E&P | NGI All News Access | NGI The Weekly Gas Market Report

Earnings Season Begins For E&Ps, Midstream And OFS — For Better? Or Worse?

Halliburton Co. will open third quarter earnings season for the energy sector early Wednesday, a period which has seen the U.S. onshore buoyed by more natural gas drilling, as well as a plethora of deals within the Permian Basin.

Several big operators from across the energy spectrum are scheduled to issue their results on Wednesday including Kinder Morgan Inc., FMC Technologies Inc., Core Laboratories NV, Helix Energy Solutions Group Inc. and Gulfmark Offshore Inc. Also scheduled before the end of the week are No. 1 oilfield services (OFS) operator, Schlumberger Ltd., scheduled for Friday, and onshore exploration and production (E&P) giant Southwestern Energy Co., now one of the big players in Appalachia. On top of that, Chesapeake Energy Corp. is holding an investor conference on Thursday.

Tilting to Natural Gas?

NGI‘s Patrick Rau, director of strategy and research, said he will be listening in about how much capital expenditures (capex) are falling or increasing, as well as how U.S. oil producers may respond to the Organization of the Petroleum Producing Countries (OPEC) tentative agreement to keep global output flat (see Daily GPI, Sept. 28). The 14-member cartel is set to finalize an agreement in late November to reduce output for the first time in eight years — to 32.5 million b/d from an August level of 33.24 million b/d.

“How sustainable is $50 oil?,” Rau asked. “OPEC has done its part, at least in theory. But how quickly will U.S. producers increase activity in response? OPEC is looking to cut production by 700,000 b/d or so, but U.S. crude production is down more than 900,000 b/d from its peak. How fast will the U.S. absorb that difference?”

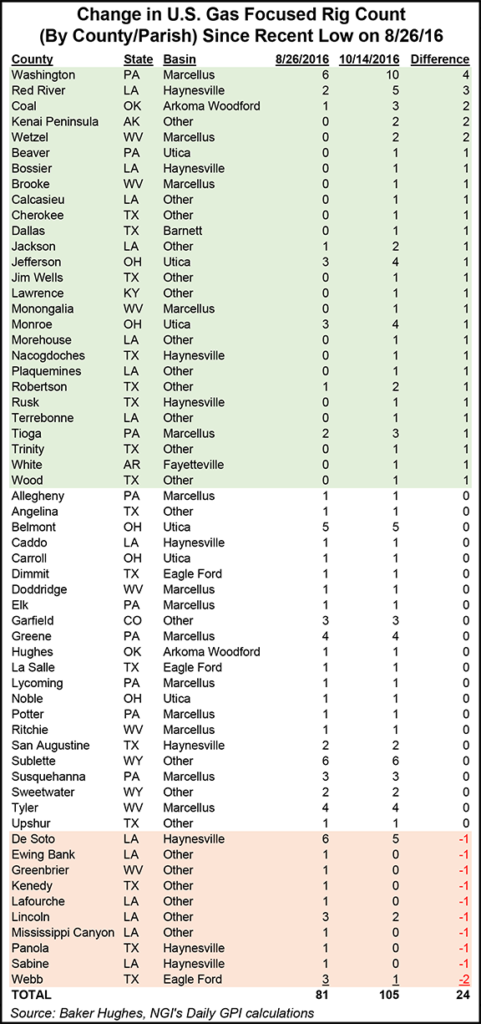

Stay tuned also for direction from the onshore E&Ps about whether they are tilting more to natural gas. The recent increase in U.S. gas rigs, said Rau, suggests that operators are becoming more bullish (see Shale Daily, Oct. 14).

“Gas-focused rigs increased by 11 for the week ended Oct. 14, the largest week/week increase in quite some time,” he said. However, “only three of those new rigs came in the Marcellus/Appalachia, which has accounted for the overwhelming majority of new rig adds of late. Two were in the Haynesville, with additional rigs in other parts of Louisiana, Texas, Kentucky and even Alaska.”

One area that many likely will tune in for information is from Apache Corp. and any offset wells by other E&Ps in the newly unveiled Alpine High play in the Permian’s Delaware sub-basin (see Shale Daily, Sept. 7). “I’m sure there is lots of follow on interest in Apache’s Alpine High play,” Rau said. ” What updates will Apache provide, and will any offset operators chime in with data this quarter?”

As Appalachia Goes…

As Appalachia goes, so go quarterly results? Spot market prices in the Appalachia were lower than expected in the third quarter, and results of producers in the area should reflect this, according to Rau. Deustche Bank this week slashed the earnings outlooks for some big Appalachian players, including Southwestern, Cabot Oil & Gas Corp. and EQT Corp.

“But any below consensus results should be largely expected, in my view, because this will be the result of lower realized prices,” Rau said. “Everyone knows spot prices were in the gutter last quarter. It just is taking sell-side analysts some time to lower their official estimates, which means consensus numbers are likely artificially high. If Appalachia producers miss their estimates by a country mile, that will be bad. But my guess is investors will be far more focused on their outlooks for the next few quarters than they will about the third quarter.”

In any case, everyone wants more clarity on Appalachian gas takeaway, Rau said.

Last week the Federal Energy Regulatory Commission requested comments on a pair of route variations for the Atlantic Sunrise expansion proposed by Williams Partners’ LP’s Transcontinental Gas Pipe Line Co. LLC, raising speculation in the market that the project could be delayed (see Shale Daily, Oct. 14). A delay could create issues for Appalachian gas players including Williams’ frequent partner, Cabot, which is an anchor shipper.

“Williams sent ripples through the market last week when it announced a delay in getting approvals for its Atlantic Sunrise project, and although several prominent analysts believe the delay will be minimal, it has heightened the nerves of investors,” Rau said. “Similarly, Dawn basis differentials could be severely curtailed if Rover, Nexus, and any revised west-to-east tariff on TransCanada Corp. floods Ontario with gas” (see Shale Daily, Oct. 12).

“Rover appears to be a go, but what about those other two projects? Many ears will be tuned” to the Spectra Energy and TransCanada calls to learn more. “Finally, ANR Pipeline Co. announced a 35% increase in its tariff, effective Aug. 1, but absolutely none of its shippers have commented on this. What will this do to netbacks in the Appalachia, especially to Antero Resources Corp. (800 MMcf/d of firm capacity) and Rice Energy Corp. (135 MMcf/d)?”

Investors want more details too about additional pipeline infrastructure in Appalachia.

“Of the last three pipeline delays/cancellations out of the Appalachia, two have been Williams projects,” Rau said, pointing to Atlantic Sunrise and Constitution Pipeline LLC’s project (see Shale Daily, July 26). The other is Tennessee Gas Pipeline Co.’s Northeast Energy Direct project (see Daily GPI, April 21).

“The Northeast Direct project never really stood much of a chance, being that it was in New England. But the other two are in New York and Pennsylvania. New York is another tough state to navigate, to be sure, but investors are wondering, is the problem of not getting projects built specific to Williams, or is in endemic to the entire area? That has major implications.”

According to Rau’s estimates, commercial players increased their short positions in gas futures by more than 10% during 3Q2016.

“More hedges for 2017 means more production for 2017, everything else being equal,” he said. “It’s probably still too early for companies to reveal formal capex budgets for next year, but I’d expect more to take Southwestern’s lead from July and announce more rigs” (see Shale Daily, July 22). Or they may “at least guide their 2017 budgets higher, even without giving specific estimates.”

One item unlikely to draw as much attention are the fall bank redeterminations, Rau said. Lenders are more optimistic about borrowing levels, while E&Ps appear to accept that low commodity prices may be sustained (see Shale Daily, Oct. 4).

E&Ps Ready to Ramp Up — in 2017

On the E&P side, all eyes will be on how results from the last six months of this year set up 2017, according to Wells Fargo Securities Inc.

“With strip prices above the $50/bbl level, sentiment has shifted for both investors and management teams as OPEC seems to have placed a floor on prices (at least for now),” said Wells Fargo’s David Tameron and his team. “And while we expect E&Ps to maintain flexibility in the face of macro uncertainty, we anticipate that more companies will signal that plans are in place to ramp activity levels in the near future as growth comes back into focus for 2017.”

Following three quarters of lower capex, declining production and asset sales, “we anticipate this quarter to mark the bottom before the group returns to growth. It seems as though sentiment has begun shifting with several operators signaling activity increases already. We expect the focus of conference calls this quarter to center around the early innings of the broader activity ramp we have called for and the resulting set up for 2017 growth.”

In the first stages of increased drilling, Wells Fargo’s team expects E&Ps “will be able to take advantage of both temporary slack in the service markets as well as structural improvements. In addition, operators have high-graded portfolios and right-sized cost structures. These efficiency tailwinds along with an improving macro backdrop likely will translate into greater cash flow available for redeployment into year-end.”

Cash flow redeployed through the end of the year also supports more activity — and that means growth in 2017. Wells Fargo is modeling 7% year/year growth for the E&P group overall.

“We forecast cash flows to be up 51% in 2017 and capex to be up 37%, driving total outspend of $1.7B next year representing 4% of cash flow. Contrast this with our estimate of a $4 billion aggregate spending gap (15% cash flows) this year and a declining production profile,” Tameron said.

Wells Fargo also updated its price forecasts based on actual 3Q2016 pricing, incorporating senior analyst Roger Read’s updated West Texas Intermediate/bbl forecast of $43.29/$57.28/$60.00 in 2016/2017/2018 from prior estimates of $45.32/$57.53/$60.00.

“For natural gas we are slightly tweaking our forecast” per Mcf to for 2016, 2017 and 2018 to $2.54/$3.20/$3.59 from $2.50/$3.20/$3.59. Natural gas liquids move higher for 2016, 2017, 2018 to $20.08/$25.94/$28.29 per barrel from $19.37/$24.15/$31.86. The 2017 oil/gas deck is 6%/2% higher than the Street respectively.

Jefferies LLC’s team, led by Jonathan D. Wolff, expects capex additions to provide “rising oil growth outlooks,” supported by better pricing and big equity launches. Also, the drilling efficiencies that have been touted by E&Ps for several quarters “likely extended into 3Q2016, but we expect to hear about the potential for rising costs by year-end…”

E&P stocks are recovering, with U.S. onshore oil producers generally the best performers year-to-date, according to Wolff. “We see better current value in more diversified E&Ps,” which include Encana Corp. and Noble Energy Inc., and “gas-focused companies with ample access” to New York Mercantile Exchange markets that include Range Resources Corp. and Rice Energy Inc.

Permian Basin and Oklahoma’s stacked reservoir well results are the focus this earnings season, while the Eagle Ford Shale is showing more cracks, according to Jefferies. Analysts expect to see play-specific well results evaluating infill drilling and delineation capturing attention, particularly from the Permian’s Delaware sub-basin and Oklahoma’s resource plays.

An overview of Permian deals into 3Q2016 are included in NGI‘s special report Permian: ”The Mother Lode’ — Texas Play Heats Up as Industry Looks to Get Back to Work. NGI also recently published an in-depth review of Oklahoma’s myriad reservoirs in THE SOONER BOOMER: How SCOOP, STACK and the OK Liquid Plays are changing the game in the Midcontinent.

First Up: Halliburton

D.A. Davidson’s Sonny Randhawa is forecasting a revenue beat for Halliburton (HAL) of $3.95 billion on earnings/share (EPS) of 5 cents, versus consensus revenue estimates of $3.9 billion on 7 cents/share earnings.

“Based on the strength of the recovery in the North American rig count and continued market share gains during the downturn, we expect HAL’s 3Q2016 results to largely beat current top and bottom line expectations,” Randhawa said. “Although it may take a few more quarters for larger operators (HAL’s core customer base) to adjust capex budgets and increase activity, a slight miss would only add to the trajectory of future earnings.

“We expect the level of service intensity to increase significantly in coming quarters as larger operators gain comfort with the recovery in commodity prices and adjust 2017 capex budgets higher,” he said. Through the downturn, HAL “has been positioning for a recovery by protecting its market position with key customers by staying in every market and keeping crews running,” Randhawa said. “This has enabled HAL to gain significant pressure pumping market share during the downturn, according to Spears and Associates. We believe share gains could accelerate even further even with an increase in fracture intensity. We believe HAL’s sizable sand logistics operation and buying power puts them at a considerable advantage when negotiating sand pricing versus smaller peers.”

In fact, HAL, which performs more pressure pumping in North America than any other oilfield services provider, said it recently moved with U.S. Silica Holdings Inc. the largest sand unit train of its kind to date, traversing a route from Illinois to Texas (see Shale Daily, Oct. 17).

HAL’s commentary over the past quarter “remained well scripted, with little deviation from 2Q2016 call commentary,” said Coker Palmer Institutional analysts. They estimate EPS of 5 cents, “achievable based on 3Q2016 activity levels.” The last time analysts spoke with HAL, management “focused on ‘low calorie’ rig count additions, while channel checks with other fracture companies suggest that while the fracture space remained challenging, HAL was also trying to move pricing slightly higher from unsustainably low 2Q2016 levels. Also, 3Q2016 moves to secure additional fracture sand volumes…speaks to HAL’s outlook, in our opinion.

“We feel they beat, talk about optimistically the October fracture calendar, but also play up 4Q2016 seasonality (Thanksgiving, Christmas, etc.) leading to some uncertainty for November-December.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |