NGI Data | NGI All News Access

Market Bulls Tackled By Bears In Weekly NatGas Trading; Quotes Average A Dime Lower

There was not a whole lot of black ink to be found in natural gas trading for the week ended Sept. 25. Only six points followed by NGI managed gains, and the NGI Weekly Spot Gas Average fell 10 cents to $2.41.

At individual market points double-digit gains were dwarfed by much bigger double digit losses. At actively traded points the week’s greatest advance proved to be Tennessee Zone 4 200 L with a move of 18 cents to average $1.79. The week’s biggest loser was the Algonquin Citygate with a drop of 87 cents to average $2.30 followed closely by Tennessee Zone 6 200 L with a decline of 72 cents to $2.25.

All regions fell into the loss column with the Northeast leading the pack down 22 cents to an average $1.82. California proved the most resilient giving up just 4 cents to $2.79.

South Texas, East Texas, and South Louisiana all shed 10 cents to $2.50, $2.51, and $2.51 respectively.

Six-cent declines were posted by the Rocky Mountains, the Midcontinent and Midwest at $2.49, $2.51, and $2.72, respectively.

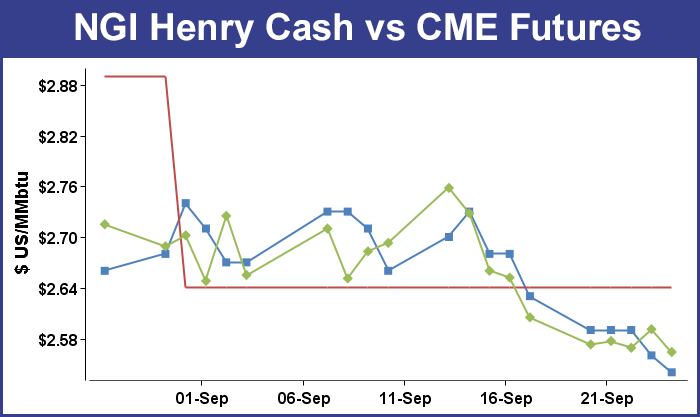

October futures retreated 4.1 cents on the week to $2.564, but in Thursday’s trading bears who sold on the outsized 106 Bcf storage build reported by the Energy Information Administration (EIA) were rewarded with a turnaround that ultimately saw futures settle in the win column. At the close Thursday October had added 2.2 cents to $2.591 and November was higher by 3.6 cents to $2.674.

Going into the EIA report Thursday analysts were confident that their estimates in the high 90 Bcf range were on target and there was little likelihood of much deviation from expectations. “We’ve seen little or no indication of a surprise this week; however, the spread between the three categories we track is somewhat elevated: 2.85 [Bcf],” said John Sodergreen, editor of Energy Metro Desk. “Oddly high. If there is a surprise, it would likely be to the high side, we think. Our GWDD forecast came in at 96 Bcf. So 96 to 101 should be right on the money this week, barring any reclassifications, revisions or incomprehensively uneconomic maneuvers at the hands of storage operators. With roughly seven (maybe eight) weeks to go in the storage season, we’d say we’re well on our way to breach the 4 Tcf mark this year.”

Moderating late-summer weather has made heftier storage builds easier, and indications were that Thursday’s build would be significantly greater than last week’s 73 Bcf injection. ICAP Energy calculated a 100 Bcf increase, and Tim Evans of Citi Futures Perspective was up at 108 Bcf. A Reuters survey of 22 traders and analysts revealed an average 96 Bcf with a range of 83 to 108 Bcf. Last year, 96 Bcf was injected and the five-year average came in at 83 Bcf.

Given the magnitude of the difference between estimated and actual figures, market response was relatively tame. “It basically took a 3 cent dip, and in the scheme of things we are off a penny and a half prior to the number coming out,” a New York floor trader said. “It looks like $2.50 is a big number on the downside, and $2.60 on the upside. If it settles below $2.50 that would be a bearish sign.”

“The 106-Bcf net injection was more than the consensus expectation, a bearish result that was also more than the 83-Bcf five-year average level. It was close to our model’s 108-Bcf estimate however, so we don’t see much need for revisions to our overall storage forecast,” Evans said.

Inventories now stand at 3,440 Bcf and are 466 Bcf greater than last year and 148 Bcf more than the 5-year average. In the East Region 62 Bcf were injected and the West Region saw inventories increase by 7 Bcf. Stocks in the Producing Region rose by 37 Bcf.

Sodergreen et al were correct that errors were on the high side, but the actual figure of 106 Bcf had many scratching their heads. “Generally speaking everyone was expecting a risk to the high side,” Sodergreen told NGI in post-report comments. “It [106 Bcf] is not that much of a surprise, but it is a surprise because it was so much higher than I thought. Without question I think analysts will be tweaking their numbers higher for next week.”

Supplies currently stand at 3,440 Bcf, and to reach the marquee level of 4 Tcf, and a new record, injections a touch over 93 Bcf will be necessary over the next seven weeks.

In Friday’s physical trading all one had to do was look at the load-killing weekend weather forecasts to realize that committing to a three-day deal was less attractive than spot purchases.

Physical natgas prices fell across a broad front, with only a handful of market points followed by NGI making it to the positive side of the trading ledger. The NGI National Spot Gas Average skidded 10 cents to $2.31, and eastern points were seen more than 20 cents lower on average. Double-digit declines were posted in the Mid-Atlantic as well as the Marcellus.

Futures at first appeared to have a delayed reaction to Thursday’s super-sized inventory build, opening 4 cents lower and trading down as much as 6 cents before scrambling back to a modest setback. October futures expire Monday, Sept. 28.

Analysts are viewing the market’s ability to ignore a seemingly bearish storage report Thursday as a sign that further declines are unlikely. “[W]e still see the ability to easily absorb yesterday’s seemingly bearish EIA storage figure as evidence that this bear market may be approaching completion,” said Jim Ritterbusch of Ritterbusch and Associates in a Friday morning note to clients. “While it is premature to rule out one more round of fresh lows by a slight margin, we are maintaining a view that upside price risk is exceeding that to the downside by a ratio of at least two to one.

“[W]hile unusually mild temperature expectations during the next two weeks will be sharply limiting accumulation of either HDDs or CDDs, we feel that these weather views have been fully priced. In other words, a couple more triple-digit storage builds would appear to lie ahead but also have likely been discounted. From here, we feel that market surprises are much more apt to be bullish than bearish and that the large speculative presence on the short side will be accentuating upside price response to seemingly minor supportive headlines.”

Rather than focusing on a tepid market reaction to Thursday’s plump 106 Bcf storage build, others see sub $2.50 fuel-switching and higher coal plant retirement-driven shoulder season demand as sufficient to prevent a pronounced market decline.

“[W]ith just a few weeks left of the official injection season, there appears to be little need for further discounts to manage surplus supplies,” said Teri Viswanath, director of natural gas strategy at BNP Paribas. “Despite the re-acceleration in inventory restocking, the price-induced accommodation that has taken place this season leaves sufficient space in storage to manage the excess.” Moreover, sub-$2.50 pricing would likely invite a substantial increase in fuel-switching that is unnecessary given the increased replacement demand from retiring coal units.

“Given the concentration of coal unit retirements in June, the replacement demand appears to be accelerating during the second half of this year as gas generators are utilized to replace the aggregate lost plant capacity. Consequently, the higher level of shoulder-season demand and ample room to manage the supply surplus will likely prevent an exaggerated sell-off during the last few weeks of the season.”

On Friday morning WSI Corp. said, “The six-10 day period forecast is sharply cooler across the eastern half of the nation when compared to previous forecasts with near to slightly below average temps. Portions of the West and Southwest are a bit warmer. PWCDDs are down 1.3 to 19.9. HDDs jumped 7.7 to 19.1 for the CONUS.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |