Marcellus | E&P | NGI All News Access

EQT Announces $2.5B Budget for 2015

EQT Corp. released a capital expenditures budget Monday that came with few surprises and largely met analysts’ expectations, with spending up slightly from the company’s 2014 budget and forecasted production up 25% year-over-year at the midpoint.

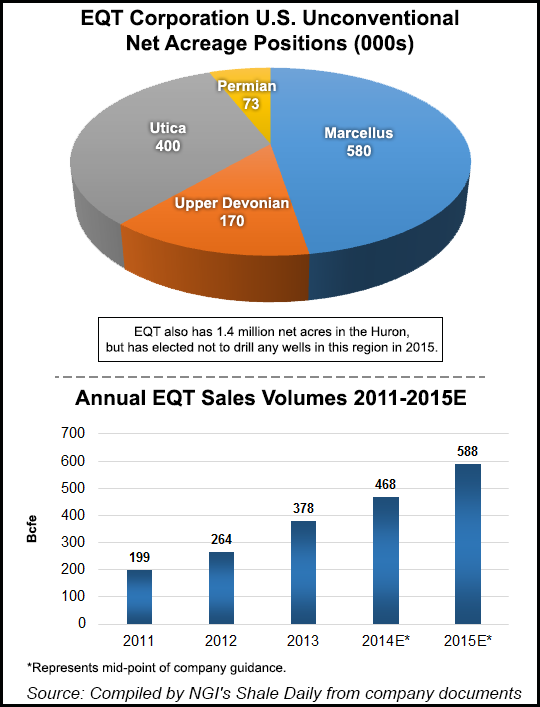

EQT, one of the largest Appalachian producers, said it would shell out $2.5 billion next year, excluding business development and land acquisitions. Most of that figure — $2.3 billion — will go toward production, which EQT said would be 575-600 Bcfe. The company’s 2014 capital budget called for $2.4 billion in spending and 460-480 Bcfe of production (see Shale Daily, Dec.18, 2013).

Next year’s breakdown includes $1.95 billion for well development; $90 million for exploration and the rest for overhead maintenance.

EQT also announced a long-awaited plan to monetize EQT Midstream Partners LP (EQM), saying it would sell a small percentage of its 32% interest in the general partner, along with its 21.3 million limited partner units in an initial public offering sometime next year. EQM’s earning results have been consolidated with EQT’s, and the company has been considering ways to better reflect its value and bring down costs associated with those midstream operations. A public master limited partnership would highlight unrecognized value in the partnership and provide cash for upstream operations, Wells Fargo Securities analyst Gordon Douthat said.

EQT is one of the earliest Appalachian operators to report capex during a time in which weak commodity prices have operators across the country approaching next year with caution.

The company produced 378.2 Bcfe last year, 73% of which came from the Marcellus Shale and was mostly gas, which has fared better than stagnant oil prices as of late. A recent Wunderlich Securities analysis of 50 exploration and production companies showed that just 15 provided formal guidance for 2015 after the third quarter. Those companies collectively slashed $1.3 billion in year-over-year expenditures, with many heavily involved in onshore oil production.

Despite price swings this quarter, natural gas is expected to hover around $4/MMbtu heading into next year, according to a forecast from Barclays released Monday. EQT said it has 256 Bcf of its natural gas hedged for 2015 at a price of $4.21/MMbtu.

Following a third quarter announcement, in which EQT said it would do more with less (see Shale Daily, Oct. 24) the company said Monday that it plans to drill fewer wells this year than last in some areas. Longer laterals and pad development in the Marcellus and Upper Devonian shales are expected to push production higher, though.

EQT plans to drill 181 Marcellus wells in southwestern Pennsylvania and northern West Virginia with an average lateral length of 5,500 feet, down slightly from the 186 wells it forecast last year at this time. Another 58 wells, with an average lateral length of 5,800 feet, are planned for the Upper Devonian, all of which will be drilled from Marcellus well pads to minimize costs. In the Utica Shale, EQT plans to drill five wells, with a test well set for Wetzel County, WV, in 1Q2015.

In the Permian Basin, which EQT entered in an asset exchange with Range Resources Corp. earlier this year (see Shale Daily, May 1), the company plans to drill 15 horizontal wells, 12 of which will be developmental and target the upper Wolfcamp Shale. Three exploration wells will also target the lower Wolfcamp and Cline zones.

EQT said it does not plan to drill new wells in the Huron Shale during 2015, primarily due to the consistently low price of natural gas, which has made the Huron less profitable than the company’s required returns.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |