milder temperatures and much lower prices by week’s end. The NGI Weekly Spot Gas Average stayed flat on the week at $2.63.

Weather remained front and center for the June 18-22 period. Much of the country returned from the weekend facing well above-average temperatures, making for strong demand in key demand regions like the Northeast. But the intense heat was not to last, as milder weather moved in midweek and sent demand sliding. Most of the United States is expected to see the comfortable conditions last for several more days before intense heat moves in to close out June and bring in July.

In addition to the swing in temperatures during the week, pipeline and storage issues in California combined with ongoing maintenance-related production cuts to send prices in southern California on a rollercoaster ride. Southern California Gas’ (SoCalGas) Line 3000 has been out of service since July 2016, and the Line 235-2 has been out of service since an explosion on Oct. 1, 2017.

“These two events represent a combined operational capacity reduction of over 1 Bcf/d. Additional maintenance events are further reducing the pipe’s import capacity,” Genscape analyst Joe Bernardi said.

Given the volatility that ensued once warmer weather showed up in forecasts and the pipeline restrictions that remain in place on the SoCalGas system, the California Public Utility Commission’s (CPUC) decided to allow SoCalGas to increase the Aliso Canyon storage facilities inventory from 24.6 Bcf to 34 Bcf.

After the Aliso Canyon leak was stopped in early 2016, state law granted the CPUC the authority to set working capacity limits for the facility. Before the leak, the working capacity was 86.2 Bcf; it has been set at 24.6 Bcf since last fall. SoCalGas’ current overall storage inventory is 60.1 Bcf. The three non-Aliso storage facilities have a combined working capacity of 49.1 Bcf, which is estimated to be 72% full at 35.5 Bcf, Genscape said.

SoCal Citygate prices surged as high as $4.10 before ultimately averaging $3.24 for the week, up 17 cents from the previous week.

Elsewhere, Permian Basin prices experienced their own volatility as regional production remains below highs seen in mid-April. Genscape on Thursday said Permian production has averaged ~7.35 Bcf/d for the last week, coming in low Wednesday at around 7.09 bcf/d and bouncing back up to around 7.25 Bcf/d for Thursday. These levels are down from a high of 7.94 Bcf/d in mid-April.

“We are seeing a really choppy pattern of production flows” as El Paso Natural Gas (EPNG) and Transwestern Pipeline have both scheduled multiple maintenance events through May and June, Genscape natural gas analyst Nicole McMurrer told NGI.

“This is typical of the shoulder season before the hot weather ramps up in Texas, however, it is lasting longer and impacting a greater magnitude of production this year,” she said.

EPNG has posted a preliminary maintenance schedule for July that shows much lower levels of impacted production, “although this is certainly subject to change over the next couple of weeks,” McMurrer said.

Meanwhile, on Friday, Genscape reported that a three-day planned maintenance on EPNG was set to kick off Saturday, cutting roughly 150 MMcf/d of flows on the South Mainline. EPNG is performing pipeline remediation work on its Line 1103, which will necessitate an operating capacity of 678 MMcf/d at the “EL PASO” meter. This location, which is just downstream of the Cornudas constraint point exiting the Permian, has flowed an average of 824 MMcf/d in the past month, Gencape’s Bernardi said.

Despite the intraweek volatility, El Paso-Permian weekly prices averaged just 3 cents lower than the previous week at $1.92. Northern Natural Gas 1-7, meanwhile, saw weekly prices tumble 20 cents to an average of $1.92.

Rockies prices posted substantial decreases almost across the board as production returned to nearly normal levels. Total Rockies production was estimated to be close to 10.2 Bcf/d on Friday, about 0.5 Bcf/d above the previous week’s average, according to Genscape. Volumes out of the Echo Springs Plant in southwestern Wyoming dropped off by more than 200 MMcf/d in the previous week, but had rebounded to be almost even with prior averages. This processing plant delivers to Colorado Interstate Gas, Rockies Express Pipeline, Southern Star Central Gas Pipeline and Wyoming Interstate Co.

Genscape confirmed with the operator that the decrease was the result of planned maintenance, and the drop was consistent with an annual pattern of several days of notable declines in receipts during the spring-summer timeframe.

After posting a month-long 337 MMcf/d average and then falling to as low as 105 MMcf/d, receipts had come back up to 318 MMcf/d in the initial cycles for Friday’s gas day, Genscape natural gas analyst Joe Bernardi said.

Opal was down 12 cents as weekly prices averaged $2.25. Cheyenne Hub was down 19 cents to $2.21.

Nymex July Contract Sees Volatile Week

It was a volatile week for Nymex July futures, which saw prices start off the week coming down from a rally that sent prices above $3 before the June 16-17 weekend. Prices fell again on Tuesday as weather outlooks pointed to cooler weather in the short term before hotter weather moved in for the end of June/early July.

But Wednesday brought about a shift in weather models that showed the heat on tap to close out the month intensifying. In fact, each subsequent weather model run from Wednesday morning through late Thursday continued to reflect even hotter trends for that time period.

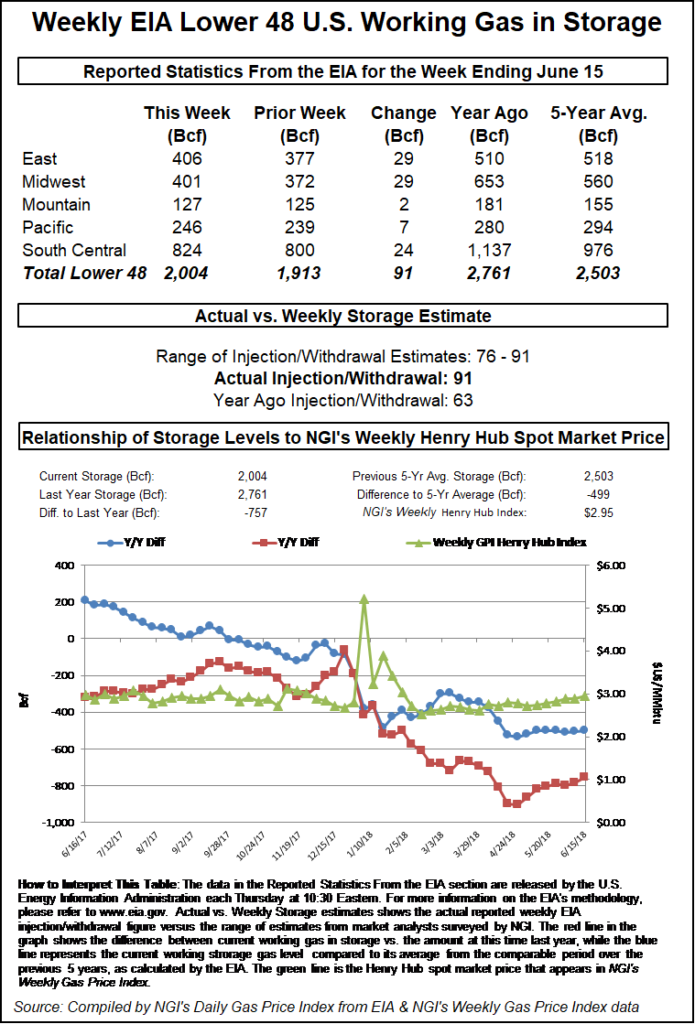

With temperatures too high to ignore, traders couldn’t help but send the prompt month higher on Thursday, even when the Energy Information Administration reported another surprise bearish storage injection. In its weekly storage inventory report, the EIA reported a 91 Bcf build into storage stocks for the week ending June 15, once again well above market consensus of an 85 Bcf build.

Working gas in storage climbed to 2,004 Bcf, which is still 757 Bcf below year-ago levels and 499 Bcf below the five-year average of 2,503 Bcf. The East and Midwest regions each injected 29 Bcf into storage, while the South Central injected 24 Bcf.

“This is the second bearish miss from our expectation in a row, showing the impact of loosening power burns we had observed” through June 15, Bespoke Weather Services said following the report’s 10:30 a.m. ET release. Balances in the natural gas market continue to remain loose, especially as the past gas week included what were significant maintenance-related production declines.

Ahead of the report, market consensus had built around a storage injection in the mid-80s Bcf range. IAF Advisors’ Kyle Cooper projected an implied build of 86 Bcf and a headline build of 82 Bcf, while Bespoke estimated an 84 Bcf build. A Bloomberg survey had a range of 76-91 Bcf, with a median of 86 Bcf. A Reuters poll pointed to an 85 Bcf injection, with estimates ranging from 80-91 Bcf and a median build of 85 Bcf.

For the comparable week a year ago, EIA reported a 63 Bcf; the five-year average build stands at 83 Bcf for the corresponding period.

When news of the storage injection hit the market, Nymex July futures immediately pulled back 2.5 cents. Just before 11 a.m. ET, the prompt month was trading at $2.983, an increase of about 2 cents from Wednesday’s settle. July prices that had climbed as high as $3.012 before the storage report, fell as low as $2.947 after the report and then eventually bounced back to settle 1.1 cents higher on the day at $2.975.

“This continues to be a market where bullish weather is weighed against bearish balances, and it appears the improved daily balance this week allowed the market to shake off what was clearly significant looseness this past week,” Bespoke Weather Services said.

The weather forecaster said that at least short term, the impending heat looks intense enough to overwhelm other factors in the natural gas market and support the front of the strip. But production is likely set to recover from its most recent dip soon, and that seems likely to cap upside moving forward.

“…[W]e would need to see more participation from the winter strip to not think any large move above $3 is a strong short opportunity. So though short term we still see a bit of upside, as soon as forecasts cool at all, prices fall,” Bespoke chief meteorologist Jacob Meisel said.

Indeed, the back-to-back-to-back hotter weather models were bound to flip, NatGasWeather said, and they did just that first on Thursday night and again at midday Friday. The Weather data overnight Thursday turned slightly cooler for the South and Gulf Coast region in the medium term, but still with intense heat overall for the majority of the country.

By midday Friday, weather models flipped again, this time with one of the models being a touch hotter compared to Thursday night, with heat building into the last week of June and through the first week of July, the forecaster said. Still, Nymex July futures ended the day in the red, sliding 3 cents to $2.945. For the July 18-22 period, the prompt-month slipped a mere six-tenths of a cent.

“We see the coming pattern as plenty hot enough to impress and see [Friday’s] decline having more to do with other factors,” such as the last two Energy Information Administration (EIA) storage reports implying a looser supply/demand balance, NatGasWeather said.

While the severity of the coming heat wave remains unclear, Bespoke said it still expected significant heat well into the first week of July and likely into the second week. Beyond July 10, however, “we see increasing cool risks in the pattern that would appear likely to significantly hit a natural gas market that is being propped up on expectations of major sustained cooling demand,” Meisel said.

Meanwhile, Societe Generale (SocGen) is maintaining its bullish view for prices. While the curve has recently crept up to be roughly in line with its $3 view through the end of 2019, “we still see more upside risk than downside” given the current position of storage and the outlook

for supply/demand balances over the next six months. “We reiterate watching for market dips to go long core summer contracts (August/September),” SocGen natural gas analyst Breanne Dougherty said.

Oil Rallies as OPEC Agrees to Increase Output

This week’s focus for oil markets, as has been the case the past few weeks, was Friday’s meeting of the Organization of Petroleum Exporting Countries (OPEC). The meeting was held in part, to discuss the possibility of key producers raising output to compensate for potential supply shortfalls stemming from U.S. sanctions against Iran and the loss of Venezuela output.

Crude oil prices appeared to be treading water throughout much of the week, shifting only 31 cents lower from June 18-21. On Friday, though, crude oil futures jumped more than $3 to $68.58 after news spread that OPEC secured a compromise, albeit modest, agreement that effectively will add about 600,000 b/d to the market, or around 0.5% of global supply.

The Saudi-led cartel of 24 OPEC and non-OPEC members in its 174th meeting in Vienna agreed to adjust the production reductions and raise output by 1 million b/d; global output has been reduced by 1.2 million b/d since the start of 2017.

OPEC and its allies, which include Russia, will share in the planned increase. Because some members for now cannot raise output, the actual amount to be returned to the market is estimated to be closer to 600,000 b/d than 1 million b/d.

Meanwhile, the U.S. rig count fell for the second week in a row after seven units exited the patch, according to data released Friday by Baker Hughes Inc. (BHI).

The United States dropped six gas-directed units and one oil-directed unit to fall to 1,052 active rigs for the week ended Friday, up from 941 a year ago, according to BHI. Five directional units packed up, along with two horizontal units. Three rigs departed on land, along with two in the offshore and two in inland waters. The Gulf of Mexico fell by one rig to 18, down from 21 a year ago.

Spot Gas Falls as Pipe Work No Match for Mild Temps

Spot gas prices moved mostly lower Friday as seasonal weather was on tap across much of the country for the next several days. A weather system was tracking across the northern and east-central United States with showers, thunderstorms and cooling, where temperatures are expected to bring comfortable conditions through the weekend. A majority of the nation’s energy demand the next several days is forecast to come from the hot southern and western United States, where highs are expected to reach the 90s to 100s from California to Florida, NatGasWeather said.

There is still expected to be a weather system cut across the north-central United States early in the coming week for locally comfortable conditions, although with the rest of the country becoming quite hot as high pressure expands. Late into the week and for the first week of July, the ridge becomes focused over the east-central United States, where hotter trends have shown up, the forecaster said.

“We expect the weather data to show the hot upper ridge dominating most of the country going into mid-July, but likely with a minor shift of the heat dome over the west-central United States instead of the east-central United States, which isn’t quite as hot and bullish as the pattern June 30-July 4, but it’s certainly not bearish,” NatGasWeather said.

Some of the steepest declines occurred in the Permian Basin, where EPNG’s three-day maintenance event was set to begin Saturday, cutting roughly 150 MMcf/d of flows on the South Mainline.

Given the restricted flows, El Paso-Permian spot gas plunged 40 cents to $1.71. Waha tumbled 33 cents to $1.78.

On the West Coast, prices were mixed as cooler weather on tap through the end of June combined with planned maintenance scheduled to begin Monday (June 29) in the region. Pacific Gas & Electric (PG&E)-to-Southern California Gas (SoCalGas) deliveries are expected to be cut by 300 MMcf/d for three days as part of a planned line inspection retrofit.

The maintenance event will reduce SoCalGas’ capacity to receive gas from PG&E to 45 MMcf/d lasting through and including Wednesday (June 27). The current 30-day average scheduled capacity is 349 MMcf/d, so the work would cut 304 MMcf/d based on that average, Bernardi said.

SoCalGas will likely need to rely somewhat on increased storage withdrawals in response to the supply limitation, and there is potential for more price increases and volatility in SoCal Citygate basis price, he added.

In Friday trading for gas delivery through Monday, spot gas at SoCal Citygate plummeted 98 cents to $2.53. PG&E Citygate spot gas slipped just 4 cents to $3.06, while Malin fell 36 cents to $1.91.

Prices also moved substantially lower in the Rockies, where Opal tumbled 28 cents to $1.98 and Northwest Wyoming Pool dropped 27 cents to $1.90. In the Midcontinent, it was the same story as NGPL-Midcontinent fell 29 cents to $1.97 and OGT slid 17 cents to $1.80.

The losses in the Rockies and Midcontinent come ahead of maintenance set to begin Tuesday on Trailblazer Pipeline, which will restrict flows to zero through Segment 20 for three days. The segment has averaged just above 800 MMcf/d in the past month, Genscape said.

In the East, smaller losses were seen in the region as some pipeline work was set to begin there as well. Beginning Saturday (June 23), Millennium planned to begin restricting volumes through the Corning-Empire (meter 640167) to about 90 MMcf/d. This event would constrain deliveries onto Empire Pipeline by 55 MMcf/d (deliveries at the meter averaged around 145 MMcf/d during the last seven days), Genscape said.

Millennium posted a critical notice Thursday evening stating the need to restrict flows through Corning-Empire, citing ongoing maintenance at the Corning compressor station, which was a planned event that began June 19, Genscape natural gas analyst Allison Hurley said.

Algonquin Citygate spot gas fell 6 cents to $2.41, while Transco zone 6-NY climbed 8 cents to $2.69. Over in the Appalachia supply region, Columbia Gas slipped 6 cents to $2.79.

Across the border in Canada, Nova/AECO C spot gas tacked on a penny to reach $1.67.

Low storage inventories and a multitude of pipeline maintenance events in and around the region have led to increased volatility at AECO in recent weeks. Through 11 weeks of the injection season, cumulative builds are down 60% compared to a five-year average of 70 Bcf. Inventories are now 38 Bcf below the five-year average (-11%).

“It feels like we’re in injury time, picking the ball up out of our net with large slugs” of TransCanada Corp.’s Nova Gas Transmission Ltd. maintenance throughout injection season causing AECO volatility with the inability to flow interruptible volumes,” Tudor, Pickering, Holt and Co. (TPH) said.

The silver lining, if there is one, is that TPH estimates storage will enter the upcoming winter 20% below the five-year average, “with builds the rest of the way expected to be roughly half normal levels,” analysts said.

The summer strip has firmed up materially (+50% over last month), and TPH said it thinks it’s only a matter of time before the longer-dated contracts begin catching the same tailwind. “This week’s inventory report showed a 4 Bcf build, slightly higher than our forecast, but below seasonal norms of 6 Bcf. Next week, we’re looking for a 2 Bcf build.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |