They Get It Right; 111 Bcf NatGas Storage Build Inline With Estimates

After a couple of weeks of storage report estimate misfires from natural gas analysts and traders, they finally got one right Thursday morning as news of a 111 Bcf injection into inventories for the week ending June 5 was nearly spot on with the industry consensus ahead of the report.

With no real surprise for the first time in a number of Thursdays, natural gas futures traders yawned. The July contract, which was hovering around $2.880 just ahead of the 10:30 a.m. EDT report, stayed right in the same vicinity in the minutes that followed. Just 10 minutes following the report, the prompt-month contract was trading at $2.860, down 3.1 cents from Wednesday’s regular session finish.

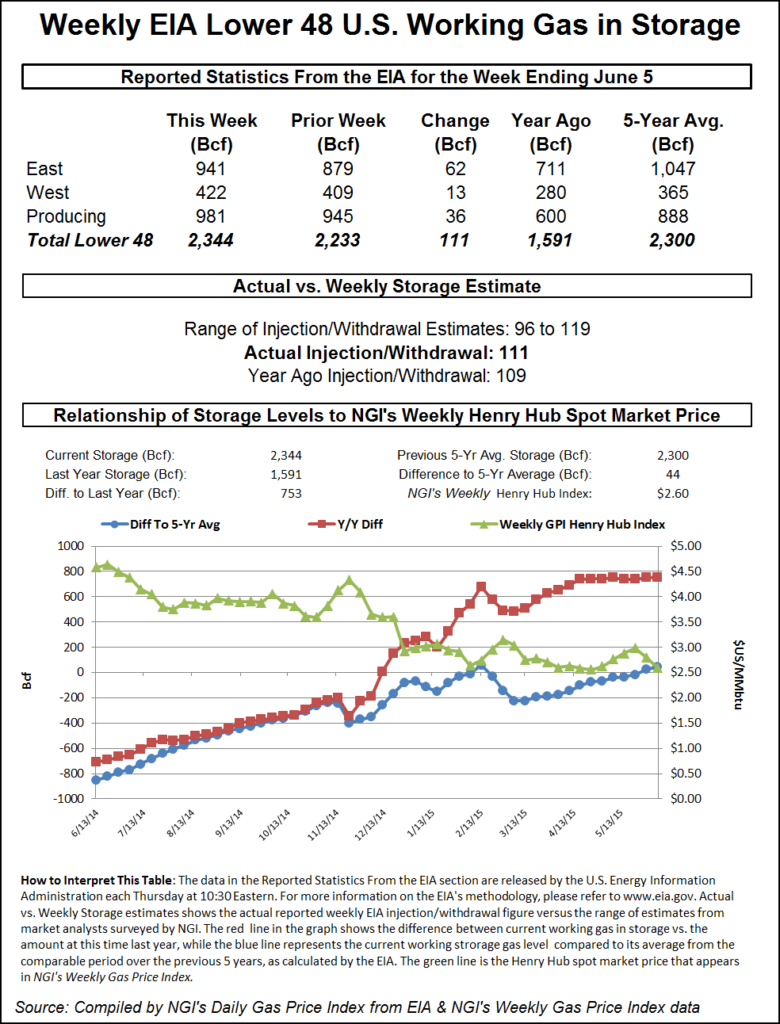

This week analysts at Ritterbusch and Associates calculated a 109 Bcf injection, and IAF Advisors expected a 114 Bcf build. A Reuters survey of 25 industry cognoscenti showed an average 112 Bcf with a range of 96 Bcf to 119 Bcf. Last year 109 Bcf was injected and the five-year average is for a 89 Bcf increase.

The actual 111 Bcf build was also a steep departure in size from the previous week’s 132 Bcf injection.

While the build was basically on target with most estimates, some industry experts were looking at the larger storage picture for direction. Citi Futures’ Tim Evans, who was on the record with a 115 Bcf build estimate, called the actual number “supportive,” noting that it was a bit smaller than some were expecting. “The 111 Bcf in net injections was less than the median estimate and confirmed a drop from the prior 132 Bcf surge, a constructive development,” he said. “This may also ease fears regarding the current background supply-demand balance to some degree.”

As of last Friday, stocks are 753 Bcf higher than last year at this time and 44 Bcf above the five-year average of 2,300 Bcf. For the week, the East Region injected 62 Bcf, while the Producing and West regions chipped in 36 Bcf and 13 Bcf, respectively.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |