NatGas Cash Eases, While Futures Stuck in Neutral Ahead of Fresh Storage Figures

Physical natural gas trading Wednesday continued to be a two-sided affair, with interior basins and market zones showing movement of just a few pennies either side of unchanged while Southern California and New England put up double-digit drops. The NGI National Spot Gas Average fell a nickel to $2.50.

Futures trading mirrored that of the interior basins and market zones, and at the close September had risen two-tenths of a cent to $2.619 and October had also added two-tenths of a cent to $2.659. September crude oil gained 21 cents to $46.79/bbl.

Most major market hubs were flat to slightly lower. At the Chicago Citygate, next-day gas was quoted at $2.66, flat and deliveries to the Henry Hub also were flat at $2.71. Gas at Opal fell 2 cents $2.51, along with PG&E Citygate, off a penny at $3.15.

For the most part, market points along the Eastern Seaboard took some hits as temperatures were forecast not far from normal. Forecaster Wunderground.com predicted Wednesday’s high of 82 in Boston, with a heat index of 83, would reach 87 Thursday and settling back in at 81 on Friday, 1 degree above normal. New York City was forecast to see its Wednesday high of 82, with a heat index of 86, reach 84 by Thursday and 88 on Friday, 5 degrees above normal.

Gas at the Algonquin Citygate was quoted at $2.84, down $1.04, and deliveries to Tenn Zone 6 200L changed hands 55 cents lower at $2.74.

Packages on Texas Eastern M-3, Delivery added a penny to $1.38, and gas bound for New York City on Transco Zone 6 fell 29 cents to $2.44.

Although quotes at the Henry Hub moved little, analysts were seeing a significant decrease in nominations on Louisiana pipelines resulting from recent heavy rains.

“There a very discernible drop in demand nominations in Louisiana on the order of almost 200 MMcf/d from a 14-day average before the rain started on Saturday,” said Genscape Inc. analyst Eric Fabry. “It’s been a sustained drop over the last five days and most of it has been on Columbia Gulf and Gulf South pipeline.”

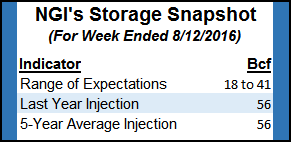

Traders are expecting an addition to gas storage inventories far less than normal in the Department of Energy (DOE) Energy Information Administration report. Last year 56 Bcf was injected and the five-year average also stands at 56 Bcf. Estimates for Thursday’s report are coming in sharply lower. A survey of industry experts taken by Bloomberg produced an injection range of 18 Bcf to 41 Bcf.

Tim Evans of Citi Futures Perspective estimated a build of 18 Bcf, and IAF Advisors calculated a build of 24 Bcf.

“The market was supported primarily by the current cycle of warmer than normal temperatures expected to have limited storage injections for the week ended Aug. 12 to less than the 56 Bcf five-year average for the date,” Evans said in recent comments. “There is still time for the consensus expectations to shift before the DOE releases the weekly storage report at 10:30 AM EDT on Thursday, but early indications suggest 25-30 Bcf in refills comparable to last week’s 29 Bcf gain.”

With such lean builds, the market will continue its trend of tightening supplies under an umbrella of plump, if not burdensome, overall supplies. Evans noted that “the rate of storage injections will be stepping higher as seasonal cooling demand fades and the rate of decline in the surplus may also slow, and this may give the market a further opportunity to test the downside on the weeks ahead.

“We continue to see a retreat to a more conservative valuation in the $2.40 to $2.50 range as possible in the weeks ahead, with the recent consolidation near the bottom of the range as just a temporary consolidation on the path lower.”

Tom Saal, vice president at FCStone Latin America, in his work with Market Profile said to expect the market to test Tuesday’s value area at $2.161 to $2.596. Market Profile is a breakout trading system that identifies trading targets above and below the breakout range. That range, termed the initial balance, is between $2.626 and $2.567. Saal identifies objectives higher at $2.671 and lower at $2.533.

What was a disorganized system earlier has morphed into Tropical Depression Six, the National Hurricane Center reported at 5 p.m. EDT Wednesday. The system was about 920 miles west of the Cabo Verde Islands. Maximum sustained winds were 40 mph, and it was headed west northwest at 16 mph.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |