E&P | Eagle Ford Shale | NGI All News Access

Matador Resources to Drop Two Eagle Ford Rigs

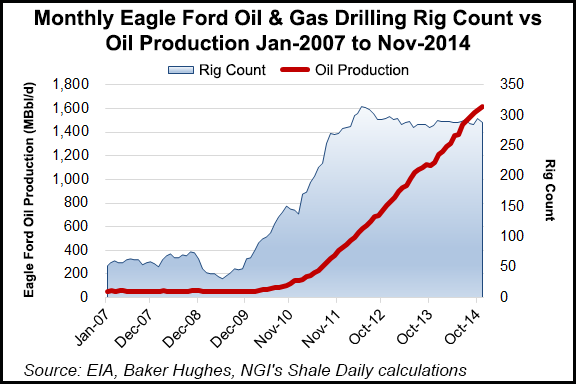

Matador Resources Co. said it plans to scale back its drilling program over the next few months, dropping two rigs deployed in the Eagle Ford Shale in South Texas but keeping three rigs in the Permian Basin in southeast New Mexico and West Texas, a familiar refrain as exploration and production (E&P) companies of all stripes continue to grapple with the collapse in world crude oil prices.

Matador, an independent E&P based in Dallas, said it plans to spend between $325 million and $375 million on capital expenditures in 2015. It plans to run a three-rig drilling program focused on the Permian throughout most of 2015.

“The reasons that Matador has decided to reduce its Eagle Ford drilling program significantly in 2015 are due to lower oil and natural gas prices and the fact that almost all of the company’s acreage in the Eagle Ford Shale is now held by production,” Matador said Tuesday. “As a result of the company’s strong execution in the Eagle Ford over the past three years, this asset has become an ‘oil bank’ that Matador can return to and develop further at a future time when commodity prices are more favorable.”

The company said it had recently taken delivery of the first of three newly-built rigs that would allow for what it called “simultaneous operations.” Matador is to receive the second rig in a few days and the third around July 1.

“These new rigs have full walking capabilities and high-pressure circulating systems and are designed so that drilling operations can be conducted in the Wolfcamp formation while completion operations are performed in the Bone Spring or other intervals and vice versa — i.e., simultaneous drilling and completion operations,” the company said. “[We expect] these rigs will result in additional operational efficiencies and will reduce the costs associated with [our] Permian drilling program in 2015.”

Matador currently has three rigs deployed in the Permian Basin, one in each of its primary prospect areas: the Wolf Prospect in Loving County, TX, and the Ranger and Rustler Breaks prospects in New Mexico’s Lea and Eddy counties, respectively.

In the Wolf Prospect, the company recently completed its Norton Schaub 84-TTT-B33-WF #2010H well, the first to test a deeper target of the Wolfcamp A formation and which Matador intends to use to determine the productivity of another Wolfcamp A target. The company said it was “pleased with the early performance of this well,” and would release additional results at its analyst day, which was rescheduled to Feb. 5.

Matador said it plans to begin completion operations on the first two wells drilled on its Barnett lease, which is in the northern part of the Wolf Prospect, in about two weeks. The first will test the “X-sand” interval of the Wolfcamp A formation, while the second will test the formation’s deeper “Y-sand” interval, both on 80-acre spacing.

“These wells will determine not only the productivity of the ‘Y-sand’ target, but also the viability of completing these two intervals in a ‘W-type’ pattern at 80-acre spacing across Matador’s Wolf acreage,” the company said, adding that it has also finished drilling the first test well targeting the Wolfcamp A from its Guitar lease, in the southeastern part of the Rustler Breaks Prospect. Matador said this well would be its first to test the Wolfcamp A from this area and would be completed soon.

Elsewhere, Matador said Chesapeake Energy Corp. placed five of eight gross (1.9 net) new wells in the Haynesville Shale in northwest Louisiana — which were drilled on Matador’s Elm Grove properties — into production before the end of 2014. The final three wells are expected to be placed into production by mid-January, and are expected to increase Matador’s natural gas production rate from approximately 65 MMcf/d to 70-75 MMcf/d.

“[We continue] to be very pleased with the early performance of the 14 gross (3.2 net) Haynesville wells previously completed and placed on production in 2014 by Chesapeake,” Matador said, adding that its natural gas production rate “has more than doubled over the past year from an average daily production of 27.4 MMcf/d in 1Q2014 to its current rate of approximately 65 MMcf/d.”

In a note to clients Tuesday, Irene Haas, an analyst with Wunderlich Securities Inc., said the firm’s net asset value (NAV) and price target remained $30/share, “based on $70/bbl oil and $4.20/Mcf gas; this is equivalent to 6.6x our 2016 cash flow per share forecast of $4.52. Our NAV and earnings estimates will change with year-end reserves and production guidance in early February.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |