U.S. NatGas, Oil CFOs Optimistic on Prices, More M&A

The U.S. energy industry may finally be in recovery mode, with optimism for higher natural gas and oil prices rising, according to a survey of 100 financial chiefs by BDO USA LLP.

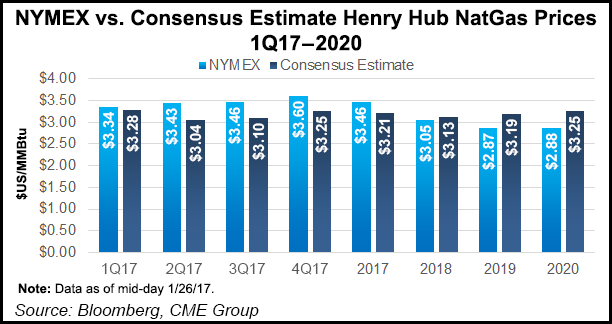

According to a findings published Wednesday, CFOs generally believe commodity prices will improve this year, with more than half (57%) predicting a price increase for natural gas and close to two-thirds (64%) expecting higher oil prices. The nationwide survey of oil and gas CFOs tallied responses from September through Nov. 4.

“In fact, 63% of respondents believe increased oil and gas prices will drive overall industry growth in 2017, an uptick from last year (60%) and a remarkable resurgence from 29% in 2015,” researchers said. Fewer CFOs — 62% versus 85% a year ago — cited low oil and gas prices as their biggest financial challenge this year, and fewer (49% versus 55%) expect decreasing prices to inhibit growth.

“American oil and gas companies have demonstrated remarkable resilience amid the continued industry downturn this past year,” said BDO’s Charles Dewhurst, global leader of the natural resources practice. Spurred in part on reduced production by the Organization of the Petroleum Exporting Countries, “oil prices are steadily climbing and the sector is regaining a sense of optimism that will hopefully come to fruition in 2017 and beyond.”

The energy industry is not yet out of the woods as low oil prices savaged many sub-sectors and the effects are lingering for some. While exploration and production company bankruptcies had slowed by the end of 2016, 53% of the CFOs surveyed still expect to see more Chapter 11 filings this year “as last year’s low oil prices continue to haunt this year’s balance sheets.” Another 58% of the respondents reported project terminations and delays last year, with nearly all — 91% — blaming low oil prices.

“Many companies will try to mitigate the damage by shedding distressed assets,” researchers said. A majority of respondents (53%) think the distressed balance sheets will be the primary driver of merger/acquisition (M&A) activity, while 35% expect their companies to sell off distressed assets in 2017. About two-thirds of the BDO respondents see dealmaking increasing from 2016, while about one-third (32%) expect it to be flat from year-ago levels. PwC said Tuesday it expects to see more dealmaking this year as well.

“Private equity investment is expected to play a large role in M&A in the coming year as rising prices and healthier financial statements prompt many private equity firms to re-explore investment in energy companies,” the BDO survey found. “Fifty-four percent of CFOs predict that private equity will be the primary source of capital behind industry transactions this year.”

A “changing regulatory environment” is a top concern and not a surprising one for an election year. “The number of CFOs citing legislative changes as their greatest financial challenge this year more than tripled from 4% last year.” While 62% of respondents felt better about the U.S. economy, up from 44% in 2016, fears of a recession and its impact on oil price volatility increased to 15% from 8%.

“A sense of uncertainty was prevalent in 2016 in anticipation of the U.S. general election and in the months following the Brexit vote,” with Great Britain voting to exit the European Union, said BDO’s Tom Elder, co-leader of the natural resources practice. “That uncertainty is likely to persist in early 2017, as energy companies wait to see how the new administration’s policies will take shape and what impact they will have on the industry.”

Consistent with previous surveys, many CFOs cited intangible drilling costs (42%) and percentage depletion (32%) as the sector’s top tax issues. The change may have stemmed from the new regulations issued by the Internal Revenue Service (IRS) in October, which have added an additional layer of complexity to the master limited partnership structures in the industry.

“Whenever there is a transition between presidential administrations, the potential for tax reform becomes a larger concern across all industries,” BDO’s Clark Sackschewsky, tax managing principal in the natural resources practice, said. “Energy companies are particularly attuned to any changes to tax policy that could impact their bottom line. Adjusting to the recent IRS rulings on partnership taxation is one area that CFOs will likely prioritize in 2017.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |