Futures Delay Reaction to Storage Stats

Natural gas futures worked higher following the release of government inventory figures showing an increase in working gas storage that was incrementally less than what the market was expecting.

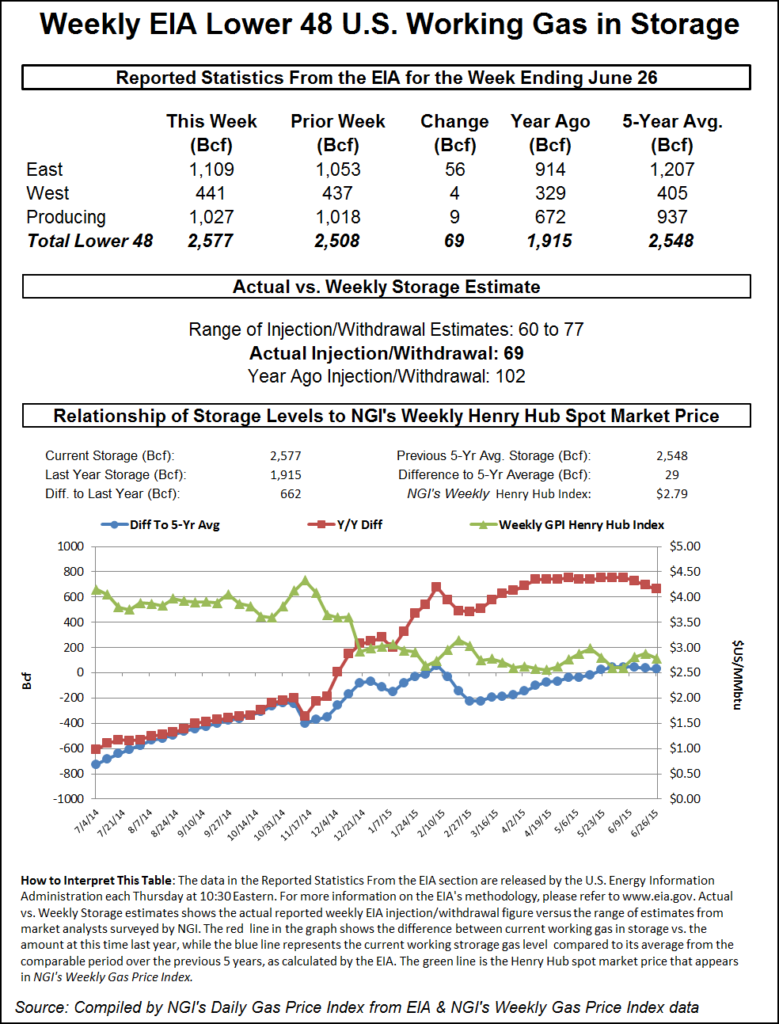

For the week ended June 26, the Energy Information Administration (EIA) reported an injection of 69 Bcf in its 10:30 a.m. EDT release. August futures rose to a high of $2.875 after the number was released and by 10:45 a.m. August was trading at $2.861, up 7.8 cents from Wednesday’s settlement.

Prior to the release of the data, analysts were looking for an increase right at 70 Bcf. Bentek Energy’s flow model calculated a build of 70 Bcf, yet Ritterbusch and Associates was counting on a 77 Bcf increase. A Reuters poll of 24 traders and analysts showed an average 70 Bcf with a range of a 60-77 Bcf injection.

“67 to 70 Bcf was the number people were looking at, and I can tell you the market did not move at all once it came out. We were trading $2.825 and it wasn’t until 10 minutes later that the market rose to $2.875. It was a very delayed reaction,” said a New York floor trader.

Analysts, however, viewed the report as basically neutral. “The 69 Bcf net injection for last week was quite close to the consensus expectation and moderately below the 74 Bcf five-year average for the date,” said Tim Evans of Citi Futures Perspective. “While constructive, we don’t see the market as driving significant support from the report, as the outlook for upcoming reports will still feature a swing back to above average injections.”

Inventories now stand at 2,577 Bcf and are 662 Bcf greater than last year and 29 Bcf more than the five-year average. In the East Region 56 Bcf was injected, and the West Region saw inventories increase by 4 Bcf. Stocks in the Producing Region rose by 9 Bcf.

The Producing Region salt cavern storage figure was down 3 Bcf at 292 Bcf, while the non-salt cavern figure increased 13 Bcf to 735 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |