Markets | NGI All News Access | NGI Data

NatGas Cash Weakens, But Futures Hold On Following Hefty Storage Stats

Next-day gas tumbled Thursday as traders scurried to get deals done before the Energy Information Administration (EIA) weekly storage report.

Near term weather is expected to be benign, although next week is forecast to bring near-record warmth to major energy markets. The NGI National Spot Gas Average fell 8 cents to $2.65, and only a handful of points made it to positive territory.

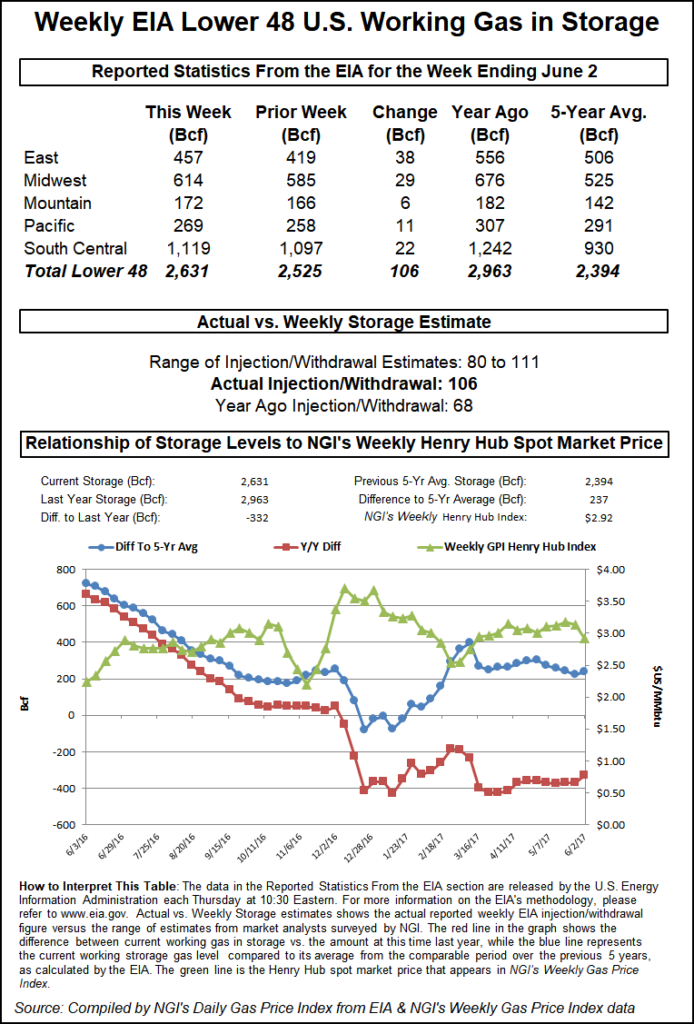

EIA reported a storage build of 106 Bcf for the week ending June 2, well above expectations, and at first prices plunged. Bulls sensed an opportunity and turned the tide. At the close, July had added eight-tenths of a cent to $3.028 and August had increased eight-tenths as well to $3.062. July crude oil eased 8 cents to $45.64/bbl.

The reported 106 Bcf injection put inventories at 2,631 Bcf, and July futures fell to a low of $2.978, but by 10:45 a.m. EDT July was trading at $3.05, up 3.0 cents from Wednesday’s settlement.

Prior to the release of the data, analysts’ estimates were in the high-90 Bcf withdrawal area. Ritterbusch and Associates was looking for a build of 90 Bcf, and a Reuters poll of 25 traders and analysts showed a range from +80 Bcf to +111 Bcf, with an average of 98 Bcf.

“We were expecting a build of 96 Bcf to 98 Bcf, and when the number came out it made a new low, but the subsequent bounce over $3 tells me that there are a lot of buyers out there looking to get long under $3,” a New York floor trader told NGI.

“The 106 Bcf net injection into U.S. natural gas storage for last week was at the top end of the range of expectations and more than the 94 Bcf average, a bearish surprise,” said Tim Evans of Citi Futures Perspective. “The build also suggests some weakening of the underlying supply/demand balance, although we note the reporting period did span the Memorial Day holiday, which may have had a one-time effect in suppressing commercial and industrial demand.”

The Denver-based analytical team at Wells Fargo said, “The reported figure was 7 Bcf above consensus, 41 Bcf above last year and 13 Bcf above the five-year average of 93 Bcf. This marks the fourth straight week that the storage injection has been higher than forecasted, exceeding the median estimate by 6 Bcf on average each week. Based on current weather forecasts, our model indicates a 135 Bcf cumulative injection over the next two weeks, which would bring the storage surplus (versus the five-year average) down to just 211 Bcf.

“The East region accounted for the majority of the surplus versus the five-year average as mild temperatures caused a 38 Bcf injection versus the historical average of 27 Bcf,” Wells Fargo said.

Inventories now stand at 2,631 Bcf and are 332 Bcf less than last year and 237 Bcf more than the five-year average.

In the East Region 38 Bcf was injected, and the Midwest Region saw inventories grow by 29 Bcf. Stocks in the Mountain Region increased by 6 Bcf and the Pacific region was up 11 Bcf. The South Central Region added 22 Bcf.

Tempered moves in the futures markets may be a thing of the past next week as brutal heat is forecast to rake major population centers. “A drastic change in the weather pattern brings near record high cooling demand to the Midwest and Northeast this weekend and through much of next week,” said MDA Weather Services in a report. “Readings in the low to mid 90s F begin this weekend in the Midwest, including Chicago where the MDA Weather forecast has 90 F or better each day from Saturday through Tuesday.

“The East, likewise, sees a prolonged period of heat next week, with the current forecasted EIA week ending June 15 featuring the highest national Population Weighted Cooling Degree Day (PWCDD) total for the period on record. This EIA forecast includes peaks early next week in the mid- and upper-90s F in Philadelphia, Washington, DC, and Richmond. Temperatures in the 90s F are forecast from Sunday through Thursday in Philadelphia and Sunday through Saturday in Washington D.C. next week.

“A strengthened Bermuda High will be the catalyst for the upcoming heat wave,” says Bradley Harvey, an MDA meteorologist. “PWCDD totals are forecast to rank near period records in the EIA week from June 9 to 15 not only nationally but also regionally in MISO, NEISO, NYISO and PJM.

“The current national PWCDD total for the period of June 9-15, 2017 is 70.42, the highest for the period since “

Not surprisingly analysts are expecting above-average power burns. Industry consultant Genscape has “Lower 48 power burn rising to an average 31.2 Bcf/d, peaking Tuesday at what is expected to be a summer and year-to-date high of 32.1 Bcf/d. (Coincidentally, that matches the June 2016 daily average).

“The main thrust of increased gas burns will be a product of heat hitting major population markets in Midwest, Northeast, New England and SEMA [Southeast Mid-Atlantic]. Elsewhere, Texas will be mostly around normal. West burns will remain suppressed, with significantly cooler-than-normal temps, continued strong renewables output, and the return-to-service of the 1175 MW Columbia Nuke station in Washington.”

In the physical market, prices across the board fell as power prices offered little encouragement to make incremental purchases. Intercontinental Exchange reported that on-peak Friday power at ISO New England’s Massachusetts Hub fell $1.86 to $21.17/MWh and on-peak power at the PJM West terminal rose $2.71 to $27.46/MWh.

[Subscriber Notice Regarding NGI’s Market-Leading Natural Gas Price Indexes]

Gas at the Algonquin Citygate fell 10 cents to $2.14 and parcels on Dominion South shed 8 cents to $1.92. Deliveries to the Chicago Citygates were quoted 4 cents lower at $2.82, and gas at the Henry Hub dropped a nickel to $2.94.

Gas on El Paso Permian changed hands 7 cents lower at $2.63, and parcels on Northern Natural Demarcation were seen at $2.73, down 5 cents. Gas at Opal dropped 11 cents to $2.63, and gas priced at the PG&E Citygate fell 4 cents to $3.13.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |