Natural Gas Futures in Holding Pattern as Weather Disappoints; SoCal Continues Run Higher

Natural gas futures traded near even Wednesday, with the market seemingly ready to usher in the shoulder season as the February heating demand outlook continued to disappoint.

Soft near-term demand weakened spot prices across most regions, though some colder-than-normal temperatures helped drive up prices at SoCal Citygate; the NGI National Spot Gas Average gave up a dime to $2.40.

Futures had a quiet day. The March contract settled at $2.587, down 0.7 cents, while April settled 0.7 cents higher at $2.630.

In the long-range outlook, the major weather models “have been really stubborn” in breaking down a southeastern ridge preventing cold air from pushing into the eastern part of the Lower 48, Commodity Weather Group Senior Forecaster Brian Bardone told NGI.

The European model on Tuesday hinted at a pattern developing that would allow more cold air to push eastward starting around early March, then backed off overnight, then brought the cold trends back in an afternoon run Wednesday, Bardone said.

But forecast confidence remains low, and “even with the cooler shift, day 15 of the outlook is still looking normal to slightly above normal” in the East, he said.

Bespoke Weather Services said following Wednesday’s close that it saw “a number of peculiarities along the strip that lead us to see the market still trying to bottom at these price levels, with weather increasingly looking like it should help.

“…We see the market shifting focus to the spring and summer injection season as it tries to determine the best price to fill storage levels ahead of next winter,” the firm said, adding that “any incremental heating demand additions should simply help bid up the March contract.”

An increase in projected heating demand was looking more likely Wednesday with the Global Ensemble Forecast System joining the European in showing signs of more cold air pushing eastward late in the 11-15 day period, Bespoke said.

“This still does not look like a pattern that will feature significant heating demand, at least not yet, but this blocking should at least pull heating demand back closer to average,” the firm said. “We still think that this is all that is necessary to pull the March contract back into the $2.70-2.75 range, especially given what should be a tight Energy Information Administration (EIA) print Thursday and recent strip support.”

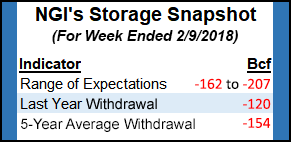

Estimates for Thursday’s EIA storage report point to a triple-digit withdrawal that would be bullish versus recent norms.

A Reuters survey of traders and analysts on average estimated a 183 Bcf withdrawal from U.S. gas stocks for the week ending Feb. 9, versus a year-ago withdrawal of 120 Bcf and a five-year average pull of 154 Bcf. Responses ranged from -162 Bcf to -207 Bcf.

Stephen Smith Energy Associates revised its estimate higher Tuesday to a withdrawal of 183 Bcf. That’s versus a seasonally normal withdrawal of 147 Bcf based on 2006-2010 norms, according to the firm.

PointLogic Energy called for a withdrawal of 179 Bcf, citing “significantly colder weather in the East and Midwest regions.” Kyle Cooper of ION Energy estimated a withdrawal of 182 Bcf.

Intercontinental Exchange futures for this week’s EIA report settled at -184 Bcf Tuesday.

Wednesday’s spot market saw broad-based declines across most regions. Henry Hub gave up 6 cents to average $2.51, coming in a few cents shy of the March contract.

PointLogic Energy analyst Alan Lammey said the firm’s forecast for the one- to five-day period Wednesday showed U.S. population-weighted low temperatures averaging 40.8 degrees, about 6.8 degrees above normal, with high temperatures averaging 60.3 degrees, 8.3 degrees above normal.

“A majority of the South is dealing with the impact of a strengthening upper level high pressure system in the Gulf of Mexico this week, which is poised to warm temperatures notably across Texas and the Gulf Coast states as well as through the Southeast” over the next couple days, Lammey said.

“…Meanwhile, a large percentage of the eastern U.S. states are now in the midst of a warm-up that will last through Thursday, where temperatures could run as much as 20 degrees above average across the Mid-Atlantic region,” Lammey said. “…Out West, a pattern of wet and cool conditions will remain predominant throughout the region, and in fact snow appears likely for the western Rocky Mountains” including Colorado and Utah.

A notable exception amid the cash weakness Wednesday was SoCal Citygate, which continued its recent run higher, adding 19 cents to $4.43.

Genscape Inc. has attributed this week’s gains at SoCal Citygate to colder-than-normal temperatures in the region, with upstream maintenance on El Paso Natural Gas also potentially playing a role.

AccuWeather on Wednesday was forecasting lows in Los Angeles to hover around the high 40s over the next several days, and utility Southern California Gas (SoCal) was forecasting system demand totaling around 3,100,000 Dth/d through the end of the work week, exceeding forecasted daily receipts of just under 2,800,000 Dth/d.

“SoCal’s receipts from points comprising the SoCal Border price point have reached a winter-to-date high at 1,859 MMcf/d,” Genscape said. “With little additional capacity for further incremental flows on these points, additional upward price movement is unlikely to correspond with commensurate flow increases. This expectation matches with the more moderate gains seen in SoCal Border basis compared to Citygate.

“Further increases in demand are likely to be met via a combination of increased volumes from other receipt points and increases in net storage withdrawals,” the firm added. “Genscape meteorologists are currently forecasting a gradual return to more seasonally normal temperatures by the weekend, before another wave of cold weather moves in beginning Sunday and early next week.”

SoCal Border Average fell 13 cents to $2.36, while El Paso S. Mainline/N. Baja tumbled 22 cents to $2.36.

In South Texas, Tetco S. TX dropped 7 cents to $2.48, and Tennessee Zone 0 South fell 5 cents to $2.44.

South Texas exports to Mexico could drop by around 0.8 Bcf/d Friday due to planned maintenance on the Los Ramones I (LR1) pipeline in northeastern Mexico, according to Genscape.

“On Friday the operational capacity on LR1 will be reduced to 1.2 Bcf/d, a reduction of about 0.9 Bcf/d from normal levels, due to the planned maintenance vent on the Frontera Compressor Station located in Camargo, Tamaulipas,” Genscape said in a note to clients Wednesday. “Friday’s event is expected to last 12 hours, beginning 9 a.m. CST and ending at 9 p.m. CST. LR1 receives gas from the NET Mexico pipeline” north of the border.

“Genscape monitored flows from NET Mexico to LR1 during the past 14 days have averaged 2.045 Bcf/d, suggesting roughly 800 MMcf/d of exports may be curtailed,” the firm said. “We do not anticipate U.S. gas will get re-routed into Mexico via other systems. During five distinct flow reduction events in 2017 (determined by NET flows dropping below 1.5 Bcf/d, including 10 days of flows below 1 Bcf/d) we did not observe an increase on other South Texas export lines to any meaningful degree.”

Northeast prices fell Wednesday on a weak demand outlook. Algonquin Citygate dropped 26 cents to set a new three-month low at $2.42.

AccuWeather was calling for highs in the mid-50s in Boston Thursday and Friday, while Genscape estimated that New England regional demand would drop from 3.26 Bcf/d Wednesday to 2.47 Bcf/d Thursday and 2.93 Bcf/d Friday.

Appalachian prices dropped across the board as well. Dominion South tumbled 13 cents to $1.98, and Columbia Gas gave up 10 cents to $2.28.

The Rockies Express Pipeline (REX) issued an update Wednesday on the ongoing force majeure for its Seneca Lateral in Ohio following a reported explosion on the line late last month. In a notice to shippers, REX said it “does not have a completion date for a repair at this time” and that scheduled volumes through its Segment 400 will remain at zero “until further notice.”

In conference call this week, management for REX parent Tallgrass Energy Partners LP said the Seneca Lateral incident has not had a material impact on the pipeline’s Zone 3 east-to-west flows.

Meanwhile, the Rover Pipeline, another east-to-west Appalachian takeaway pipe, is ready to start up its Burgettstown Lateral, the operator told FERC this week. The lateral would connect supplies from southwestern Pennsylvania to Rover’s mainline, which flows east-to-west across Ohio.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |