Longs Getting Out? January NatGas Drops as Supportive Storage Withdrawal, Weather Expected

Natural gas futures fell Wednesday as if to offer a rebuttal to seemingly supportive storage and weather predictions. A short-covering rally ahead of next week’s expiration could be in the cards, according to analysts. The spot market weakened for the post, with notable exceptions in the Northeast and Rockies, and the NGI National Spot Gas Average fell 2 cents to $2.99/MMBtu.

The January contract traded higher overnight before taking a nosedive after the open, and the prompt-month — set to expire next week — settled 5.5 cents lower Wednesday at $2.637. February settled 6.1 cents lower at $2.636.

“It was evident almost instantly that none of the selling was weather-driven,” Bespoke Weather Services said of Wednesday’s declines. “Though we did lose a few short-term gas-weighted degree days through the day…we saw the January contract remain comparatively stable relative to the other winter contracts, and we saw later natural gas contracts sell off in a similar magnitude to the front.

“The back of the strip initially led the front lower, indicating that the market still does not feel it has found balance and priced in both current production levels and expectations of production increases through the next few months,” Bespoke said. Low cash prices “have generally suffocated any recovery in prices over the last few weeks, partly because any forecast cold has generally underwhelmed.

“We are a bit worried about this still initially being the case” for cold weather expected to move in over the holiday weekend, though the forecasts “remain quite bullish,” and a large storage withdrawal could also provide support, according to the firm.

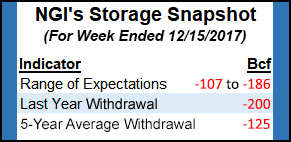

Predictions for Thursday’s Energy Information Administration (EIA) storage inventory report show the market expecting a withdrawal much larger than last week and higher than the five-year average.

A Reuters survey of traders and analysts on average predicted a 170 Bcf draw for the week ended Dec. 15. That’s versus a 200 Bcf draw in the year-ago period and a five-year average pull of 125 Bcf. Responses ranged from -107 Bcf to -186 Bcf.

A -170 Bcf net change to U.S. gas stocks would rank as the sixth largest weekly withdrawal for the month of December since 2010, with the largest being -285 Bcf reported for the week ended Dec. 13, 2013, an NGI analysis of EIA historical data shows.

Stephen Smith Energy Associates is calling for a 175 Bcf draw from U.S. gas stocks for the week ended Dec. 15, based on 16 total degree days more than normal for the period. That’s versus a seasonally normal draw of 145 Bcf (based on 2006-2010 norms), the firm said.

PointLogic Energy estimated that EIA would report a 172 Bcf draw for the period. “The significant increase in week-on-week withdrawals comes amid demand gaining nearly 18.5 Bcf/d week-on-week,” analysts said in a note to clients earlier in the week.

Kyle Cooper of IAF Advisors was looking for a withdrawal of 176 Bcf, while Price Futures Group was calling for a pull of 155 Bcf.

Next week’s expiration for the prompt-month contract may have also played a factor in Wednesday’s price action, INTL FCStone Financial Inc.’s Tom Saal, senior vice president, told NGI.

“When the market’s going down, the pressure’s not on you if you’re short. The pressure’s on you if you’re long,” Saal said. “The expiration is creating a little bit of a drag on the market…I would characterize it as long liquidation ahead of expiration.”

He noted that January “didn’t make a new low today. It doesn’t look like new short positions. If we had seen new short positions, the market would have continued to go lower.”

With the longs getting out, Saal said the market could be setting up for a short-covering rally prior to expiration.

Price Futures Group’s Daniel Flynn, trader and analyst, said given the potential for a bullish storage number from EIA, combined “with the long weekend, I do expect a short-covering rally. I don’t think anyone’s going to want to be heavily short going into the long weekend.”

In the spot market Wednesday, prices fell in most regions, though some points in the Rockies and California posted strong gains, as did a few points in the Northeast.

NatGasWeather.com said, “Mild conditions will dominate much of the country through Thursday with above-normal temperatures and light demand. The exceptions will be a weather system with rain and snow arriving into the Northwest, along with a dry cool front into the Northeast. Most important, frigid air will pour across the western and central U.S. late Thursday and Friday, with lows of 15F to 20F.

“Cold air will push deep into Texas and the South this weekend with lows of teens to 30s. Cold air will advance across the East Coast Christmas Day.”

Prices in the Northeast were mixed, with Algonquin Citygate continuing to show indications of capacity constraints, climbing $1.13 to $10.87. Tennessee Zone 6 200L similarly jumped 92 cents to $10.03. Iroquois Waddington was flat at $3.20, while Transco Zone 6 NY added 30 cents to $3.44.

In Appalachia, Tetco M3 Delivery jumped 14 cents to $2.78 as other regional points declined. Dominion South dropped a dime to $2.26, while Columbia Gas fell 9 cents to $2.54.

MDA Weather Services was expecting temperatures to flip to below-normal in Denver Thursday and Friday before falling to much below-normal levels over the weekend.

Most Rockies points gained Wednesday, including Cheyenne Hub (up 7 cents to $2.57) and Kern River (up 5 cents to $2.65). Prices in Arizona/Nevada surged, with El Paso S. Mainline/N. Baja jumping 81 cents to $4, while Kern Delivery climbed 58 cents to $3.65.

Genscape Inc. said Wednesday its meteorologists were “forecasting a prolonged period of significantly colder-than-normal weather for Southern California over the next week and a half. The coldest temperatures are currently expected to hit on Friday at 18.5 heating degree days.”

This could put some pressure on the import-constrained Southern California Gas (SoCalGas) system, the firm said.

“Based on winter-to-date demand per degree behavior, that would translate to a system-wide demand number of 3,750 MMcf/d, which would be over 0.5 Bcf/d higher than the current season-to-date maximum,” Genscape said. Since Oct. 1, the maximum for receipts on SoCalGas’s system was 2,839 MMcf/d. “Even assuming that maximum receipt level, SoCalGas would still need to withdraw over 900 MMcf/d from storage in order to meet that demand number.”

Speaking of storage, Genscape said there was a short-term leak reported at the Aliso Canyon facility late Monday, “which was caused by equipment malfunction and stopped within an hour.”

Meanwhile, SoCalGas issued an update Tuesday on its Line 4000 maintenance, expected to restore capacity at the Needles receipt point later this month. SoCalGas said it expects to have a combined import capacity of 870 MMcf/d through its Needles and Kramer Junction receipt points once Needles is back in service, up from 700 MMcf/d during the Line 4000 outage.

While still trading at a premium, prices at SoCal Citygate declined Wednesday, giving up 19 cents to average $4.97. SoCal Border Average, meanwhile, climbed 43 cents to $3.50. Malin added 6 cents to $2.66, while PG&E Citygate dropped 5 cents to $2.89.

Elsewhere, prices fell. Henry Hub dropped 4 cents to $2.70. Chicago Citygate fell 7 cents to $2.64. Northern Natural Demarcation declined 6 cents to $2.62.

In Texas, Katy fell 12 cents to $2.59, while Waha dropped 8 cents to $2.42. Agua Dulce ended at $2.72, down 3 cents.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |