Markets | NGI All News Access | NGI Data

December Lows Tested Following Lean Storage Draw

Natural gas futures plunged Thursday morning after the Energy Information Administration (EIA) reported a storage withdrawal that was much less than the market had expected.

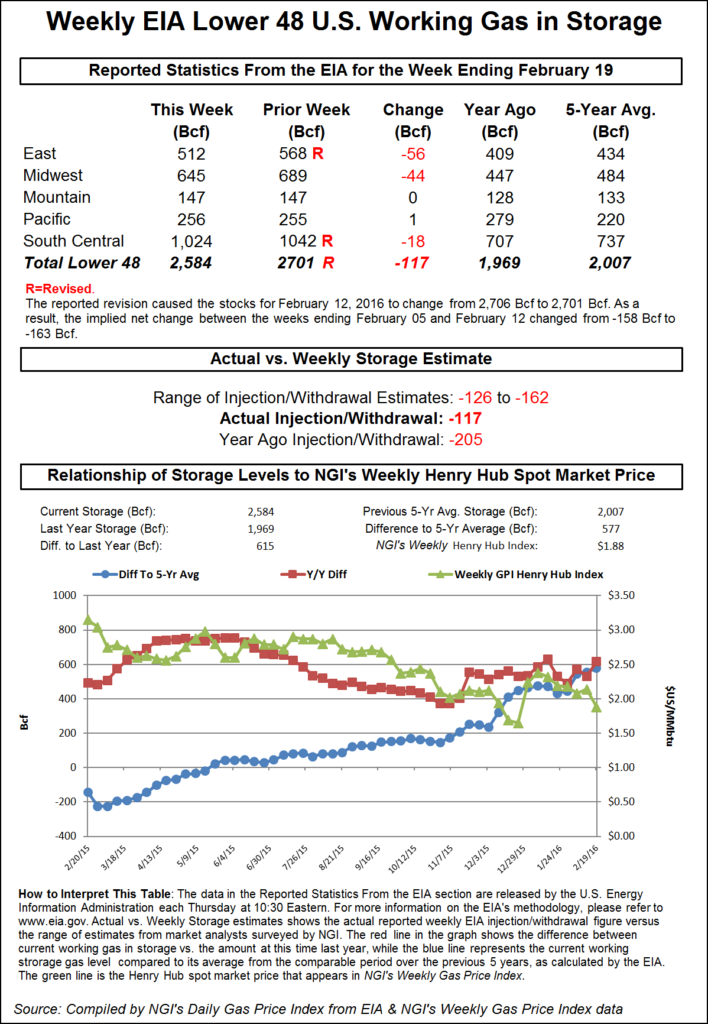

EIA reported a 117 Bcf withdrawal in its 10:30 a.m. EST release, and the market immediately tested December lows at $1.684.

The EIA also revised last week’s withdrawal from 158 Bcf to 163 Bcf, thus imparting a touch of bullishness to an otherwise highly bearish report. The expiring March futures contract fell to a low of $1.683 following the release of the storage data, and by 10:45 a.m. March was trading at $1.686, down 9.2 cents from Wednesday’s settlement.

“I think a little bit of money was taken off the table on the dip, but otherwise the shorts are very comfortable right now,” a New York floor trader told NGI. “The drop put prices below the previous support in the low $1.70s and is exactly what the shorts were looking for. We may test $1.61 to $1.63,” he said.

“[T]he small revision wasn’t enough to make up for a much smaller than expected 117 Bcf net withdrawal for the week ended Feb 19,” said Tim Evans of Citi Futures Perspective. “In place of the expected, relatively neutral, near-average withdrawal, we have a small decline that implies a significantly weaker supply-demand balance.”

Inventories now stand at 2,584 Bcf and are a stout 615 Bcf greater than last year and 577 Bcf more than the five-year average. In the East Region 56 Bcf was pulled, and the Midwest Region saw inventories fall by 44 Bcf. Stocks in the Mountain Region were unchanged, and the Pacific Region was higher by 1 Bcf. The South Central Region shed 18 Bcf.

Salt cavern storage was lower by 5 Bcf to 281 Bcf, while the non-salt cavern figure fell 13 Bcf to 743 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |