Utica Shale | E&P | NGI All News Access | NGI The Weekly Gas Market Report | Shale Daily

Gulfport Will Cut Spending, Focus on Utica in 2015

Gulfport Energy Corp. on Thursday reported triple-digit production growth in 2014 and said it would slash capital spending this year by 40% from last year’s level.

But management said a restrained budget won’t curtail production volumes this year, when it aims to grow production by up to 100% to 432-480 MMcfe/d. CEO Michael Moore called 2014 a “transformational year for Gulfport” and said it “represented our coming of age in the Utica Shale.”

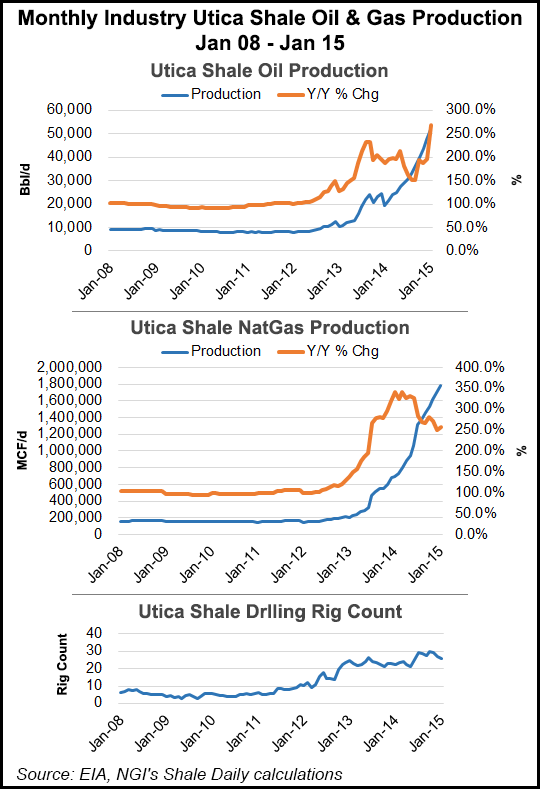

The company produced 381.9 MMcfe/d in the fourth quarter, up 282% from 100 MMcfe/d in the year-ago period. Full-year volumes increased 255% to 240.3 MMcfe/d from 67.7 MMcfe/d in 2013. Gulfport has been focused in recent years on building its position in Ohio’s Utica Shale, which accounted for 353.4 MMcfe/d of fourth quarter production, up 450% from 4Q2013. About 74% of the company’s fourth quarter volumes were natural gas, in what Moore said was a clear indication of the company’s transition to a gas producer.

Moore added that the company has budgeted $630-690 million this year for its operations, with 96% of its exploration and production budget dedicated to the Utica, where Gulfport will be “very focused,” he said.

Last year, the company scaled-back in the play in favor of better quality wells managed on a restricted choke program. In May, management said it would focus on building an inventory of wells to maintain consistency and cut future costs for crews working to tie them into sales (see Shale Daily, May 8, 2014). It exited the year with about 25 wells backlogged and it plans to do the same this year.

“To better align with our planned operated rig count during 2015, we have started to slow our pace of completions,” Moore said Thursday during a fourth quarter earnings call with financial analysts. “During 2014, our operations teams saw tangible benefits to the creation of a well inventory with the goal of maintaining three to five pads in inventory at all times. Although our 2015 plans forecast a reduced level of drilling activity, the goal is to maintain a similar well completion inventory.”

As oil prices remain low and continue to pressure natural gas liquids prices as well, Gulfport will focus primarily on its dry and wet gas windows in the Utica, where it’s had higher production rates and more sustainable well pressures compared to its condensate window to the west of those phases. Higher-rate wells, pressure management and shorter frack stage lengths should help grow the company’s production this year, management said. A backlog of wells will also help preserve momentum heading into 2016.

The company will run three Utica rigs this year and plans to turn inline 42-46 net wells in the play, down slightly from the more than 47 it turned to sales last year. The remainder of its capital budget will be spent on maintenance and recompletions on its legacy assets in southern Louisiana.

“I think there would have to be meaningful improvement in oil. I mean the returns we’re getting in the wet and dry gas window, quite frankly, are really good,” Moore said when asked if the company would consider drilling more condensate wells in the Utica this year if commodities prices rebound. “You have to keep in mind that we don’t have a lot of acreage in the condensate window, the majority of our acreage is in the wet gas window and the dry gas window.

“There are cost reductions possibly ahead that we haven’t realized yet,” Moore added. “I doubt you’ll see us reallocate a rig.”

Moore said service costs are down by about 15% since November. Those savings have brought the price tag for a typical Utica well with an 8,000-foot lateral to less than $10 million.

Gulfport’s oilier assets and holdings didn’t fare as well last year. The company recorded a $9.6 million loss related to its equity interest in Permian Basin operator Diamondback Energy Inc. It was also forced to write-down its three onshore blocks in Thailand, where it’s been conducting geological tests, resulting in a $12.1 million loss.

In the Canadian oilsands, where Gulfport owns 25% of Grizzly Oil Sands ULC, that company produced 1,400 b/d in the fourth quarter after a steam plant took longer to return to operation than anticipated. Moore said Gulfport will “wait until the markets are right” before it makes any move to monetize its interest in Grizzly, which it has discussed in the past.

So far this quarter, production has averaged about 395 MMcfe/d and has been adversely affected by winter weather conditions in the Northeast. The company is forecasting first quarter production will finish at 378-390 MMcfe/d.

Fourth quarter revenue increased to $267 million from $68 million in the year-ago period. Full year revenue also increased to $671.3 million from $262.7 million in 2013.

Gulfport reported fourth quarter net income of $110.1 million ($1.28/share), compared to $24.3 million (30 cents) at the same time last year. Full year net income was $247.4 million ($2.88), up from $153.2 million ($1.92) in 2013.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |