Shale Daily | E&P | NGI All News Access | NGI The Weekly Gas Market Report

Led by Texas, U.S. Land Permitting at Multi-Year High, Says Evercore

U.S. land permitting is off to a hot start in November, standing at 2,106 as of last Friday (Nov. 10), but a seasonal slowdown may temper year-end results, Evercore ISI said Tuesday.

The four-week rolling average for land permits in the United States as of last Friday was 1,003, a multi-year high, said Evercore analyst James West.

Evercore’s monthly U.S. drilling permit report found a 28% increase in Texas permitting week/week as of last Friday drove the improvement, while the 1,050-plus permit/week run rate “implies a November total of over 4,200, which would be the third 4,000-plus month this year,” West said.

The influx of smaller private/independent exploration and production (E&P) companies may drive permitting activity to year’s end, as West Texas Intermediate crude oil moves above $55/bbl.

“This ”handoff’ between the more prominent E&Ps that are wrapping up their drilling cycle and budgeting for 2018 and the small independents has resulted in some rig count choppiness, but will ultimately result in another leg-up for the rig count in 1Q2018 if the strong macro continues,” West said.

The seasonal disruption brought by the holidays may impact permitting heading into year’s end, “but U.S. land clearly has its ”finger-on-the-trigger’ with the four-week permitting average comfortably at a multi-year high.”

The backlog is growing for drilled but uncompleted (DUC) wells, which in turn could impact 2018 capital expenditure (capex) plans.

“Aside from the seasonal weakness typically exhibited toward the end of the year as state oil and gas offices run under-staffed, the growing number of DUC wells could impact the drilling budget cycle (and therefore, permitting) heading into 2018,” West said.

The DUC build has been “circularly positive” for the broader oilfield services (OFS) sector as the dearth of completion crews causes challenges to growing production.

Besides a more favorable pricing regime for the OFS sector, E&Ps are exhibiting more capital discipline, serving as a tailwind to commodity prices and equities.

“We have postulated for several months now that continued robustness in permitting would force the rig count steadily higher, and instead we’ve witnessed more ”stabilization’ than growth,” West said.

The stabilization is twofold. The industry has gotten “somewhat ahead of itself” in terms of drilling wells versus completions. Days to drill a well to total depth continue to decline, and multi-well pads have boosted the number of spuds per rig, but completion intensity still is consuming larger amounts of high horsepower for longer periods of time, West said.

What that means for the softer rig count “may be symptomatic of larger E&Ps out-drilling their completion programs.” The decline in October permitting may reflect the “slack” in activity, he said.

More important to Evercore’s thesis of the rig count continuing to rise is the number of smaller privates/independents operating rigs, which has increased in recent weeks.

“This has been the offsetting (upward) force against the pressure associated with larger E&Ps releasing rigs, and is focal to the continued strength in permitting,” as the four-week average still is at a multi-year high.

While higher permit volumes may indicate stepped up drilling in the next one to six months, the current “handoff” in rig utilization could turn into a race for top-of-the-line super-spec rigs early next year 1Q2018 when the public E&Ps finalize their drilling plans.

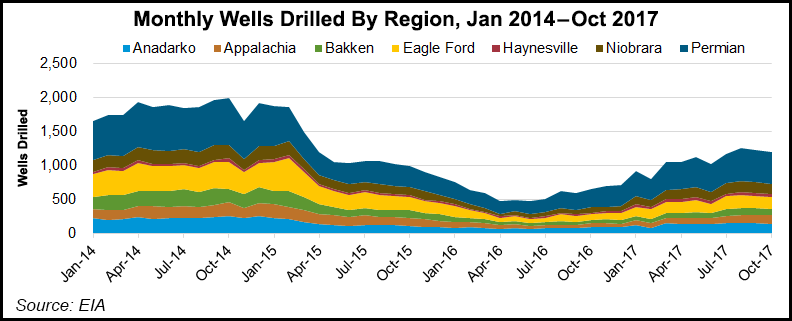

During October, U.S. land permits fell month/month by 17% to 3,908, but the count still was 56% higher year/year. Year-to-date, 2017 has surpassed fiscal year 2016 permit levels by 61%, according to Evercore.

As it has for months, Texas continues to be the leader, with permitting up 56%, while Oklahoma permitting is up 52%; North Dakota is up 39% and Louisiana is up 17%.

During 2016, permitting was down 38% from 2015 and off 46% from 2009, when drilling activity was considered to be in a trough from the 2008 peak.

Weakening permit numbers month/month during October in California (down 52%), Colorado (down 24%), and Louisiana (down 18%) drove the sequential U.S. land decline, partially offset by gains in New Mexico (up 5%) and Wyoming (up 9%).

“Texas permitting exhibited a 13% sequential decrease on the back of a 9% increase the month before,” said West. “With over half of the working U.S. oil rigs, Texas continues to be the single-most important state in terms of evaluating the magnitude and direction of U.S. permitting trends.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |