Markets | NGI All News Access | NGI Data

Season’s First EIA Injection a Bearish Surprise; Natural Gas Futures Slide

The Energy Information Administration (EIA) ushered in the start of injection season Thursday with a reported natural gas storage build that was larger than expected, sending futures lower.

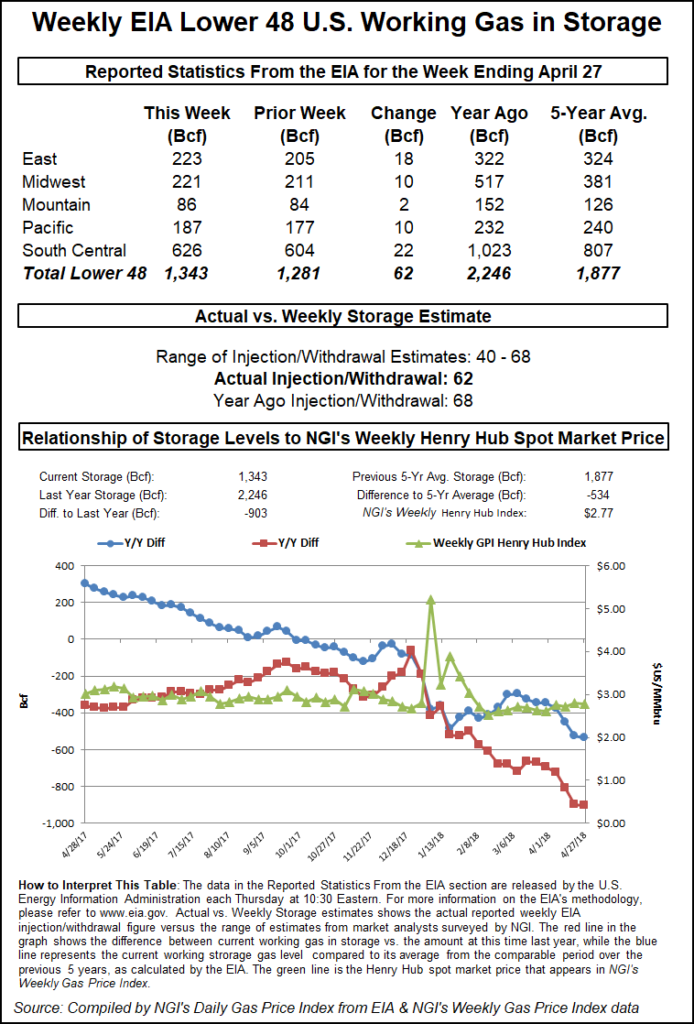

EIA reported a 62 Bcf injection into Lower 48 gas stocks for the week ending April 27, about 10 Bcf looser versus surveys that had anticipated a build of around 51-52 Bcf. Last year, EIA recorded a 68 Bcf build for the period, and the five-year average is an injection of 69 Bcf.

Shortly after the 10:30 a.m. ET release of the number, the June contract — already down after selling earlier in the morning — dropped about 2 cents to around $2.700-2.710. By 11 a.m. ET, June was trading around $2.705, down about a nickel from Wednesday’s settle.

Prior to the release of the final number, a Reuters survey of traders and analysts on average had called for EIA to report a 52 Bcf injection, with responses ranging from 40 Bcf to 68 Bcf. A Bloomberg survey had produced a median build of 51 Bcf, with a range of 40 Bcf to 62 Bcf.

IAF Advisors analyst Kyle Cooper had predicted a 53 Bcf injection, while Genscape Inc. had called for a 55 Bcf injection. Intercontinental Exchange EIA storage futures settled Wednesday at an injection of 55 Bcf for the upcoming report.

The larger-than-expected injection Thursday came after a string of consecutive bullish misses — withdrawals driven by colder-than-normal April weather.

“The print the previous week missed our estimate by minus 11 Bcf, and this week missed by plus 10 Bcf, an indication of the week-to-week noise we can often see in shoulder season EIA data,” Bespoke Weather Services said following the release of the number. “We see this print as slightly bearish; EIA data the last couple of weeks ran decently tight to expectations, while this more bearish print confirms that was overdone.

“We now set up to see a trio of very large storage injections, with multiple triple-digit injections expected into the final third of May,” Bespoke said. “This could put $2.65 in play with tightness concerns waning, though late May heat will add support.”

Total working gas in underground storage stood at 1,343 Bcf as of April 27, versus 2,246 Bcf last year and a five-year average inventory of 1,877 Bcf. The year-on-year deficit increased slightly week/week from 897 Bcf to 903 Bcf, while the year-on-five-year deficit widened from 527 Bcf to 534 Bcf, EIA data show.

By region, the largest build came in the South Central at 22 Bcf, with EIA reporting 8 Bcf injected into salt and 15 Bcf injected into nonsalt. The East region saw a build of 18 Bcf for the week, while 10 Bcf was injected in both the Midwest and Pacific regions. The Mountain region saw a 2 Bcf build for the week, according to EIA.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |