Markets | NGI All News Access | NGI Data

Physical NatGas Falls 2 Cents; Futures Inch Higher as Traders Eye Hurricane Harvey

Physical natural gas for next-day delivery declined slightly Thursday, even as Hurricane Harvey continued to bear down on the Texas Gulf Coast. Hefty losses in the Northeast and lesser setbacks in Appalachia were nearly matched by flat trading in Texas and gains in the Midcontinent, Midwest, and Louisiana. The NGI National Spot Gas Average fell 2 cents to $2.69.

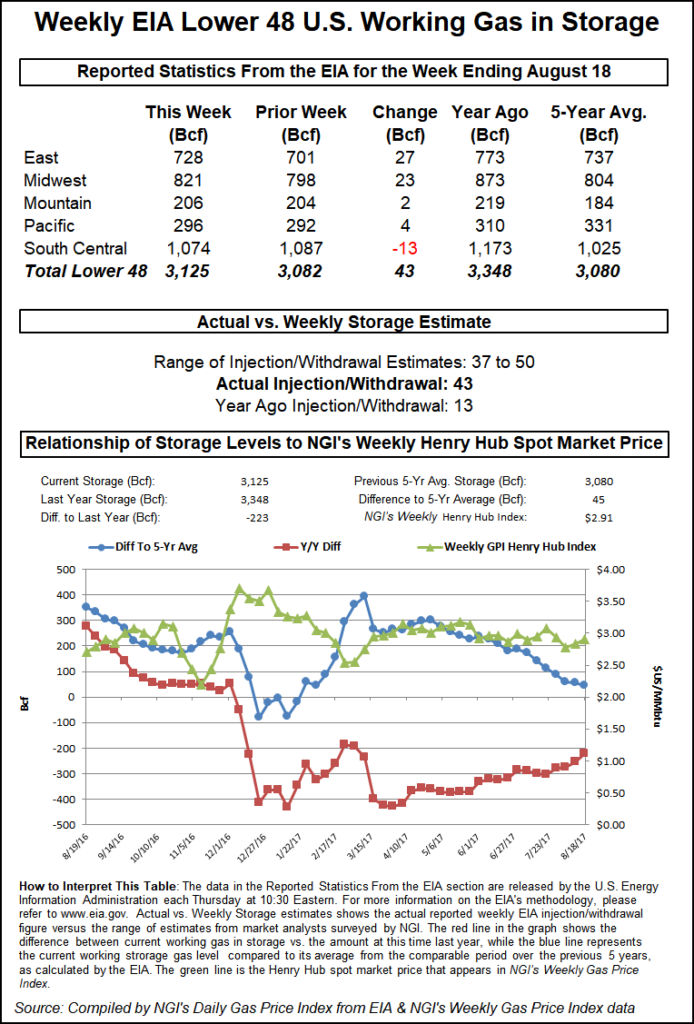

The Energy Information Administration (EIA) reported a storage increase of 43 Bcf for the week ended August 18, right in line with trader expectations, and at the close September natural gas futures had added 2.1 cents to $2.949 and October was up 2.2 cents to $2.982. October crude oil tumbled 98 cents to $47.43/bbl.

The storage report took a backseat on Thursday as all eyes were fixed on Hurricane Harvey and the potential damage the storm could bring to Gulf of Mexico (GOM) energy infrastructure, as well as to the state of Texas, which hasn’t seen a hurricane landfall since Ike in 2008.

The September Henry Hub contract had already climbed nearly 4 cents day/day to $2.974 by the time the inventory report was released at 10:30 a.m. EDT. As forecasts showed Harvey bearing down on the Texas coast, threatening heavy rainfall and flooding, the potential supply disruption seemed to have grabbed traders’ attention more so than EIA’s on-target storage stats.

Workers were evacuated from one rig and 39 production platforms in the GOM, and a total of 167,231 b/d of oil was shut in, the Bureau of Safety and Environmental Enforcement (BSEE) said Thursday afternoon. The shut-in oil was equivalent to 9.56% of GOM production, BSEE said. In addition, 1,135 MMcf/d (0.04%) of natural gas was shut in. No rigs had been moved off location out of the storm’s path, BSEE said.

Traders are having a hard time discerning any major market impact. “We do not see Harvey as presenting any specific trade-able possibilities within the natural gas market yet,” said Harrison NY-based Bespoke Weather Services. “In the oil market, we are expecting severe damage to refineries in the path of the storm, and we will see production shut-ins across the Gulf of Mexico. For now, supply shut-ins for natural gas still appear canceled out by expected demand loss, which may explain the low volatility in the natural gas market. Cash prices could dip at Henry Hub if the storm takes a path to knock out power across much of eastern Texas without supply impacts.”

Others see strictly a demand loss. “It’s all about demand destruction,” said Tom Saal, vice president at FCStone Latin America LLC in Miami. “There have been some Gulf shut-ins, but it’s definitely not going to have an impact on supply; it will be an impact on demand because of the weather in Texas.”

Genscape Inc. said in a note to clients Thursday that both TGP and NGPL have declared force majeure events in South Texas due to Harvey, primarily impacting flows to Mexico. The analytics firm said up to 900 MMcf/d of exports to Mexico could be impacted based on recent 14-day averages.

The force majeures are likely to extend through Sunday, according to Genscape.

The potential supply disruption from Harvey approaching the Texas Gulf Coast Thursday appeared to overshadow the market’s response to a 10:30 a.m. EDT natural gas storage report from the EIA that was in line with estimates.

The EIA reported a build of 43 Bcf for the week ended Aug. 18, slightly below the 45 Bcf build called for by a Reuters poll of analysts. The figure compares to 53 Bcf injected in the prior week and 12 Bcf injected a year ago. Total working gas now stands at 3,125 Bcf, slightly above the five-year average inventory of 3,080 Bcf but below year-ago stocks of 3,348 Bcf. The year-over-five-year surplus shrank by 10 Bcf during the report week, according to NGI calculations.

Citi Futures’ Tim Evans called the weekly EIA inventory figure “a constructive outcome. The data suggests a minor tightening of the background supply/demand balance that may carry over into the weeks to follow.”

David Thompson, vice president of Powerhouse, said the 3-4 cent gain Thursday morning was a fair reflection of the potential production impact from Harvey and a slightly leaner-than-expected storage build.

But given that the market has been range-bound for a while now, “the bigger question is does anything on the bullish side get you above $3.10 on the prompt month, and for the winter, above $3.40? Until that happens, it’s just back and forth and choppiness, which is a function of a market where supply is in balance with demand,” Thompson said.

For now, the market appears to be waiting for “a definitive new breakout, either bullish or bearish,” he said.

By region, the South Central saw a withdrawal of 13 Bcf, including 9 Bcf withdrawn from salt storage and 4 Bcf withdrawn from nonsalt. The East saw an injection of 27 Bcf for the week, while the Midwest region injected 23 Bcf week/week.

Next-day prices at eastern points fell into the loss column as the near-term temperature outlook had maximum readings well below normal. Wunderground.com forecast that New York City’s Thursday high of 79 degrees would slip to 77 Friday and 76 by Saturday, 6 degrees below its seasonal average. Chicago’s high Thursday of a comfortable 70 was expected to rise to 74 Friday and 78 Saturday, still 3 degrees below normal.

Gas priced at the Algonquin Citygate fell 16 cents to $2.10 and gas on Tetco M-3 Delivery shed 10 cents to $1.71. Deliveries on Dominion South shed 6 cents to $1.68 and gas bound for New York City on Transco Zone 6 skidded 42 cents to $2.11.

The National Weather Service (NWS) in New York City reported that Canadian high pressure will build through Saturday, and dominate into Monday and perhaps Monday night. “Offshore low pressure to the south may impact the area Tuesday into Wednesday, especially along the coast, while the high remains to the north and west. A weak cold front will approach on Thursday,” NWS said.

Further west prices firmed. Gas at the Chicago Citygate rose 3 cents to $2.87, and parcels at the Henry Hub rose 4 cents to $2.96. Gas on Transco Zone 4 added 4 cents as well to $2.94, and deliveries to Panhandle Eastern gained 2 cents to $2.58.

NWS in Chicago noted that “high pressure will spread south across the region through the period, with generally dry/quiet conditions expected and with another cool night of below normal temps likely.”

Deliveries to the Cheyenne Hub rose 3 cents to $2.65 and gas at Opal rose 4 cents to $2.72. Parcels at PG&E Citygate gained 6 cents to $3.37, and gas priced at the SoCal Border Average was quoted 4 cents lower at $2.83.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |