Shale Daily | E&P | NGI All News Access

Forget The U.S., Canada’s Oil Has Rich Markets Elsewhere, Study Says

Canada stands to gain up to C$28.2 billion (US$22 billion) per year by breaking a 70-year-old habit of relying on the United States as the sole destination for oil exports, according a study released Tuesday.

New tanker ports on the Pacific and Atlantic coasts, as promised by current pipeline projects, would generate the improvement, the Fraser Institute said in a report titled “The Costs of Pipeline Obstruction.”

The pro-business research agency prepared the 50-page paper primarily to counter environmental protests, aboriginal resistance, and political hesitation that it said threaten to stunt Canadian development, primarily of the northern Alberta oilsands.

The authors, energy economists Gerry Angevine and Kenneth P. Green, recite a variation on cases that Enbridge Inc., TransCanada Corp. and Kinder Morgan Canada have built for pipeline projects aimed at developing overseas markets.

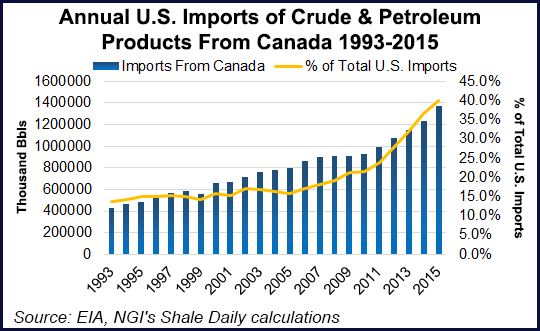

Reliance on exports to the United States has been a hallmark of Canadian oil and natural gas marketing since the Leduc discovery, near the Alberta capital of Edmonton, launched the modern industry in 1947. Producers became willing to book capacity on overseas export delivery projects since about 2010, as growing production flooded U.S. markets while President Barack Obama delayed, then finally rejected the hotly contested Keystone XL project for an express line from Alberta to the refinery complexes on the U.S. Gulf Coast (see Shale Daily, Nov. 6, 2015).

Angevine and Green estimate gains liable to be scored if three pipeline proposals — Enbridge’s Northern Gateway, TransCanada’s Energy East, and Kinder Morgan’s Trans Mountain — make possible one million b/d of tanker exports.

The calculations foresee double benefits: new sales on overseas markets where oil prices have exceeded North American benchmarks for about seven years, plus reduced price discounting in regions reached by current exports to the United States.

Counting only the direct benefits from one million b/d of new offshore sales, Angevine and Green foresee annual revenue gains of C$2 billion (US$1.54 billion) even if oil only averages US$40/bbl Increases are forecast to be C$4.2 billion (US$3.2 billion) at US$60/bbl and C$6.4 billion (US$4.9 billion) at US$80/bbl.

The value of the boost multiplies if the new pipelines also put a stop to at times steep price discounting on Canada’s current production of about four million b/d.

Angevine and Green said, “If higher netbacks from markets accessed from tidewater connections were realized by all Western Canada heavy oil production, at the US$40, US$60, and US$80/bbl price levels the annual benefits could reach C$8.9 billion [US$6.8 billion], C$18.5 billion [US$14.2 billion], and $C28.2 billion [US$21.7 billion], respectively.”

The current oil export pipeline projects would achieve more than double the overseas sales volume sought by the Fraser Institute economists if all were built. TransCanada’s Energy East proposal for partial conversion and extension of its national natural gas Mainline for oil service to the Atlantic Coast promises capacity of 1.1 million b/d (see Daily GPI, July 19). The Northern Gateway (see Daily GPI, July 1) and Trans Mountain (see Daily GPI, May 20) projects each offer deliveries approaching 600,000 b/d to the Pacific Coast.

All the oil projects have run afoul of environmental and native protests. Legal appeals are under way in various courts. Since replacing the pro-development Conservative government last fall, the new Liberal government in Ottawa has added steps to national approval procedures and embarked on an extended review of the energy regulatory regime.

The Fraser Institute study said, “Every effort should be made to expedite pipeline project review and assessment processes before windows of opportunity for access to new markets are largely pre-empted by competitors.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |