E&P | Eagle Ford Shale | Haynesville Shale | NGI All News Access | Permian Basin

Patterson-UTI’s Onshore Rig Count Falls 5% Between July and August

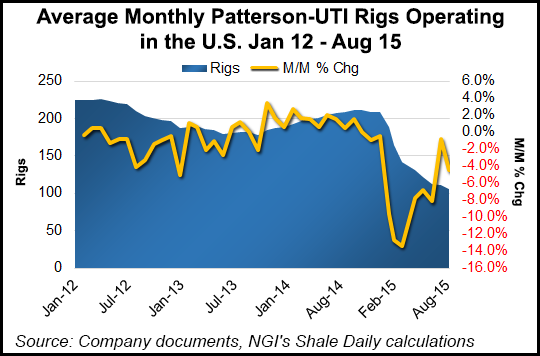

Patterson-UTI Energy Inc. (PTEN), one of the biggest onshore contract drilling and pressure pumping companies in North America, reported that its rig count in August fell by almost half from a year ago and was down 5% month/month.

The oilfield services company last month had an average 106 drilling rigs under contract operating in the United States, with four working in Canada. For July and August, the company operated on average 113 rigs in North America, including 109 in the United States.

During August 2014, PTEN averaged 218 North American drilling rigs — 208 in the United States and 10 in Canada.

Chairman Mark Siegel warned in July that the oil price collapse and the “reduced near-term optimism for natural gas” could lead to further rig count reductions this year (see Shale Daily, July 23).

The “continued downward drift” in PTEN’s rig count “is the reality of a sub-$50/bbl West Texas Intermediate oil price world,” said Tudor, Pickering, Holt & Co. in a note Thursday. The decline in the number of rigs operating “comes as no surprise given the oil price head fake this summer,” which analysts said had frozen exploration and production (E&P) operators “in their tracks” with respect to their rig needs during the second half of this year.

PTEN’s U.S. count is “now closing in on the century mark,” said analysts, with even its highest quality rigs being dropped. PTEN’s high spec APEX are 1,500 hp with alternating current and walking systems. Analysts said they now expect to see “leading-edge dayrates for top-tier rigs drift from the high-teens to the mid-teens this fall.”

Most of PTEN’s U.S. rigs during August were working in Texas, with 23 operating in West Texas (Permian Basin), 16 in South Texas (Eagle Ford Shale) and 15 in East Texas, which includes Upper Eagle Ford, Cotton Valley/Bossier and Haynesville Shale targets. Seventeen rigs were working the Appalachian Basin, while 12 were operating in North Dakota’s Williston Basin. In the Midcontinent and Rocky Mountains, there were on average nine rigs running in each play.

PTEN’s U.S. rig count in December 2014 was flat from August 2014 at 208, with eight rigs working in Canada. However, by the end of January, the bottom had begun to fall out, pressuring domestic E&Ps to realign their programs. In the first month of this year, the average U.S. rig count had fallen to 188. Canada actually added two rigs in January to 10, as producers put more rigs to work (as usual) before the winter break-up season.

February’s average rig count, however, fell sharply, with the domestic count falling to an average 164, with nine in Canada. In March, 22 rigs were dropped in U.S. fields, with 142 working on average, while four rigs worked Canadian fields. April’s U.S. rig count averaged 131, with only two rigs working in Canada.

Nine more U.S. rigs fell in May to 122 on average, with one rig on average in Canada. June’s average was even lower, with the U.S. rig count falling to an average 112, with one rig still working in Canada.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |